Matthew Clark, Global Forex Pros

This article is written by Matthew Clark who is the owner of Global Forex Pros.

ABOUT THE AUTHOR: Matthew has been a trader for more than 20 years running FX desks at major banks and retail brokers. He recently started Global Forex Pros as a service for brokers to offer their clients, teaching them to trade in real-time as professional traders learn at banks and institutions, giving the retail trader the confidence to trade and increasing volumes for the broker.

Having spent the last 2 weeks waiting upon different central banks to set their interest rate policy for at least the next few months. We have had some amazing Volatility and price action over the end of last week. Those who have been following us recently in Forex Magnates know that we have been waiting patiently for signs that a top in this dollar, having risen more than 21% since last May before last week's sell off, is about to embark on a multi-week/multi-month retracement.

Well, it certainly looks on a technical basis, and probabilities suggest that we have started the initial stages in the GBP/USD and the EUR/USD. If correct, with the potential of several hundred points to the upside.

We have been waiting for the end of the fifth wave, as once identified, we can expect the price action to trade in a corrective 3 wave retracement. This is important as it enables us to not only trade the correction but know when this correction has ended and the trend is about to resume. This gives us high probability trade setups and ones that traders should not ignore.

In our article on the 13th March, ahead of last week’s FOMC, "Will the FED Be the Final Nail in This Dollar Rally?" we said, ‘’ The next few days will be decisive for the dollar with a move in EUR/USD above 1.0700, confirming that for the moment the dollar will struggle to make new gains."

Yesterday’s impulsive sell off is the first step in signalling a top is in place. The turn is not a surprise. With a new low made last week in GBP/USD as expected and the USD sell off post FOMC we will look below at last week’s price action and see what opportunities lie ahead in the coming week.

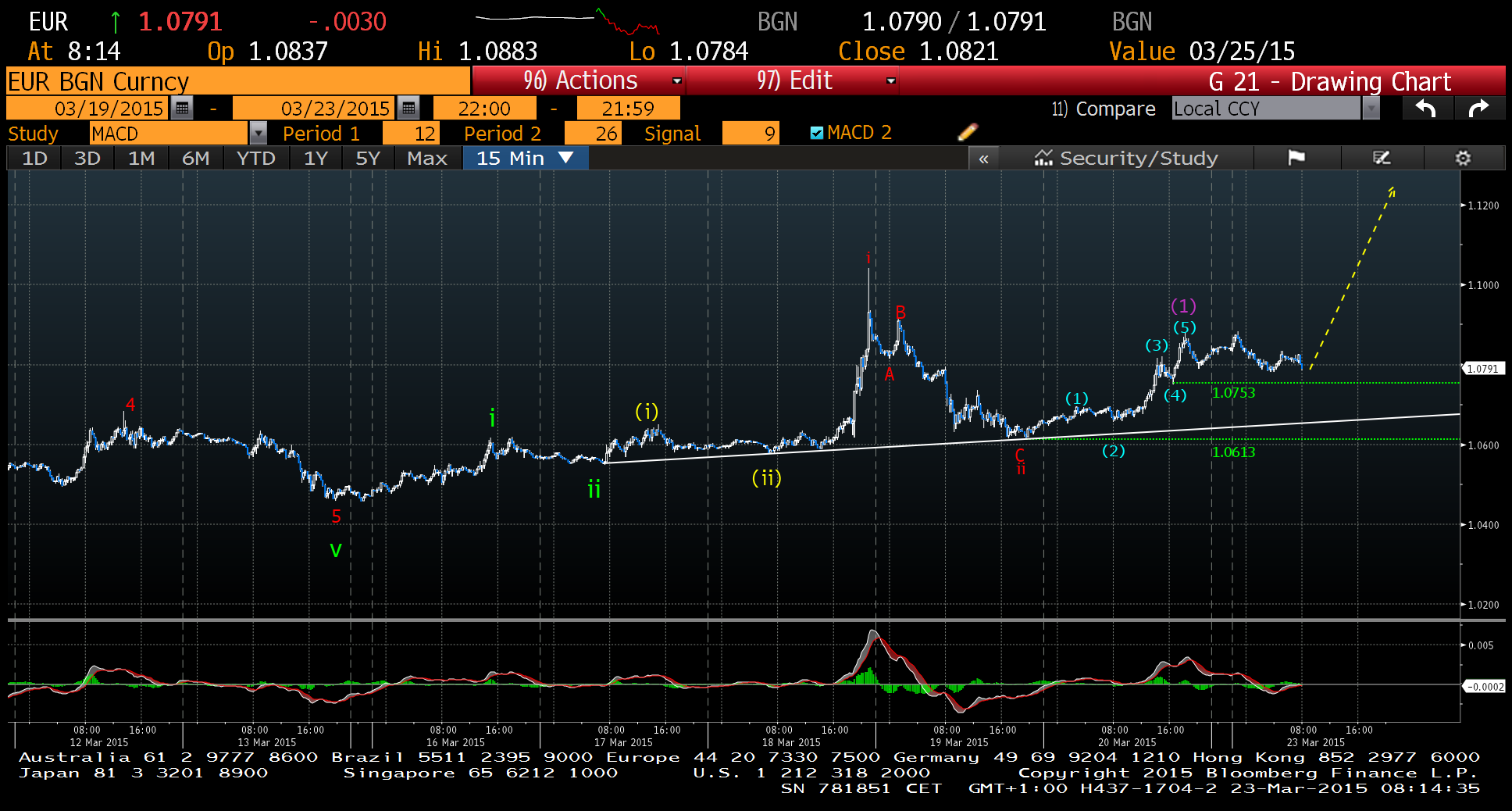

Source: Bloomberg Charts

Looking at the 15 minutes EUR/USD chart above we can see the spike in the EUR/USD following the removal of patience and a reduction in rate expectations and growth by the FOMC. This saw the EUR/USD trade through the 1.0700 we were looking for as a first sign a low maybe in place. Especially considering the divergence seen at the low of wave V compared with the previous low of wave iii.

The retracement on Thursday, though deeper than expected, stayed above the support line before starting a clear 5 wave rally on Friday which was finally completed late in the day. This has set us up for a 3 wave retracement that must end before 1.0613 but could finish as early as 1.0753. We will look for a completion of this retracement to enter longs for the next wave 3 higher knowing a break of 1.0613 would mean that we are wrong. Wave (1) moving into the wave A correction increases our confidence that a low is in place.

Source: Bloomberg Charts

In the GBP we were calling for a new low to be made last week to complete the 5 waves down and a similar divergence pattern appeared post-FOMC trading through the previous wave iv high at 1.4853. The move up Friday afternoon through the wave B high at 1.4925 bolsters our view that the corrective setback has finished. Allow for a corrective setback in a fourth wave before a push up to new highs in the coming days. This fourth wave correction could end around the 1.4855/60 level. Once the 5 waves are complete we will look for the end of the correction to re-enter long positions for the start of this multi-week/month retracement on this dollar.

As we mentioned above, a multi-week retracement looks like it is underway. From the daily chart of GBP/USD, a retest of the previous wave iv high at 1.5552 and the 38.2% retracement at 1.5612 would be our first targets in the coming weeks as a possible end to a three wave correction. In which we believe we are in the early stage of the wave A correction.

Source: Bloomberg Charts

Similarly, in the EUR/USD test of the 38.2% would be 1.1808 more than 900 pips from here and a test of the minor wave 1 and the 50 % retracement would be at 1.2225. Looking at MACD we can see that it has turned bullish on a daily basis adding weight to our overall bearish dollar expectations. The next few days will confirm our view with corrective pull backs seen as opportunities to reinstate or add to longs in both the EUR/USD and GBP/USD.

Source: Bloomberg Charts

This article is part of the Forex Magnates Community project. If you wish to become a guest contributor, please apply here: UGC Form.