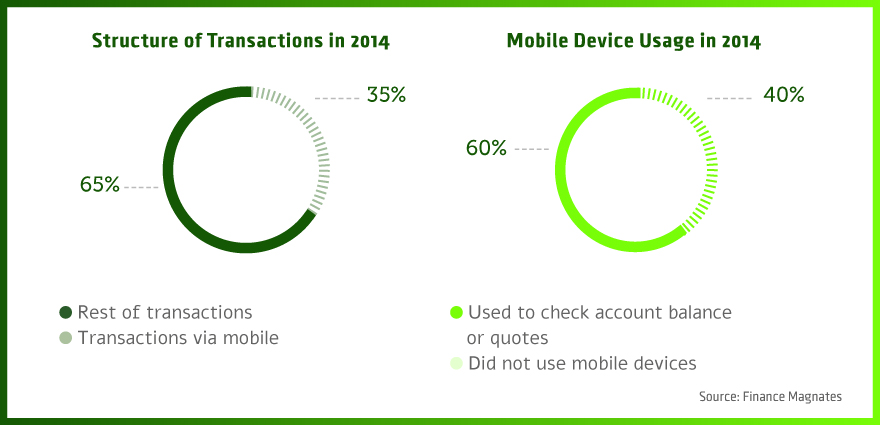

Recent years have brought the ever-growing popularity of mobile trading. According to the comSocre report in 2014, the number of mobile device users surged for the first time above the number of desktop device users. This trend is not going to reverse. So does this mean that traditional desktop applications for charting and trading will be forgotten? What does this mean for the brokerage industry and the trading tools that it currently provides, and what is the result for customers?

The beginning of charting platforms – how it all began

Computerized charting in a form similar to what is used today started in the late 1980's. The two most popular programs of that era were the famous System Writer, and MetaStock. System Writer was launched in 1987 and allowed users to not only chart but also to back-test their own strategies. It was developed by Omega Research (later renamed to TradeStation). The MetaStock package was introduced to the market even earlier, as its first incarnation was already available in 1986. Later, technical analysis was revolutionized due to computers becoming more advanced and widely available. The potential of such applications was soon recognized by the emerging retail Forex industry.

Computerized charting in a form similar to what is used today started in the late 1980's.

Today, commercial charting software is also an experimental ground where many charting concepts are introduced for the first time, only to appear later on forex platforms. So what does the charting software industry have to offer today, and how it can be used by brokers tomorrow?

Desktop software has plenty to offer- trends of tomorrow

Finance Magnates conducted broad research on the most popular charting and trading platforms. Data from 33 firms was collected, although this number is still low as only the biggest and most popular tools were subjects of the research. A list of their features was created and analyzed. This allowed Finance Magnates to track the history of changes and their current development. Finally, it allowed to us mark out future trends that can be expected from software developers. Read the article and you will also learn what industry leaders think about this subject – their predictions should be interesting to both traders and the brokers that provide them with charting tools.

This article is an excerpt from an analysis included in the Q4 2015 issue of the Finance Magnates Quarterly Industry Report. To get the full article and other research products, contact our sales team at:tals@financemagnates.com