The Moscow Exchange has just issued an announcement about the launch of a new futures contract. Starting tomorrow (the 16th of September, 2014), futures on the Russian Federation’s sovereign Eurobond maturing in 2030 will be available for trading.

As the first deal gets priced, the Volatility on Russian bonds has been particularly high after recent geopolitical developments. The latest round of sanctions against Russia has led to the Russian ruble hitting yet another all-time low at RUB 38.42 per US dollar.

A Liquid Market (For Now)

The Russian sovereign and corporate eurobond market is currently a highly liquid asset class with the total amount of debt issued at around US$230 billion. Emerging markets focused Russian investment house Renaissance Capital and Derzhava Bank will be the market makers for the newly announced contract.

Roman Sulzhyk, Derivatives Market Managing Director at the Moscow Exchange, commented in the company announcement, "The futures will provide access to the liquid sovereign Eurobond market for a wide range of investors including commercial banks, portfolio managers, and private investors. The contract could be viewed as a dollar denominated contract on Russia's credit risk, an analogue of the credit default swap (CDS) on Russia.”

The country has refrained from issuing euro-denominated bonds this year as the market's asking interest rate premium has increased materially after the eruption of the ongoing Ukrainian crisis. The country prefers to issue ruble-denominated bonds as the ruble exchange rate continues its decline to all-time lows.

Russian Ruble Decline

The pace of the decline in the country’s currency has been unprecedented in its short history, as it represents a 66% drop since its peak in July 2008 when the country’s economy was booming due to Brent crude oil prices closing in on $150 per barrel. The drop in oil prices alongside the financial crisis has caused the first big push lower due to capital flight away from Russia.

Monthly USDRUB Chart September 2014, Source: NetDania

The most recent round of exchange rate depreciation has been triggered after the escalation of the Ukrainian protests and the ousting of former president of the country Victor Yanukovitch. After the tensions escalated and Crimea was annexed, another round of capital flight has triggered the current demise of the Russian ruble regardless of the Bank of Russia raising interest rates by 2.5% in 2014.

Eurobonds Issuing Rapidly Declining

The issuance of Eurobonds has not only been declining on the sovereign front. Local companies are increasingly getting singled out from foreign currency financing markets as the interest premium is tracking the moves of the Russian ruble-denominated bond markets, which have been tanking since the final quarter of last year.

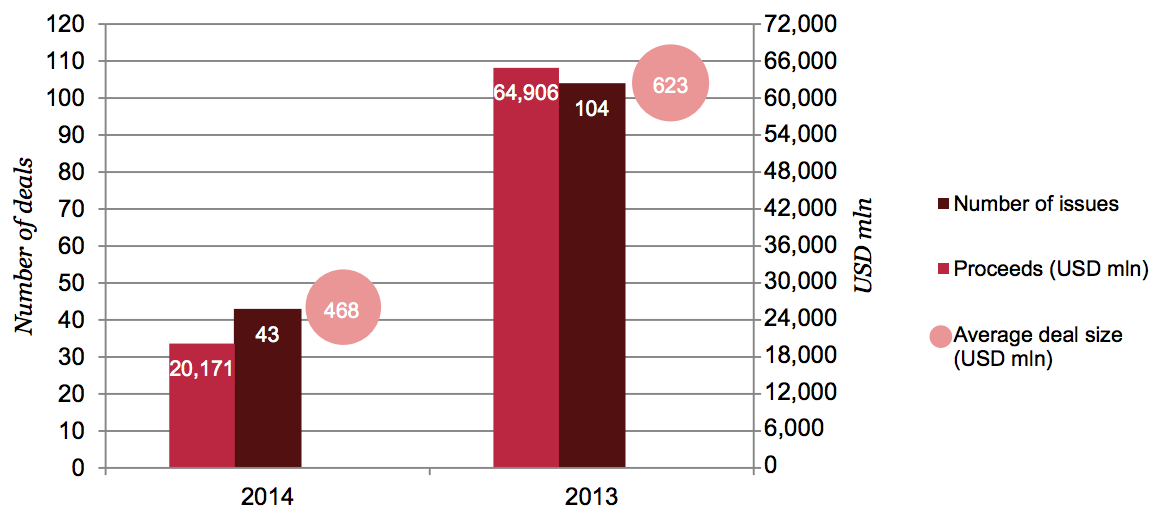

Number Of Eurobond Issues and Total Proceeds (excl. sovereign), Source: Pricewaterhousecoopers

The total number of Eurobonds, excluding sovereign debt, has declined materially when we compare the 12 months ending in May 2013 and 2014. According to a PricewaterhouseCoopers' study conducted at the close of the second quarter, the number of issues has dropped by almost 60% to 43, while the total proceeds shed 70% to $20 billion.

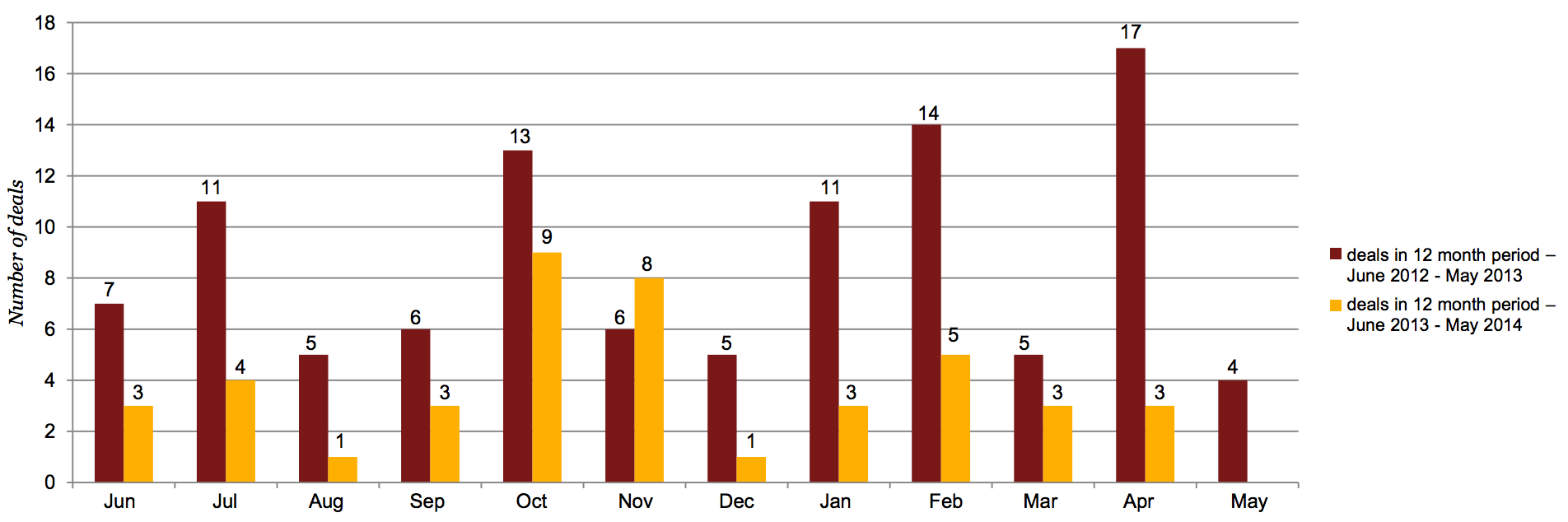

Number of Monthly Eurobond Issues, Source: PricewaterhouseCoopers

Since October of last year, the issuance in euro-denominated bonds has started dropping materially, with several months in the 12 months ending in May 2013, surpassing 10 issues per month.

Just recently, Reuters reported about Gazprom exploring the opportunity to test the bond market with a €1 billion Eurobond issue, according to sources cited in the article.

According to sources close to Forex Magnates in the Russian capital markets industry, there is an increasing worry about even higher interest rates as the central bank is expected to instill confidence in the currency by raising interest rates to new historic highs.

At the peak of the previous interest rate cycle of the Russian central bank, interest rates were raised to 10.5% attempting to stem the decline in a rapidly falling Russian ruble.