Gold price volatility has re-emerged following a slumber since April 14. The move higher could present challenges for brokers that take the other side of their client’s bets.

Client positioning from three well-established brokers shows that about 67% of retail clients are long the yellow metal. I think the retail demand for gold will increase, given the headlines seen in the press.

Traditionally, the leveraged retail trader tends to lean against trends, and the market-making broker (with an understanding of trends) can usually afford to not hedge their clients’ positions. This practice allows the market-making broker to generate more than the spread, as any of the client’s losses will result in profits for the broker.

The issue for the broker starts when the clients are correctly positioned within the trend, and they begin to make money. In this situation, the broker will lose out if the clients start to book profits. Optimal money Risk Management systems are, therefore, vital to market-making brokers.

The first quarter of 2020 was a record-breaking one for many brokers, as the Coronavirus crisis triggered some robust trends in the markets. However, some established brokers faced challenges. Earlier this month, a well-known, listed broker saw its income drop from $249 million to $102.5 million as its clients traded exceptionally well.

What is the outlook for gold prices?

The combination of higher COVID-19 cases in the USA, the ultra-loose monetary policy of central banks, and aggressive fiscal spending is a boon for gold investors. Investors flock to gold during a time of crisis, but they also tend to run to the safe-haven asset when central banks are slashing rates and printing more money than usual.

ATFX

Unfortunately, I think the COVID-19 crisis will not abate in the USA until the states that are leading the surge take action, and given the latest news, it seems that the hurdle of imposing strict social distancing measures is difficult to overcome. The states to watch are California, Texas, Florida, and Arizona, but more could follow.

The relaxed monetary conditions were due to remain loose until the end of 2021 before the new wave of coronavirus cases hit the US, and the latest developments could easily delay any chance of normalization to 2022.

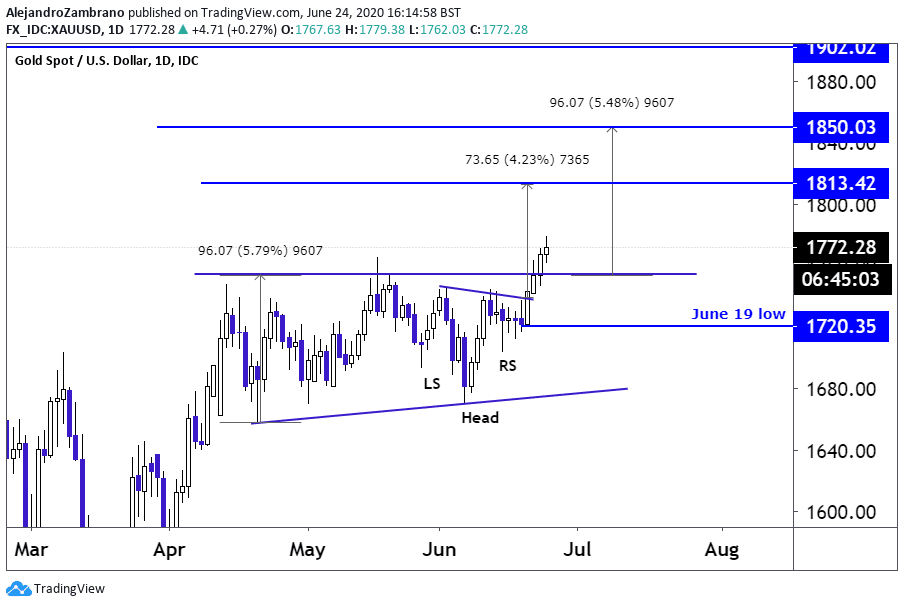

Technically, the breach to the May 20 high triggered an ascending triangle pattern, with a target of $1,850. The price also triggered an inverse head and shoulders pattern with a target of $1,813. Both of these patterns will remain in play as long as the price trades above the June 19 low of $1,720.35.

Written by Alejandro Zambrano, Global Chief Market Strategist, ATFX.