Swissquote Group has reported its financial results for the 2013 business year, citing staunch increases in Forex accounts and a 12% YoY increase in revenue, according to a company statement.

Gland-based Swissquote has established itself as one of Switzerland’s leading providers of forex and other online financial services, specializing in CHF, EUR and USD accounts. For the 2013 business year, the company reported a 12% YoY increase in net revenues to $141.3 million (CHF 124.9 million). Furthermore, its newest acquisition MIG Bank, contributed another $9.0 million (CHF 8.0 million) total revenue in Q4.

Increase in Forex Trading and Volumes Fuel Growth

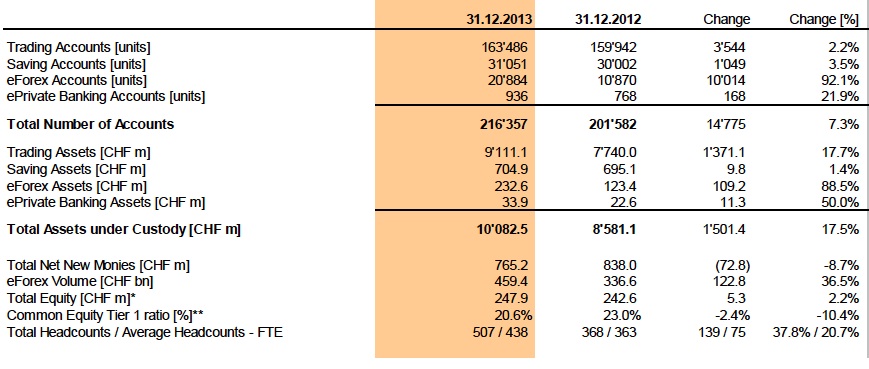

In terms of forex accounts, trading activity saw a modest increase of 11.6% during the year of 2013, or 12.5 transactions per client/year, which exceeded expectations. In addition, net fee and commission-based income jumped $58.5 million (CHF 51.7 million) in the 2013 business year. Finally, net forex and trading income – which included MIG Bank – rose by 19.2% YoY to $56.3 million (CHF 49.8 million).

Swissquote has been active in the realm of forex, specifically in its acquisition and takeover of MIG Bank since the end of last September. In the Q4 of 2013, forex trading value catapulted to $256.0 million (CHF 226.3 million) from $85.1 million (CHF 75.2 million) in Q3, a gain of nearly 201% QoQ. Indeed, these figures suggest it has established itself as one of the top ten largest forex providers by volume.

Swissquote Secures 92.1% Forex Account Growth YoY

The company has also reported an increase in the number of accounts by 7.3% YoY, or 216,357 accounts, which corresponds to 163,486 trading accounts (+2.2% YoY), 31,051 savings accounts (+3.5% YoY), 936 private banking accounts (+21.9% YoY) and 20,884 eForex Accounts (+92.1% YoY), which includes 9,600 MIG Clients.

Heading into the release, Swissquote Group Holdings SA (SWX:SQN) was trading at $36.35 a share, down nearly -7.1% from its yearly high of $39.15 in January. The company projects a 20% increase in revenue growth in 2014, coupled with targeted forex volume of $1131.5 billion (CHF 1000.0 billion).

2013 Financial Results

(Comparison with Previous Year)