For many in the global financial industry, the embers of the US crisis of 2007-2008 are still warm, having been effectively burned into the psyche of the vast majority of global market participants. The run up to the subprime mortgage crisis as well as the cataclysm it wrought on US equity markets in rapid fashion underscored the depths of Risk Management , exacerbated to the scale of an entire market-wide regime.

And yet, less than a decade later, there have been potentially troubling signs of another metastasizing crisis, this time in the world’s second largest economy, China. Last summer in Chinese equity markets proved to be one of the most schizophrenic in recent years, with state officials and authorities employing damage control techniques in a bid to help stymie the bleeding. Widely traded indexes such as the Shanghai composite were in rapid flux for months, having eventually stabilized after months of circuit breakers, Liquidity injections, and calmed nerves had taken their toll.

The new world of online trading, fintech and marketing - register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

However, this market volatility across Chinese markets is merely a specter to what could potentially be billed as the next financial crisis. For its part, China has taken extensive steps to help cool the outflow of capital and stabilize its market situation. Since last summer, many Chinese indexes have rebounded, though not back to the heights previously seen before the 2015 plunge.

Shanghai Composite, Source: Google Finance

Credit Markets in Focus

Apart from the aforementioned factors though, China is presently grappling with a credit surge, upwards of $1.0 trillion strong in March alone, which has drawn the criticism of market sage George Soros. Speaking at a recent Asia Society event in New York this week, Soros portended that the recent uptick in credit was a potentially troubling development, as it showed “how much work is needed to stop the slowdown.”

This stance is hardly new, as there is no shortage of doomsday predictions mapping out China’s alleged future. Still, the country’s financial markets did dodge a huge blow last year, as relative tranquility has reverberated through its indexes in Q1 2016. However, Soros saved his most dire words for China when he drew a comparison to the world’s last major financial culprit, the US. According to Soros, China “resembles the US in 2007-8”, which marked the period directly preceding a historic credit crunch and global recession.

Soros’ words fall on both welcome and deaf ears – China has shouldered much of the blame for last year’s handling of its market crisis, though it has largely persevered and has managed to thus far avert any sort of credit crisis. One troubling sign potentially however, is its rapid ascension in social financing, which has exponentially increased in recent years. Presently, the country is riding an estimated 350% debt/GDP ratio, which could yield problematic repercussions given its need to maintain steady growth.

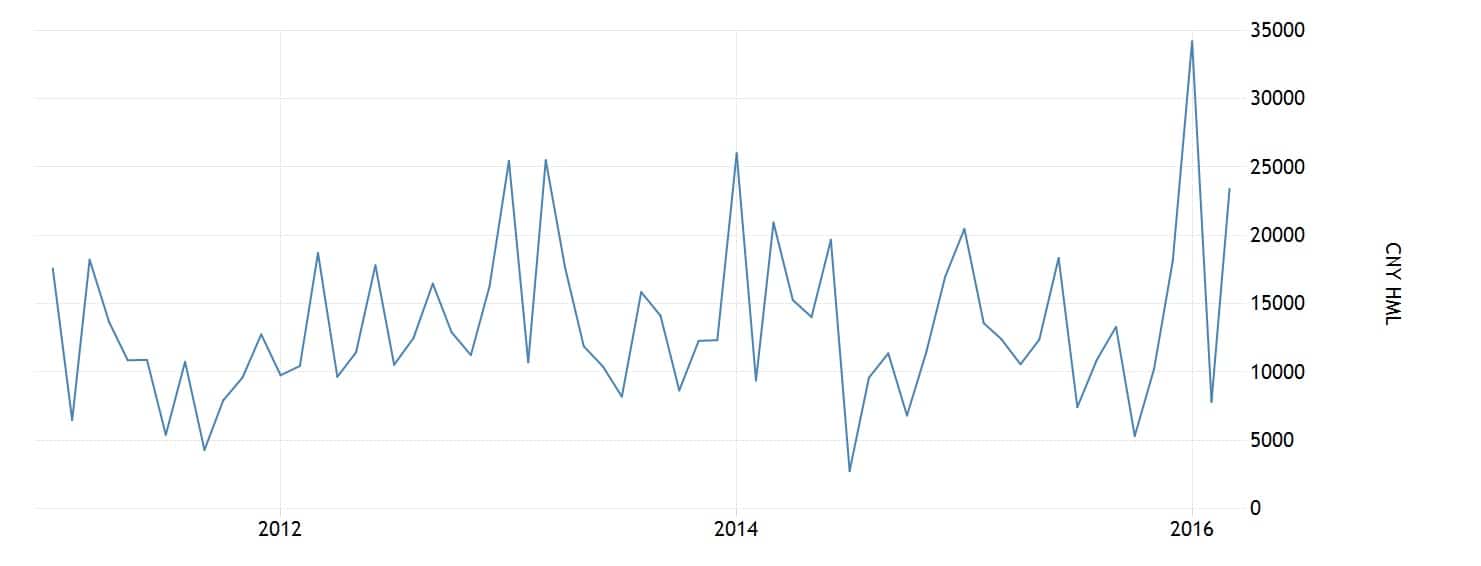

China's Social Financing

Source: People's Bank of China

In the interim, China will continue its efforts to stave off disaster, as it has done for the past several years. This has included the rebalancing of its currency, which culminated in the addition of the Chinese yuan to the IMF currency basket last year, a historic achievement for the country. Regardless, Soros and others have continued to point to troubling signs that China is grappling, as the country looks to shake the narrative that a financial downfall is inevitable.