Data released from SWIFT has shown that competition from major financial centers worldwide to get an appetizing piece of the offshore Chinese yuan market is intensifying. The second major regional financial center after Hong Kong, Singapore, has overtaken London back in February as the value of Payments transacted has increased by 375% in March over the past year.

The race for second spot dates from a while back - in June 2012 London overtook the Asia-Pacific center only to lose this spot 20 months later due to a rather abrupt rise in clearing deals in Singapore. The rate has almost quadrupled on a year-on-year basis due to increased acceptance of Chinese yuan transactions by businesses in the region.

This transition from a dollar-based trade has been coming for a long while, however with increasing efforts by the Chinese government to increase the Chinese yuan’s convertibility and the increasing dependence of Asia-Pacific economies on China for exports, the surge in renminbi demand in the region is well-founded.

The renminbi is strengthening its position as a global payment currency by marking a new record high in activity share among currencies worldwide - it is now 7th with 1.62%, catching up to the Canadian and the Australian dollars which are almost certain to be overcome during the second quarter of 2014 with shares of 1.83 and 1.84%. The growth picture on a monthly basis from February to March tells us that renminbi payments increased in value by 29.0%. Provided this trend persists, most likely by the end of May, the Chinese currency will have surpassed the Australian and Canadian dollars to become the fifth most actively traded currency in the world.

Last month the assistant managing director of the Monetary Authority of Singapore stated, "The interest that we are seeing in renminbi stands in stark contrast to the situation two to three years ago, when there was much less interest or familiarity with renminbi opportunities.”

Regional Businesses Switch to the Chinese Yuan for Trade

The development should come as no surprise considering that businesses in the region which are dealing with Chinese companies have started to settle trade and transactions in yuan in order to save the costs associated with translating deals in US dollar terms. The stage for the yuan to become a trade currency has been set for the past several years.

Recently the Australian Stock Exchange announced that it will be settling yuan trading by the middle of the year. London’s third position would be put into question after this offering becomes available, as massive trade ties between Australia and China make the switch from commodity exports by the formerly booming Australian mining sector to the expertise of Aussie companies related to creating service sector businesses - a sector of the Chinese economy that is destined to grow substantially in the coming years, unless...

Massive Risks for the Renminbi Are Lurking Ahead

Some massive risks for the Chinese economy are still lurking around the corner with the government taking charge of deleveraging and rebalancing, a process that will greatly impact local South-East Asian economies which are not ready for a China that is growing at 3 to 4% over the next several years. Should this process materialize, it could lead to a substantial adjustment in various businesses and governments in the region.

With the vast majority of market participants betting on a one-way appreciation of the renminbi over the past couple of years, the latest introduction of a two-way volatility is stoking some pressures for investors who have been flocking to China for the past decade. The Chinese government is now on the opposite side of the carry trade and it appears that it has a lot to gain by helping the unwinding process – for every 10% devaluation in the CNY/USD, China could be gaining close to $200 billion. Staying in the currency war and devaluing to boost exports is the most likely (and the easiest) step chosen by the People’s Bank of China and the Chinese leadership to support growth in a deleveraging environment.

OECD data

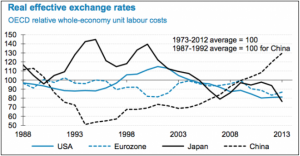

Contrary to popular belief and global allegations by Western leaders of the Chinese currency being grossly overvalued, the Chinese yuan’s real effective exchange rate has risen substantially in recent years according to OECD data.

This dynamic is precisely the same as the one which moved South-European economies, Ireland and France to become uncompetitive in the years precluding the European sovereign debt crisis.

After many years of worldwide complaints that the Chinese yuan must be free floated, Chinese policymakers might just allow that to happen. However, the direction of the trend after that happens might turn to be quite the surprise - for those of you who remember the Asian financial crisis of 1997, the average currency devaluation in the region was close to 60%. China needs time to rebalance its growth and policymakers would easily use the exchange rate tool to achieve political goals.

Despite the fact that many economists believe that China’s massive reserves can prevent the effects of capital flight, nobody is even mentioning that a vast portion of these reserves are already used for loans to foreign governments. With all of this information at hand, the Chinese yuan might become even more prudent for trading after the unavoidable exchange rates liberalization.