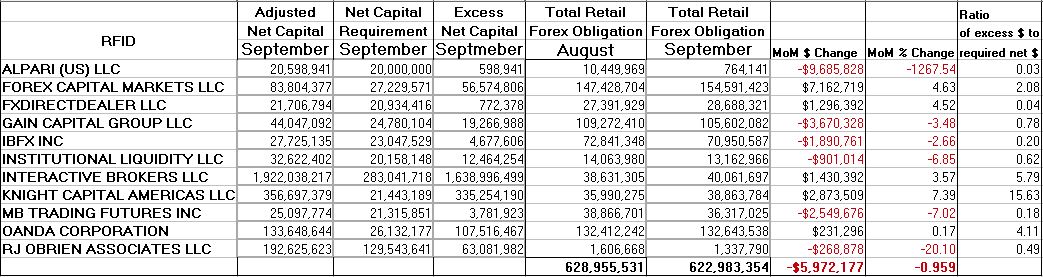

The amount of total retail Forex obligations held at US Futures Commission Merchants (FCMs) that act as Retail Foreign Exchange Dealers (RFEDs) during the month of September had a net change of nearly $6 million less than the month before, according to the latest selected data for FCM posted on the CFTC website.

This drop in combined foreign exchange deposits held by RFEDs consisted of a gross increase of $12.9 million from five of the reporting dealers, that was more than offset by a loss of the remaining six dealers whose amounts had fallen month-over-month totaling a combined $18.9 million, resulting in a net decrease of $5.9 million across the 11 reported dealers combined totals.

FXCM Benefits, FXDD Follows, Knights Capital, IB and Oanda Still Firm.

Of the 5 dealers who had MoM increases, the largest increase was that of FXCM which had $7.1 million more in Forex obligations over the previous month, bringing its total to $154.6 million at the end of September, and up from $147.4 million in August. FXDD also had a similar % increase with $1.2 million more in forex obligations MoM, up 4.5% from $27.4 million in August.

The largest percentage increase was that of Knight Capital Americas, consisting of 7.4% higher in September, up $2.87 million to $38.8 million in September from $35.9 million in August. Interactive brokers had a more modest increase of 3.57% MoM for its retail forex obligations, increasing by $1.43 million to just over $40 million in September.

Oanda had the smallest increase out of the five dealers who reported higher MoM figures, with an increase of 231K on $132.4 million, and reflecting an increase of less than two-tenths of a percent MoM. These five firms contributed to the $12.9 million increase reflected in the data (see attached spreadsheet below).

Alpari US Shifting

From the six reporting RFEDs reflected in the combined $18.96 million decrease, more than half of this consisted of Alapri’s drop of $9.68 million as the firm introduced its customers' assets to FXCM, as it prepared to shift the US entity to that of an Introducing Broker model-effectively freeing up its regulatory capital for use elsewhere.

While any amounts introduced to FXCM would have bolstered FXCM's reported figures, the amount that was attributed to either customer withdrawals or trading losses (at Alpari) is not available, and therefore cannot be ascertained as of yet,from the change in Alpari figures and in comparison to any increase in FXCM’s numbers that could be attributable to such IB efforts. In related news Alpari UK just announced a major change in its firms management, as covered by Forex Magnates today.

Of the other five dealers who reported lower amounts in September over August, RJ O’Brien had the largest percentage decrease MoM, as the amount of retail forex obligation fell from $1.6 million in August to $1.33 million in September, a change of 20% MoM.

Drop Seen in RJ Obrien, Gain Capital, MB Trading, Less in ILQ and IBFX

This was followed by MB Trading that had September Forex obligations reported as 7% lower over August, as its amount fell from $38.86 million to $36.31 million. Institutional Liquidity (ILQ) had the smallest monetary decrease of $900K from $14 million in August to $13.1 million in September, although this reflected a 6.8% drop MoM.

Gain Capital Group had the second largest decrease in monetary terms (after that of Alpari), from the amount that it held in retail forex obligations, from $109.27 million in August to $105.6 million in September, totaling a $3.67 million drop MoM or 3.4% lower during that time. IBFX had the least percentage decrease MoM totaling 2.6% or $1.89 million lower from $72.84 million in August to $70.95 million in September.

Source: CFTC September Selected FCM Data

As can be seen in the column to the far right in the above spreadsheet, the firms with the highest ratio of excess regulatory capital relative to required net capital can be compared to changes since the last time Forex Magnates covered the selected FCM data for RFEDs, where there was little change in August data over July. By comparison, September over August has changed to the tune of almost 1% lower, from $628 million in August to $622 million in September.