A monthly study by one of the biggest Wall Street brokers housing main street traders, TD Ameritrade, was published, revealing the broker’s monthly index for evaluating the trends on the U.S. Equities market. The company calls it a proprietary tool, the Investor Movement Index (IMX), and the results for last month include data until June 26th.

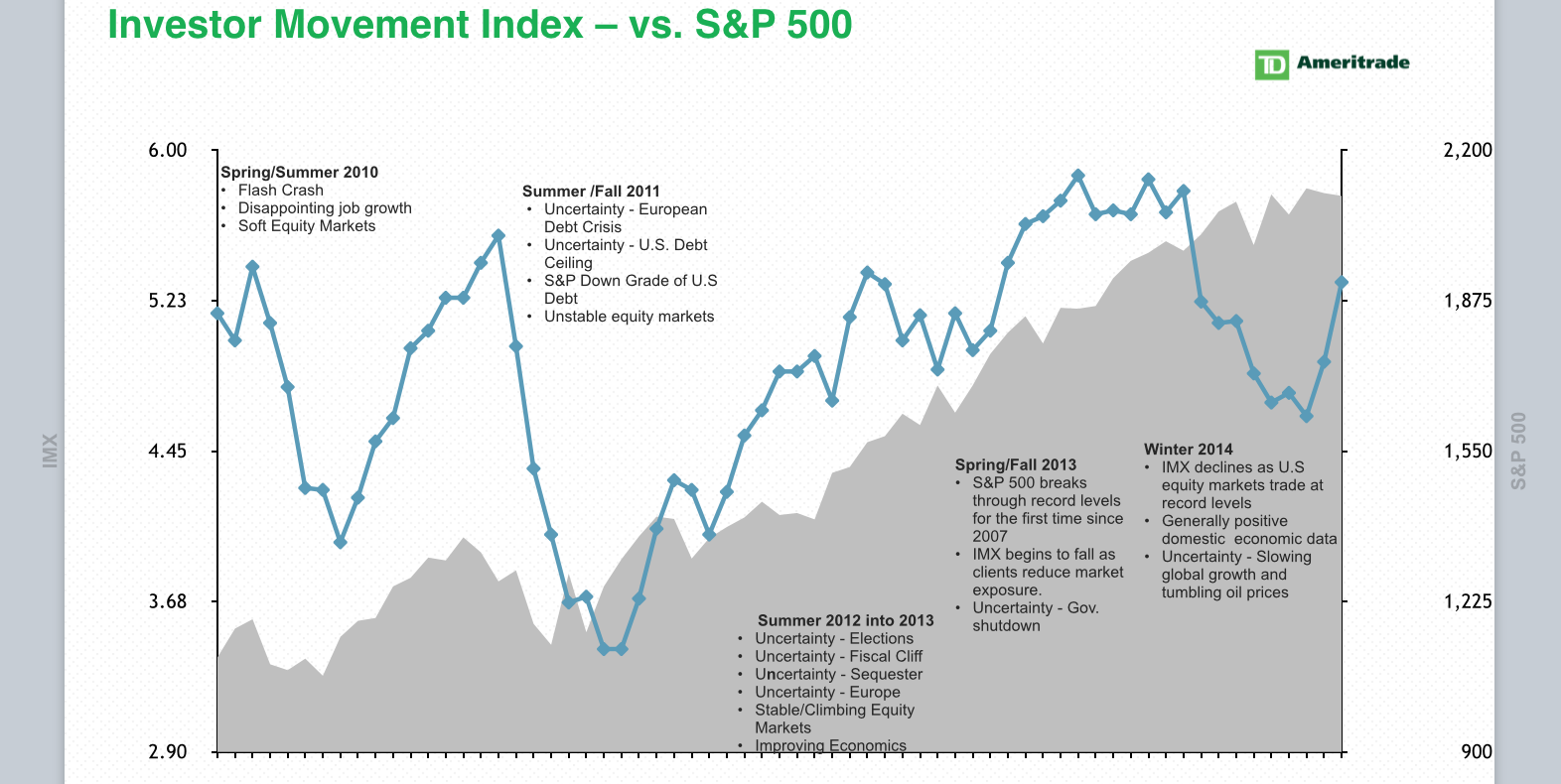

While the brokerage considers the IMX to be well correlated with the performance of the S&P 500 equities index, periods of lower correlation are present. TD Amritrade started the initiative in January 2010 which was one of the most active periods on the stock market leading to the Flash Crash in May.

The result of the event widely impacted the confidence of “main street” investors and they pulled back materially. After the IMX peaked out in April 2010, it remained subdued despite the rising level of the S&P 500. It took over a year for the retail traders’ confidence indicator to surpass its previous peak.

At the time a new scare for “main street” surfaced in the face of the European Sovereign Debt Crisis. The “whatever it takes” commitment of the European Central Bank’s President Mario Draghi did have an impact on the confidence of Wall Street, however it did little to reassure the retail investors.

As the S&P 500 kept rising, the confidence levels rebounded back up, just before retail traders became suspicious about the sustainability of the massive rally which major indices pulled since March 2009.

Historical Performance of the IMX and the S&P 500 Index, Source: TD Ameritrade

In June, the IMX representing the equity market exposure of TD Ameritrade's clients picked up materially when compared to the previous month. A vibrant jobs report instilled the confidence of the retail investors in the performance of the real U.S. economy. The reading came out at 5.32 points in June, which was higher by 8 percent when compared to the previous month.

This is the second consecutive move to the upside after a pullback which started in September 2014. Despite the stock market continuing its rally since then, the confidence of “main street” investors in the stock market rapidly deteriorated amid a growing number of worries ranging from the first rate hike by the Federal Reserve to the Greek crisis.

Commenting on the announcement, the Chief Strategist of TD Ameritrade said, “The first half of the year the S&P remained in one of the tightest percentage ranges as related to movement in history. However, clients continued to find potential opportunities in the equity markets. In doing so they have selectively dialed up their exposure over the last two months.”

The Stocks That Are Driving the Move

The shares of a number of well-known companies have marked price declines during the period of the survey until June 26th. Tech companies such as Apple Inc (NYSE:AAPL) and Twitter Inc (NYSE:TWTR) were seen as a good buy by main street investors as the prices of both firms dropped during the month.

Chevron Corp (NYSE:CVX) was another company which got the interest of retail investors after the stabilization of crude oil prices. Smaller energy companies such as Chesapeake Energy Corp (NYSE:CHK) were amongst the other net buys by “main street” financial markets aficionados.

With interest rates continuing to be low, attractive dividend plays such as Johnson and Johnson (NYSE:JNJ) and Procter and Gamble Co (NYSE:PG) were also targets of retail investors despite the share price declines since the beginning of 2015.

On the sell side, General Electric Co. (NYSE:GE) and Sirius XM Holdings (NASDAQ:SIRI) have lacked the confidence of TD Ameritrade clients, while major banks like Bank of America and Citigroup have continued to be avoided despite rallying steadily since March.

On the technology side, despite the price targets upgrades which triggered a rally, shares of Facebook Inc (NASDAQ:FB) were a net sell alongside AOL Inc (AOL) which got taken over by Verizon Communications Inc (NYSE:VZ).