The new Singapore Kilobar Gold contract is for 25 kilograms of 99.99% pure gold and will begin trading on the Singapore Exchange (SGX) at 8:15 a.m. on Oct. 13, introducing centralized trading and clearing of a physically-delivered gold contract in Singapore.

With this addition, global suppliers of physical gold are able to connect more effectively with their Asian counterparts. With this Contract, global suppliers of gold are able to connect more effectively with their Asian clientele. The Contract comprises a series of six daily contracts, which will give physical gold traders access to competitively-priced kilobars.

[gptAdvertisement]

The Contract is the result of a collaboration between International Enterprise (IE) Singapore, Singapore Bullion Market Association (SBMA), Singapore Exchange (SGX) and the World Gold Council.

Commenting on the significance of the announcement, Singapore’s Minister of Trade and Industry Lim stated, “With our close proximity to both demand and supply in Asia, I believe that Singapore is well-placed to support the bullion industry, with substantive mutual benefits.”

Asia’s incessant demand for physical gold is the biggest driver for the implementation of a new gold contract trade on the Singapore Exchange.

“Our vision is that Asia can be a driving force to continue the growth of the bullion industry, and be a global leader in areas fundamental to the demand and trade in this region,” he added.

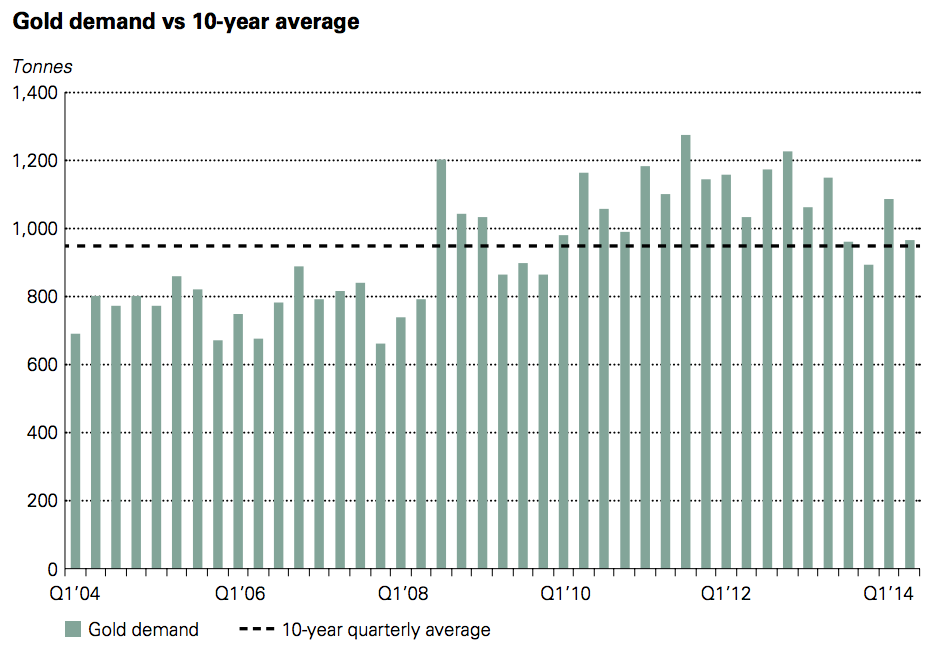

According to the World Gold Council global consumer demand for the precious metal has increased almost 50% over the past ten years, while South East Asian appetite has risen a staggering 250%.

Global Gold Demand Q2, Sources: GFMS, Thomson Reuters, World Gold Council

The move comes after in 2012 the Singapore Government exempted investment in precious metals (IPM) from a 7% Goods and Services levy. Back in June, Metalor Technologies Singapore Pte Ltd officially opened its bullion manufacturing and refining facility in Singapore.

Since the exemption from the tax on IPM in October 2012, gold trading has risen by 94% between 2012 and 2013 from SG$18 billion to SG$35 billion.

“The global gold market continues to shift from west to east and Singapore’s ambitions to become a gold hub reflect this trend. Since its inception, the World Gold Council has worked with key market participants to drive the development of this market,” said Albert Cheng, Far East Managing Director at the World Gold Council.

He went on to elaborate that, “This innovation will contribute substantially to the creation of a more efficient market capable of satisfying growing local demand for gold in a transparent and trusted manner - it will provide the foundation for further development of the gold market throughout South East Asia.”

Singapore Bullion Market Association’s President, Ng Cheng Thye, added in the joint company announcement, “This Contract will help to develop the gold market in South East Asia by creating greater Liquidity and opportunities for growth.”

“With a stock and flow of bars guaranteed by the major bullion banks, as well as an exchange open to the key Buy-Side participants, we believe this will encourage further products to be developed in South East Asia, which are based on this kilobar contract model,” he added.

Brink’s Singapore Pte Ltd has been appointed as an Approved Vault Operator and its approved vault is at The Singapore Freeport. Banks supporting the development of the contract include JPMorgan Chase Bank, Standard Bank Plc Singapore Branch, Standard Chartered Bank and The Bank of Nova Scotia.

Muthukrishnan Ramaswami, President, SGX stated, “SGX is pleased to support the consortium's efforts to develop Singapore as a global trading hub for gold. SGX's market place will enable the trading and clearing of the Singapore Kilobar Gold Contract and establish a fully transparent price discovery mechanism for gold in this region.”

The new contract illustrates Singapore government’s success in establishing the country as a key regional center where market transparency and proper business conduct are warranted in a well-governed and regulated framework in Asia.

In a recent move, the specifications of mini gold futures and options instruments traded on Inter Continental Exchange Futures U.S. have been changed last month to make physical delivery of gold bullion much more convenient for investors, while the Shanghai Gold Exchange, announced its plans to launch new precious metals contracts in the country's free trade zone.