After suffering a trading halt on its shares yesterday, Hong Kong-based broker, KVB Kunlun, today revealed that there is a potential buyer in the marketplace looking to buy up all their shares. The company added that the takeover bid is undergoing negotiations and discussions with no guarantees over the striking of any deal.

Yesterday, KVB Kunlun shares listed in Hong Kong caught a stratospheric bid, rising 35% from HK$0.46 to HK$0.62 on unusually large volumes before HKEx called a trading halt pending further announcements.

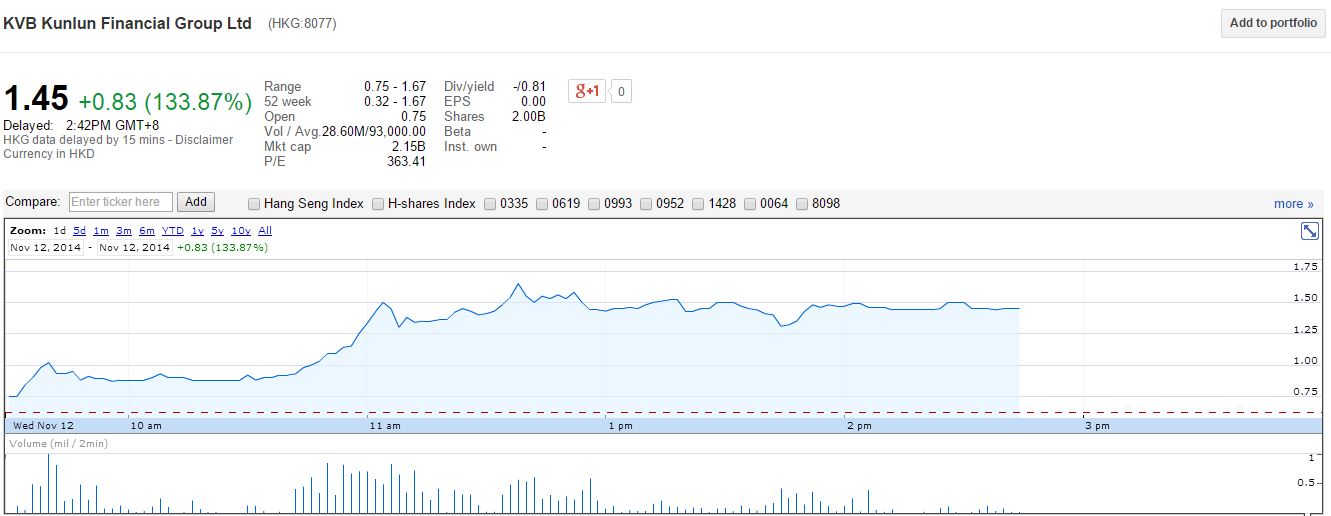

Last week, KVB shares were trading in tight range around $0.46. Yesterday's rampant buying interest helped shares rise to HK$0.62 before being halted. Trading in KVB shares resumed today (November 12) in the Asian trading session, opening at HK$0.75 and have been rising ever since. At the time of writing, shares were trading at HK$1.43 (having reached a high of $HK1.65 earlier) – more than 200% higher compared to last week.

Source: Google Finance

What Goes up Could Go Higher

On average, 10,000 – 50,000 KVB shares are traded on any given day. During the entire month of October, 1,710,000 shares were traded, however, over the course of yesterday, KVB Kunlun trading volume on HKEx reached 3,685,000 shares.

The KVB Kunlun Board has "noted the recent unusual movements in the Company’s share price and in the volume of share turnover. The Board is not aware of any specific reason that caused such movements."

In an official statement KVB it said: "For information, the Board has been acknowledged by the controlling shareholder of the Company, KVB Kunlun Holdings Limited, that it has been approached by an independent potential investor in relation to a possible acquisition of all or part of the 1,500 million Shares owned by the Controlling Shareholder. Discussions are at a preliminary stage without any definitive agreement in any form whatsoever and may or may not result in any transaction."

According to KVB, there are currently 2 billion issued shares and outstanding options to subscribe for 38,280,000 shares.

In a bid to douse speculator activity and allow for Plan B, KVB said, "There is no assurance that the discussions will result in any agreement between the Controlling Shareholder and the Potential Purchaser. However, if and when an agreement is reached, the Potential Purchaser may be required to make a mandatory offer for all issued Shares (other than those already owned or agreed to be acquired by the Potential Purchaser and parties acting in concert with it) in accordance with Rule 26.1 of the Takeovers Code."

It seems reasonable to assume that KVB's takeover is unconnected to the large share purchases, with the rise in share price coming as a rather unexpected surprise, which now means the potential suitor will likely pay more per share as a result. With a potential buyer now known to be interested and the current swirling speculation, right now is probably the worst time for a takeover.

At the start of the week KVB’s total market value was approximately HK$940 million (~$121 million), and at the time of writing, the company is worth HK$2.9 billion (~$374 million).

On the Offensive

In a sabre-rattling official statement, KVB has not gone as far as to confirm the alleged leaked information leading to the share price increases, however the company did allude to the possibility by highlighting several Rules and Sections of the Takeovers Code and GEM Listing Rules referring directly to disclosure of information and responsibilities of Stock Brokers , banks and other intermediaries– regulatory guidelines that designate appropriate actions in corporate matters.

“Stockbrokers, banks and others who deal in relevant securities on behalf of clients have a general duty to ensure clients are aware of disclosure Obligations attaching to associates and other persons under Rule 22 and that those clients are willing to comply with them,” warns KVB.

The statement goes on to say that broker-dealers (and their clients) are exempt from disclosure restrictions “as long as the value of dealings undertaken for a client during any 7 day period is less than $1 million."

In a veiled threat KVB Kunlun goes on the offensive by saying, “This dispensation does not alter the obligation of principals, associates and other persons themselves to initiate disclosure of their own dealings, whatever total value is involved."

Yesterday’s total trading activity amounted to approximately HK$1.8 million, which is possibly why KVB chose to reference the HK$1 million disclosure exemption.

Adding, “Intermediaries are expected to co-operate with the Executive in its dealings enquiries. Therefore, those who deal in relevant securities should appreciate that stockbrokers and other intermediaries will supply the Executive with relevant information as to those dealings, including identities of clients, as part of that co-operation.”

In other words, KVB is saying that small transactions that would have otherwise not been scrutinized, in this case, very large transactions will be. If information was leaked and used to purchase a large amount of shares, it will likely be found by whom and by extension, how that information could have possibly been shared.

Most likely an enquiry is already afoot.