It’s been a year and a half since the Bank of Japan delivered its unprecedented quantitative and qualitative easing policy to the markets, and almost two years since the term Abenomics appeared on the radar of Japan macroeconomics aficionados. So how successful has it actually been?

While the Nikkei 225 has increased its value by close to 80% at the time of writing, the Japanese yen has almost depreciated by one third following the unprecedented monetary easing which the Bank of Japan has embarked on.

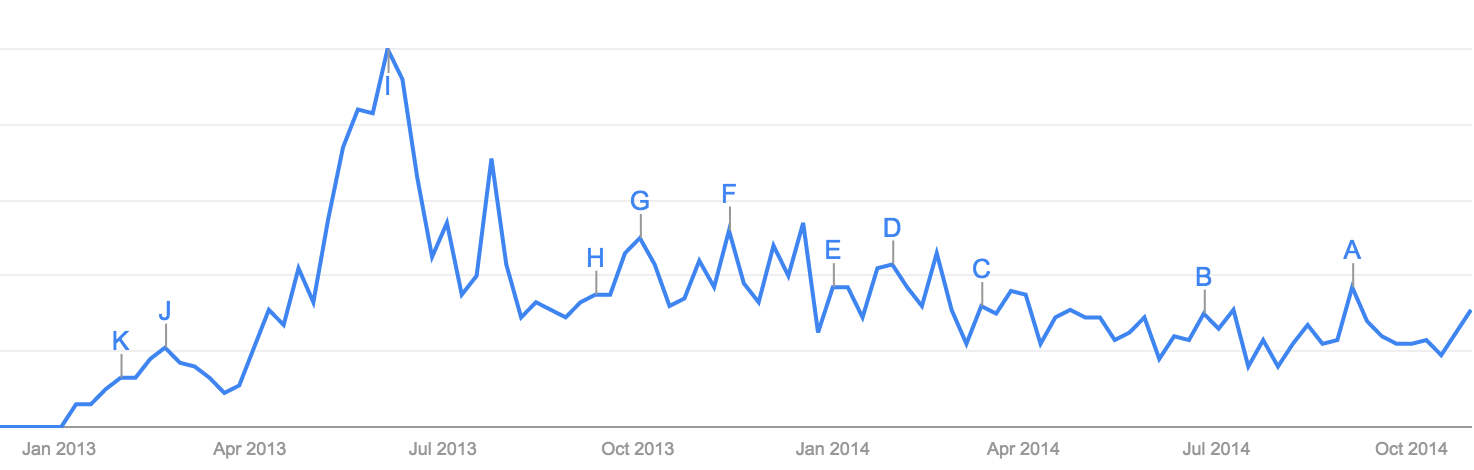

"Abenomics" (above) and "Japanese Yen" (below) Google search term interest over time, Source: Google Trends

Last Friday, the Bank of Japan delivered another blow to the value of the Japanese currency which some say is likely to unfold into a spiraling decline. The Japanese central bank has raised its targeted annual monetary base expansion by ¥10-20 trillion from the ¥60 trillion base in place.

While some analysts expected a similar move to occur sometime soon, not many have been expecting it so soon. The result was the sharpest Japanese yen daily decline for the year ever since the last time the Bank of Japan announced its gargantuan monetary policy easing measures in April 2013.

Concerns about the value of the yen have started to pour in from all over the spectrum. Saxo Bank’s Chief Economist and CIO, Steen Jakobsen, stated in his Bank of Japan decision analysis, “The easier monetary policy will force USD/JPY and NIKKEI higher as it’s a one-way street, but it will more importantly force Japanese banks to lend out and overseas.”

“I see/hear desperate Japanese bankers trolling the world to find things to finance and it seems they are in desperate need of US dollar funding (i.e: they have not hedged proportionally). This could make USD/JPY test 125/135 over coming months but the “risk” remains China, which even prior to this action was upset at the ‘beggar thy neighbour' policy of Japan,” he concluded.

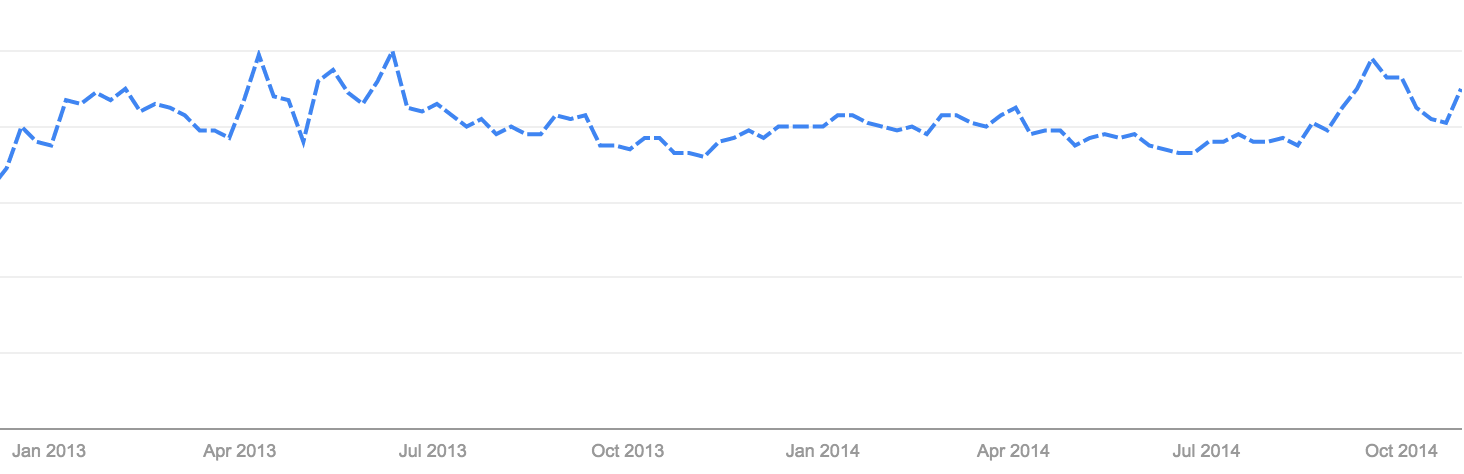

US dollar's rally to the Japanese yen following the BOJ announcement on Friday, Source: NetStation

A sharp decline in the value of the Japanese yen has already occurred and there is no telling where we are going in the short-term, however, in the long run, Mr. Jakobsen might be onto something.

The Bank of Japan's stimulus comes after the Japanese consumers suffered from the sales tax hike in the second quarter of the year. The central bank’s action has lead to an erosion of Japanese households’ purchasing and will now be further exacerbated by the latest batch of monetary policy measures.

French economist, Pascal Salin, who is a professor emeritus at the Université Paris-Dauphine, has underlined in his latest publication “Money and Micro-Economics,” published by the Institute of Economic Affairs, “If low growth is due to excessive taxation and regulation, monetary expansion cannot help.”

“It can, at best, create short-run illusions in some cases. But, by focusing on monetary policy, one diverts attention from the true problems. As the illusions created by monetary policy fade away, the outcome is increased instability without any of the underlying problems being solved,” he concluded.

Sounds Vaguely Familiar?

While the Japanese prime minister has been supporting the easing steps undertaken by the Bank of Japan, he never commented on the sharp decline of the value of the Japanese yen after the Bank of Japan's announcement last Friday.

Today's report that Japan’s Chamber of Commerce wants the USD/JPY to trade between 95 and 105 Japanese yen are hitting the wires. However, the Japanese government’s influence on the exchange rate to the upside at the current juncture when it is doing everything possible to depreciate the currency is quite limited. The Chamber of Commerce will continue to be worried.

Societe Generale’s Cross Asset Research publication underlines, “Abenomics has now almost doubled the value of the Nikkei in two years while the yen has lost almost a third of its value. Only time will tell if these are foundations on which an economic recovery can be built, but what is sure to be legacy are the disinflationary forces unleashed by the BOJ on Japan’s Asian neighbours.”

And those neighbors replied starkly and quickly yesterday when Bank of Korea’s (BOK) Governor, Lee Ju-yeol, said about the new round of easing done by the Bank of Japan, "The additional monetary easing came earlier than market expectations. We're closely monitoring the situation and our biggest focus is the currency.”

The great news from all of this is that the Volatility which we have recently seen spike higher across the foreign exchange markets is very likely to stay with us for a long time. Opportunities which are provided by the rising economic imbalances between major economies have triggered a new round of US dollar strength, while the Japanese yen and the euro are suffering across the board.

As with any trade though, timing is crucial, what the foreign exchange traders now have, is much more choice than the usual ranges overwhelming the Forex market throughout the year until September 2014.