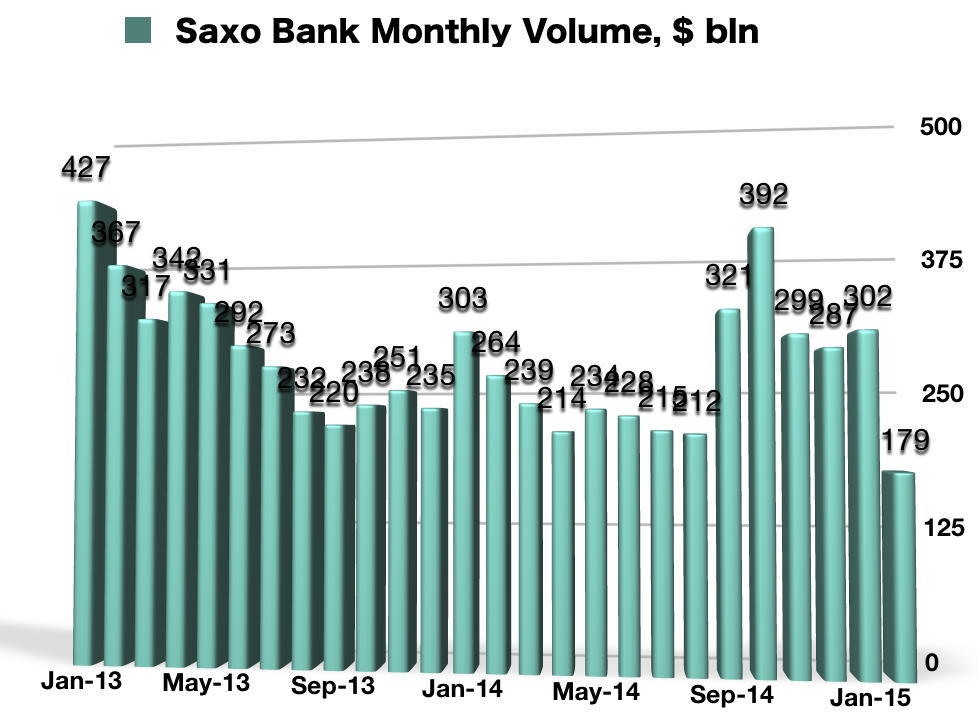

According to data released by the Danish multi-asset brokerage, Saxo Bank, trading volumes throughout the month of February have materially declined when compared to the first month of the year. The average daily trading volume (ADV) slumped by 37 percent to $9.0 billion.

The total trading volume declined 40 percent to $179 billion, marking a multi-year low. The decline comes during a challenging month for the foreign exchange industry as Volatility has declined materially in major currency pairs.

Despite dwindling volumes, client collateral deposits at Saxo Bank have increased during the month of February marking the second highest month since November 2014 in U.S. dollar terms ($11.09 billion) and an all-time high when denominated in Danish krone (DKK 73.9 billion), which is the currency which Saxo Bank uses when reporting financials.

Commenting on the decline in trading volumes, Saxo Bank’s Head of Markets, Claus Nielsen, said, "Since its peak in mid-January, market volatility has decreased. You can use EUR/USD 1 month as a reference. EUR/USD volatility topped at 14% and is now back at 9%."

"We still expect firm volatilities over the coming months and to reflect this we have during January and February increased various margin requirements on a number of products including Foreign Exchange in order to protect our clients,” he commented on Saxo Bank's recent changes in leverage levels on certain products.

Commenting on record client deposits, Mr. Nielsen said, “Since January, we have seen a fresh inflow of clients and clients' collateral deposits for trading are at a record-high, emphasising that more than ever, traders and investors require a safe environment for their funds combined with access to a robust multi-asset Trading Platform and we can give them that.”