The twenty-first Monex Global Retail Survey has just been released, based on results compiled from May 25th through June 6th 2016 from nearly 1200 retail traders and investors across Japan, the US and Hong Kong, and summarized in terms of aggregated market sentiment across prevailing themes and developments.

The online survey had responses from 747 investors from Japan-based Monex, Inc., 127 investors from US-based TradeStation Securities, Inc., and 320 investors from Monex Boom Securities in Hong Kong, over a nearly two-week period that just ended last week.

The company has been compiling these surveys for several years already, and Finance Magnates has reported on a number of them during that time, with the latest report showing financial market sentiment expectations from traders across three regions and compared to the prior survey.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016

Bremain camp win expected

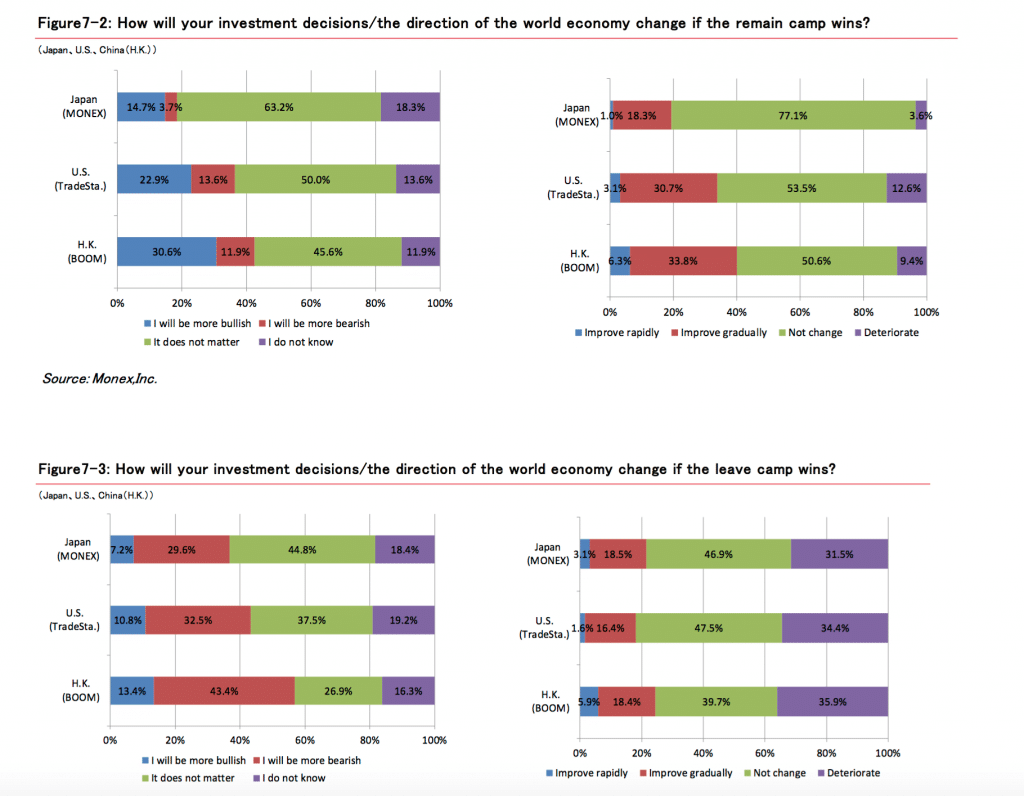

Overall, survey respondents expected global stock markets to be more bullish than the prior survey, and the impact of next week’s Brexit vote came into focus as part of the survey’s prepared questions.

From the 1194 trader’s surveyed, between 70-80% expect the UK to remain in the EU, leaning with a ‘Bremain’ camp win, whereas the effects of a ‘Brexit’ camp win were also taken into consideration based on the questions posed – which showed that 30-40% of the retail investors surveyed would be more bearish if the UK decided to leave the EU.

As can be seen in the excerpt below from the sample of traders surveyed across each firm's regional operations, Japanese investors appear to be the least affected in their view of any impact from next week's vote - indicating that Japan's markets could see a lesser reaction than European indices and related currencies.

Although, on the contrary, the Japanese currency could be sought as a safe-haven and thus could be affected by strengthening further from its current price near 106.25 which is nearly three basis points under last month's average near 109.15 - as JPY buying has been on the rise.

Source: 25th Monex Retail Investor Survey

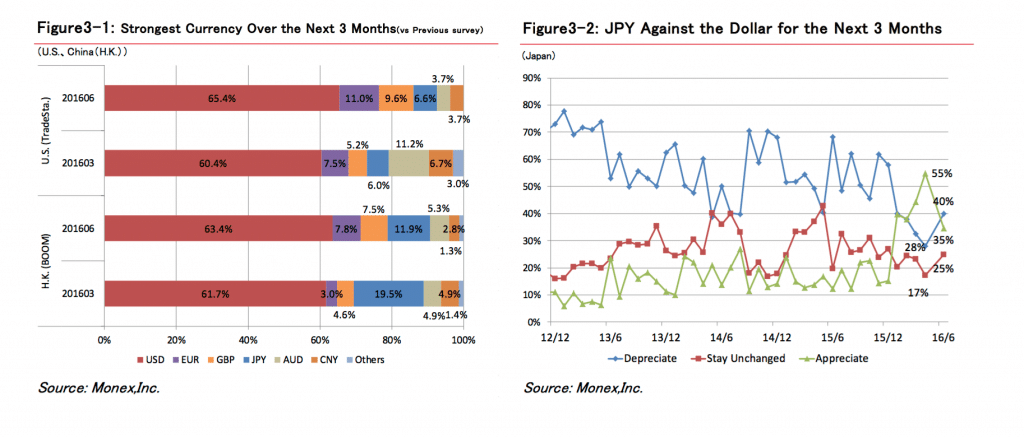

US dollar, stocks, and BoJ easing

A larger percentage of retail investors in the survey anticipated a stronger dollar, compared to the prior survey, and energy was ranked the third most attractive asset class from US and HK respondents, whereas expectations for US stocks reached a record high among retail investors in Japan.

In addition, the investment appetite for traders to invest in Japanese stocks also rose across the board, as noted in the report, and most of the Japanese retail investors surveyed expect the Bank of Japan to take further monetary easing measures during the first half of the fiscal year.

Source: 25th Monex Retail Investor Survey

Timing of US rate hike

As the likelihood of a rate hike this month comes into focus in the US, the timing of the hike saw mixed expectations in the survey as respondents across all three regions expected a hike between July and September 2016, followed by investors in Japan and China expecting a hike in the US during October through December this year. Investors in the U.S. expected the hike to take place this month.