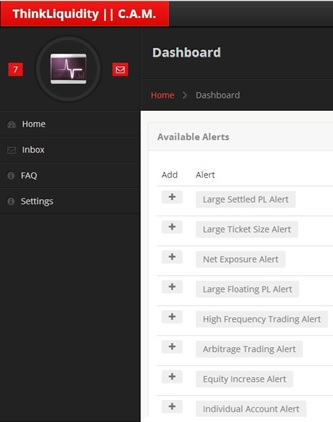

The relatively new entrant joining the number of companies offering Risk Management services to the brokerages' space, ThinkLiquidity, has announced the release of two new products. These include, SpreadCommander, a tool which can integrate with MT4 so that brokers can have granular control of displayed spreads, as well as the announcement of C.A.M., short for 'Custom Alert Monitoring' which provides alerts for MT4 brokers of a range of server-related trading activity.

According to the press release, these custom alerts from C.A.M range from detecting arbitrage or toxic flow (such as scalping or inter-dealer arbitrage), P/L swings above defined criteria, alerts of large ticket trades, or even alerts on a defined individual account. The announcement today follows the previously released, a web-based multi account manager (MAM) and compliance tool.

Analytics and monitoring of internal processes, especially those directly related to, or very close to the point of trade executions, are paramount as the quality, frequency and duration of order flow changes. The word “toxic” or "bad" has been associated with intelligent flow (or smart flow), since the dealers who get hit with these orders may have a hard time capturing sufficient spread to make it worth their while (hence the derogatory association with the flow quality).

The Different Shades of Order Flow

Source: ThinkLiquidity C.A.M

This applies not only to Forex but even exchange-traded equities and other securities, where broker-dealers who internalize order flow may consider smart flow as being “toxic” to them.

In reality, it’s only considered toxic since it’s hard to make any revenue on, whether it be via rebates from the exchange, or net revenue (from spreads and commissions) after paying (or receiving) pass-through fees from trading venues.

If sufficient revenue was made by dealers on toxic flow, it would then be referred to as “golden” flow (or more accurately, as is commonly known –good flow).

An exception to this may be ultra-high frequency trading (HFT) that focuses solely on time as trading strategy (in order to exploit market inefficiencies) rather than an actual underlying trading strategy, and such trading, while only accounting for a small percentage of all HFT flow, has already been either banned or severely limited on various venues – in an effort to curb any unfair advantages.

Commander of the Spread

While the purpose of the SpreadCommander tool may hold some of these challenges in mind with regards to the quality of order flow and the optimization of spreads in order to best accommodate fair execution benefitting both traders and dealer, this is an area of increasing concern with regards to best execution in foreign exchange – especially with the slew of FX rigging-related investigations which are developing.

With regards to growing global investigation of FX rate manipulation, Lars Christensen, co-chief executive of Saxo Bank was recently quoted by Reuters as having said to the media, "You could fear that the one market which regulators and politicians haven't got their teeth into yet is FX and, for sure, politicians can't wait to get their teeth into anything to do with financial markets. So it could be what gives them the excuse to also get into the over-regulation of this market."

Forex Magnates had previously covered (on more than one occasion) the nature of FX markets with regards to the sheer size making it difficult even for central banks to affect market rates (via intervention, not overall monetary policy), even with the often unlimited supply of cash they appear to be able to print. Although, recent studies conducted by the Bank for International Settlements (BIS) pertaining to central bank intervention did conclude that actual sales were more effective in affecting prices than actual purchases of underlying currencies (albeit this was in exotic pairs/not the majors).

However, on a lesser scale there are subtle angles where even a pip of fraction thereof may go undetected and could results in millions of dollars - given a larger enough trade or a series of smaller positions over time. This alleged profiting at an unfair expense to others, is at the heart of recent lawsuits.

Will Regulators Change how FX Rates Can be Displayed?

The pricing models that Forex brokers use vary greatly and the logic behind how tick data is updated and displayed - as well as how the bid/ask spreads are determined -including their variability or fixed nature (as well as the definition of identifying the market midpoint) are all issues that may become the matter of great discussion as regulators focus on how Foreign Exchange prices originate and function.

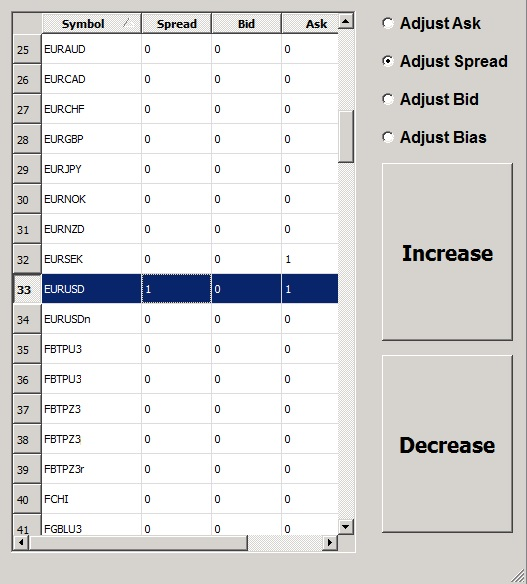

Source: ThinkLiquidity, SpreadCommander

Nonetheless, dealers do have a right to manage their prices in various ways provided that it is in the mutual interest of both sides of the trade, and in accordance with any applicable regulations and- of course- the standards of commercial honor expected in business.

Dealers are managing risk just as traders do, and in the end everyone just wants a fair price.

Even in an agency model, where the risk is mitigated, some entity still exists on the other side of the trade, (whether bank or LP) and the price provided from that party is expected to be just. With market-making under scrutiny, it seems inevitable that regulators will attempt to tackle this critical part of foreign exchange price origination.

Risk Management Expertise

According to the description in the press release from ThinkLiquidity, the SpreadCommander tool provides a broker with granular control over pricing in real-time through a simple and clean interface that quickly allows the spread on any symbol to be increased, decreased, or biased to the bid or the offer. It is compatible with any price feed, including aggregated and multiple lines.

Jeff Wilkins, Managing Director, ThinkLiquidity

“We are very pleased about the release of our newest broker products: C.A.M. (Custom Alert Monitoring) and Spread Commander," said Jeff Wilkins, Managing Director, ThinkLiquidity, commenting in the official corporate announcement.

Mr. Wilkins added,"We remain focused on developing tools to help brokers increase their profitability through sound risk management. Understanding exactly what is happening on your trade server at all times and being able to take appropriate action is paramount to success.”

Mr. Wilkins is no stranger to understanding and managing the complexities and challenges that dealers face with regards to Risk Management, as he previously held roles, such as Manager of Global Risk Management for nearly five years at GFT, until 2011.

Whether the new products released today by ThinkLiquidity will provide sufficient coverage for the needs of those brokerages it intends on targeting, or whether initially designed in response to specific brokers' needs, it will be interesting to follow as the subject of market-making and managing counterparty dealing risk continues to create attention.