The Russian President, Vladimir Putin, has tried to convince the world that the rapid drop in the ruble Exchange rates is only a passing problem due to speculators and does not represent a fundamental shift in his country's economic situation. Speaking today at the Asia-Pacific Economic Co-operation (APEC) Summit in Beijing, Mr. Putin assured the audience that the actions taken by the Central Bank of Russia (CBR) will be successful in stabilizing the currency.

“We are currently seeing speculative jumps in the exchange rate, but I think that this should stop soon,” Mr. Putin stated. According to the Russian President the ruble’s sharp drop was “absolutely not related to fundamental economic reasons,” as he asserted that “equilibrium will come soon.”

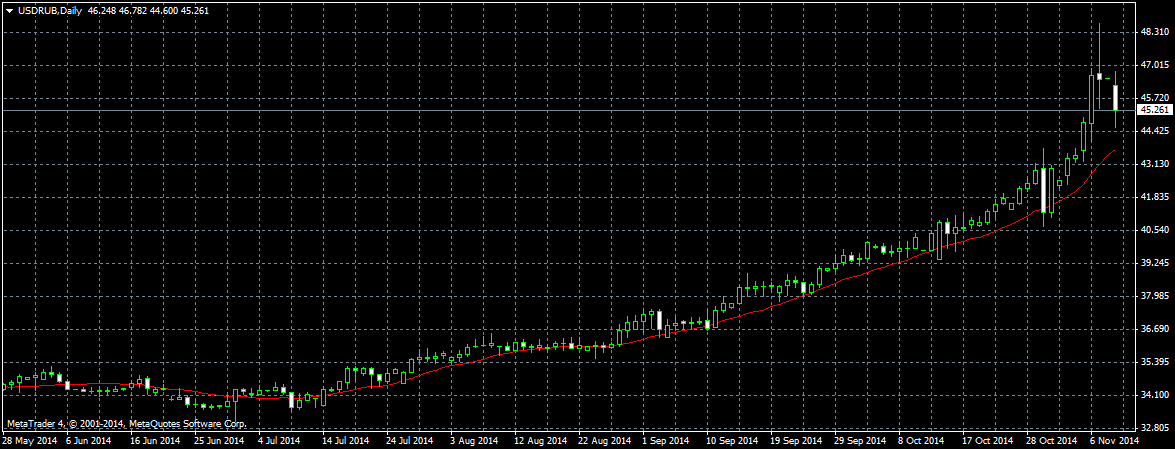

The Russian currency has dropped in value as much as 30% against the US dollar during the last year and 15% over the past month. The country's economy is suffering a trifecta of calamities as the war in Ukraine, Western sanctions and low oil prices all occur at the same time. On Friday, the ruble hit its weakest-ever level, 48.6 against the greenback.

USD/RUB Daily Chart

The Russian leader tried to convey a sense of business as usual and a feeling of confidence in face of all the difficulties. His plan seems to be to reorient Russia's economy toward the East, as Putin has stated that Russia and China will increase the amount of trade to be settled in yuan instead of USD. There have already been reports coming out about Russian firms planning to abandon Western capital markets, such as London, and scouting Chinese venues to operate in following the sanctions.

In keeping with the markets' demands, Mr. Putin has so far ruled out capital controls, despite reports of capital flight amplifying the ruble's decline. He has promised to keep Russia's debt levels down and also said that Russia planned to use part of its sovereign wealth reserves to attract foreign investment. "There will be no increase of sovereign debt. We are planning to keep it at a safe, manageable level of below 15% of GDP."