In yet another sign that the rift between the West and Russia is only deepening, the Russian Central Bank and the government’s financial and economic departments stated that a bill has been drafted to create a Russian analog of the SWIFT international financial message system.

According to a statement made by Deputy Finance Minister Alexei Moiseyev on Wednesday, the government prepared the bill in consultation with the local banking community and the Bank of Russia.

The move is in response to concerns of the Russian government that Russia may be excluded from the SWIFT (Society for Worldwide Interbank Financial Telecommunications) payment system, should tougher sanctions be applied at any point in time in the future.

Messages transmitted through SWIFT contain information about Payments transmitted through SWIFT.

The Russian government is worried that a theoretical cessation of all Russian ruble transactions can be used as part of wider sanctions against the country. In the case of a backup system developed locally, a SWIFT payments blockade would only constitute a technological hurdle.

Previously, the European Union court rolled back EU banking sanctions on some of Iran’s largest banks. With this precedent, the possibility of European Union countries using banking sanctions through the SWIFT payments system as a tool is quite remote.

The announcement comes only about a week after the Bank of Russia mandated Russian banks to develop a solution which can serve as an alternative to the widely used Brussels- based SWIFT.

According to the Russian Central Bank’s letter, “The creation of a Russian payments system is essential for assuring the national economic security.” Another possibility for the move is the aim to increase confidentiality of interbank and client operations.

Theoretically, foreign entities can have access to sensitive data, especially in light of recent revelations of intelligence agency malpractices by former CIA system administrator, Edward Snowden, who recently got permission to stay in Russia for an additional three years.

According to Russian news agency ITAR TASS, the First Deputy Chairman of the Russian Central Bank, Georgy Luntovsky, stated in July that SWIFT was discussing the possibility of establishing an operational center in Russia with the Russian regulator. At the time, SWIFT’s Director for Russia, CIS and Mongolia, Matvei Gering, confirmed the validity of this information.

SWIFT Payments

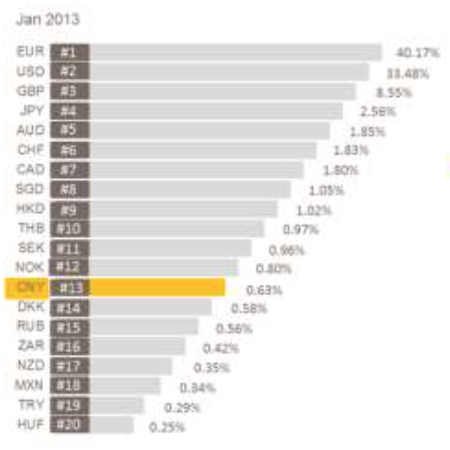

SWIFT Payments Share by currency, January 2013, Source: SWIFT

Brussels-based SWIFT transmits 1.8 billion communications per year, sending payment orders worth $6 trillion a day. The system includes more than 10,000 financial organizations from 210 countries.

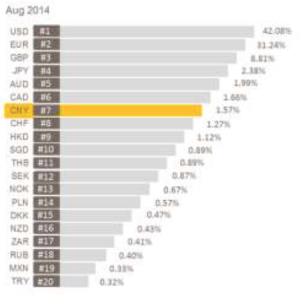

SWIFT Payments Share by Currency, August 2014, Source: SWIFT

The share of Russian ruble transactions has been declining in the past year with the Russian currency occupying the 15th place in 2013 with 0.56% of all global payments. According to data published in SWIFT’s Monthly RMB Tracker report, the ruble currently is in the 18th spot just between South Africa and Mexico with 0.40% of global transactions.

That said, according to SWIFT’s CEO, Gottfried Leibbrandt, Russia uses cash for more than 90% of all transactions. Comparing this to major developed economies, Japan and Italy use paper money for more than 85% while Germany and Switzerland about 70-75%.

The majority of other developed countries use cash for only 55-60% of their transactions.

FBI Inspecting the Possibility of Russian Hackers Tied to US Banks Infiltration

Meanwhile, Bloomberg’s Michael Riley and Jordan Robertson reported that Russian hackers allegedly attacked two major banks in the the US in mid-August. One of the banks was confirmed as JPMorgan with the other remaining unidentified.

According to the report, the attack is being investigated by the FBI as being connected to the recent geopolitical spat between the US and Russia. Sensitive data has been lost and Western governments are in close contact in order to establish any connections to the recent infiltrations of major European banks, according to Bloomberg’s sources.

Earlier this month, a Russian hacker's operation allegedly stole 1.2 billion sets of user names and passwords. Recently, FBI’s spokesman, Josh Campbell, stated, "The FBI is investigating the recently reported incident involving the potential compromise of numerous user names and passwords."

US officials warned the financial services industry in April 2014 that the Russian government could respond to sanctions by using hackers to infiltrate computer networks of US corporations and target the financial system.

Masking the location of a hacker attack is known to be a widely used practice, and at this point in time there is no proof of actual Russian involvement in the attack.