Banks V Regulators

JP Morgan Chase, one of world’s largest banks, has announced an increase in the amount of capital the bank allocates for regulatory penalties and future litigation costs. In a quarterly SEC filing, the bank has also admitted to facing a criminal investigation into its recent practises in the foreign Exchange market.

JP Morgan is currently in the middle of discussions with the US Department of Justice, the CFTC , UK’s FCA and possibly other regulatory agencies globally. The magnitude of fines levied on each financial institution being investigated and how much the banking industry as a whole will be affected by the regulatory backlash is as yet unknown. "Possible losses could be as much as $5.9 billion," according to JP Morgan. An increase of $1.3 billion since the end of June 2014. More broadly speaking, the banking industry as a whole could be tapped for over $40 billion by regulators, according to a Citigroup research note.

In an interview with Bloomberg, JP Morgan Chief Financial Officers (CFO), Marianne Lake, said legal expenses at JP Morgan in Q3 2014 was $1 billion, tied “in large part to the currency investigations." In the filing, the bank added, "These investigations are focused on the firm’s spot FX trading activities as well as controls applicable to those activities. JP Morgan continues to cooperate with these investigations and is currently engaged in discussions with DOJ, and various regulatory and civil enforcement authorities, about resolving their respective investigations.” Despite the ongoing discussions, the banks gives "no assurance that such discussions will result in settlements."

JP Morgan shares remain in an uptrend, trading at $60.88 at market close yesterday on the NYSE, at the top-end of its annual range.

Source: Yahoo

In the Same Boat

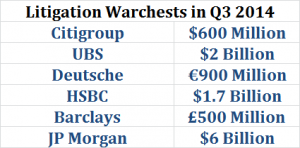

Several large top-tier banks are currently being investigated and are all expecting additional penalties. As a result, all top-tier banks are beefing up their warchests, although the nominal value of the expected fines remains disproportionally small compared to the market impact of FX manipulation alone.

In recent announcements, top-tier banks such as UBS, Barclays, Deutsche, HSBC and Citigroup have all reported increases in their litigation allocations and have warned shareholders that litigation costs will remain elevated at best for the foreseeable future given the range of manipulation and malpractice cases that have hit the largest banks over the past five years.

Various banks have been penalised for mortgage market malpractices, interest rate derivative fixing and LIBOR manipulation, just a few examples of penalties applied in response to widespread impropriety found to be occurring at Tier 1 banks.