The market always gives way too much credit to central bankers. In the case of the Swiss central bank, as is the case with many other central bankers, its governors have had an academic background without any trading experience, which prevents them from understanding how the currency markets work.

A year after the inevitable happened, Finance Magnates interviewed one of the most prominent figures who had predicted the Swiss National Bank debacle. Martin Armstrong became FXStreet’s Forex person of the year in 2015 because of his visionary call of the collapse of the EUR/CHF exchange rate floor at 1.20, a prediction he made in mid-2014.

SNB Crisis Anniversary: A Timeline of Panic

Was the SNB Crisis the Donald Trump Moment for the Forex Industry?

FX Liquidity and Clearing a Year After the Crisis

SNB Crisis Anniversary: Tales from Ground Zero

Regarding a conversation he had with Swiss officials, Mr Armstrong recalled: “When I told them the peg is going to break, they said that they will be able to hold it.”

He explained why it was clear that the casino game couldn’t last forever: “Traders were betting a billion dollars per position and they weren’t able to go wrong, because the central bank had their back.”

As the pressure built up and speculators had their feast, the peg did go, however what is now more important is where is the market going to go in the future and are we going to see more unexpected events in the coming quarters.

The Pegs Must Go

Looking at the insulation efforts of brokers that are preparing for more Black Swan events, we are seeing that currency pegs have gathered enough attention. Nevertheless we asked Mr Armstrong about the prospects for more currency pegs going in 2016.

Test your knowledge, win a prize! Take the Finance Magnates quiz...

“All the pegs are largely going to go, because the U.S. dollar is going to go up dramatically. If these pegs don’t go, the countries are going to be challenged with severe deflation,” he explained.

We then decided to ask 2015's forex person of the year how the markets are going to trade throughout this year after their rocky start.

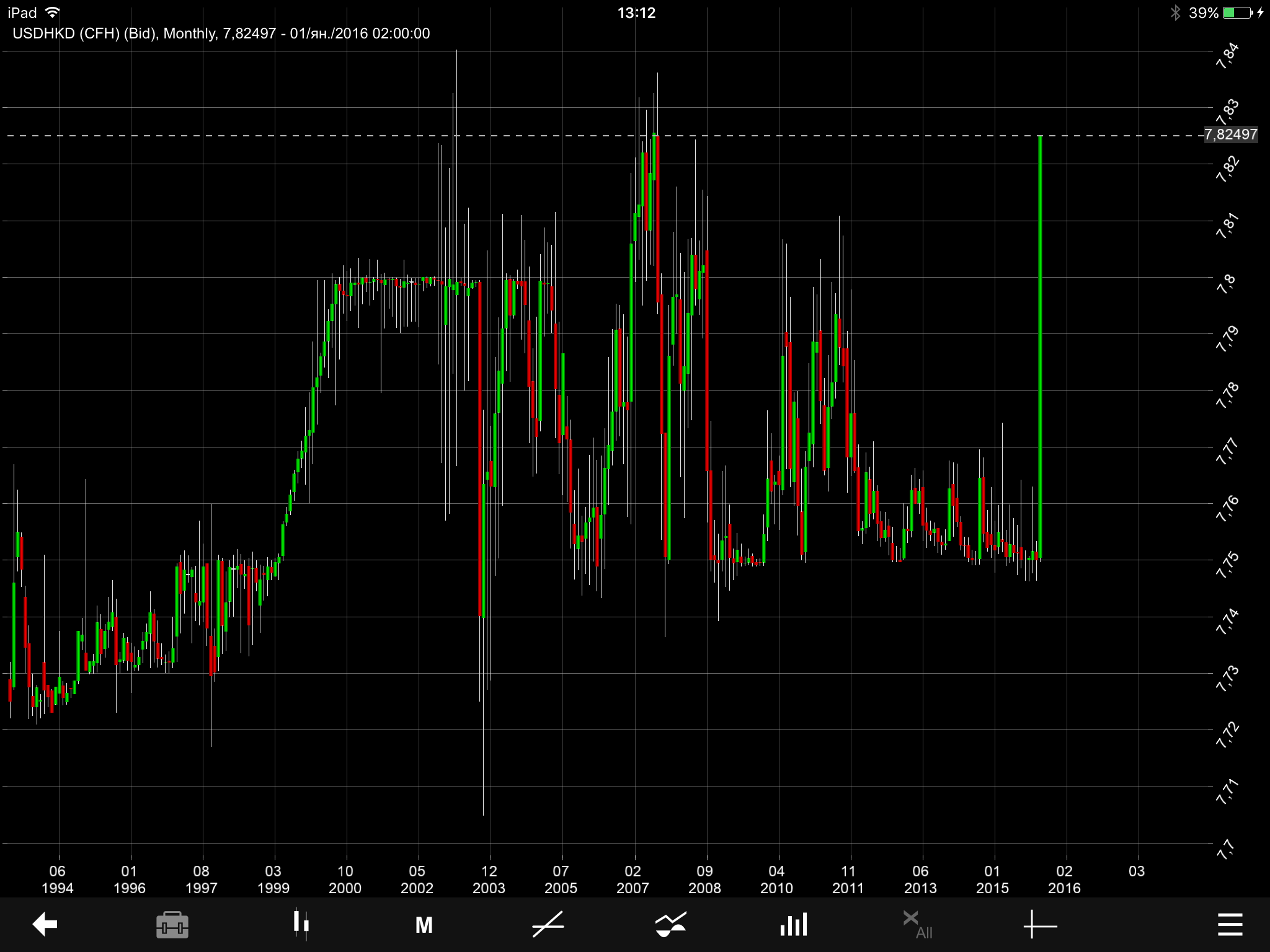

The USD/HKD is testing the higher range of the peg which is in place since 1983 at 7.80

“Next year will be the year when everything goes nuts, this year we are in the preparatory stage for it, especially in the second half,” he explained.

Elaborating on volatility, Mr Armstrong said: “Volatility will continue to be coming in spikes. In the first quarter we are going to be in a deflationary mode. We don’t really see the stock market taking off. We have to get through to May before we see any change in sentiment for risky assets.”

Europe’s Problems Lurking Around the Corner

With the rising risks for the European Union, which is facing one of its key members leaving the block, we asked Mr Armstrong what he thinks about the future of the euro.

“You have a currency which is backed by bureaucrats, instead of the people. The Troika of unelected officials, Mario Draghi Jean-Claude Juncker and Christine Lagarde, are deciding on the best course of action for European states,” he explained.

Southern European states have been in a way like Swiss franc borrowers, Mr Armstrong argued: “They converted their debts into euros at a time when the EUR/USD exchange rate was at 0.8, fast forward to 2008, and their debts have doubled in U.S. dollar value.”

With the ability of the Southern European states to pay back their debt continuing to be questioned, the likelihood that we are going to see a massive U.S. dollar rally increases. “The extent to which the U.S. dollar may rally in the coming years is greatly underestimated by the currency markets,” Mr Armstrong explained.

With the rise of anti-European Union sentiment in the United Kingdom, the risks for a big adjustment to the exchange rate of the British pound have been increasing. Mr Armstrong explained: “Our models are very bearish on the British pound, probably it will be able to take out the 1985 low (1.0520).”

With all this information on the table, 2016 looks to be a very profitable year for financial markets intermediaries in terms of trading activity. January certainly is shaping up to be a positive month especially for indices trading, after some months of unstable volumes.