Last week’s steep sell-off in crude oil futures helped drive the USD/CAD sharply higher. This is because the Canadian economy is dependent on energy-related commodities. February WTI crude oil futures broke below $36.00 per barrel last week for the first time since February 2009. It settled at $35.62, down over 10% for the week. The weak close put the market in a position to challenge the December 2008 bottom at $32.40.

Brent crude finished at $37.94 per barrel, down 12 percent for the week. It closed below $38 a barrel for the first time since December 2008 and is now in a position to challenge its next major targets at $36.20 and $34.00. The latter was reached in June 2004.

If the selling pressure in the crude oil market continues then we expect to see another surge by the USD/CAD. The downside target for the nearby WTI futures contract is $32.40. The downside momentum at last week’s close suggests that sellers will go after this price this week.

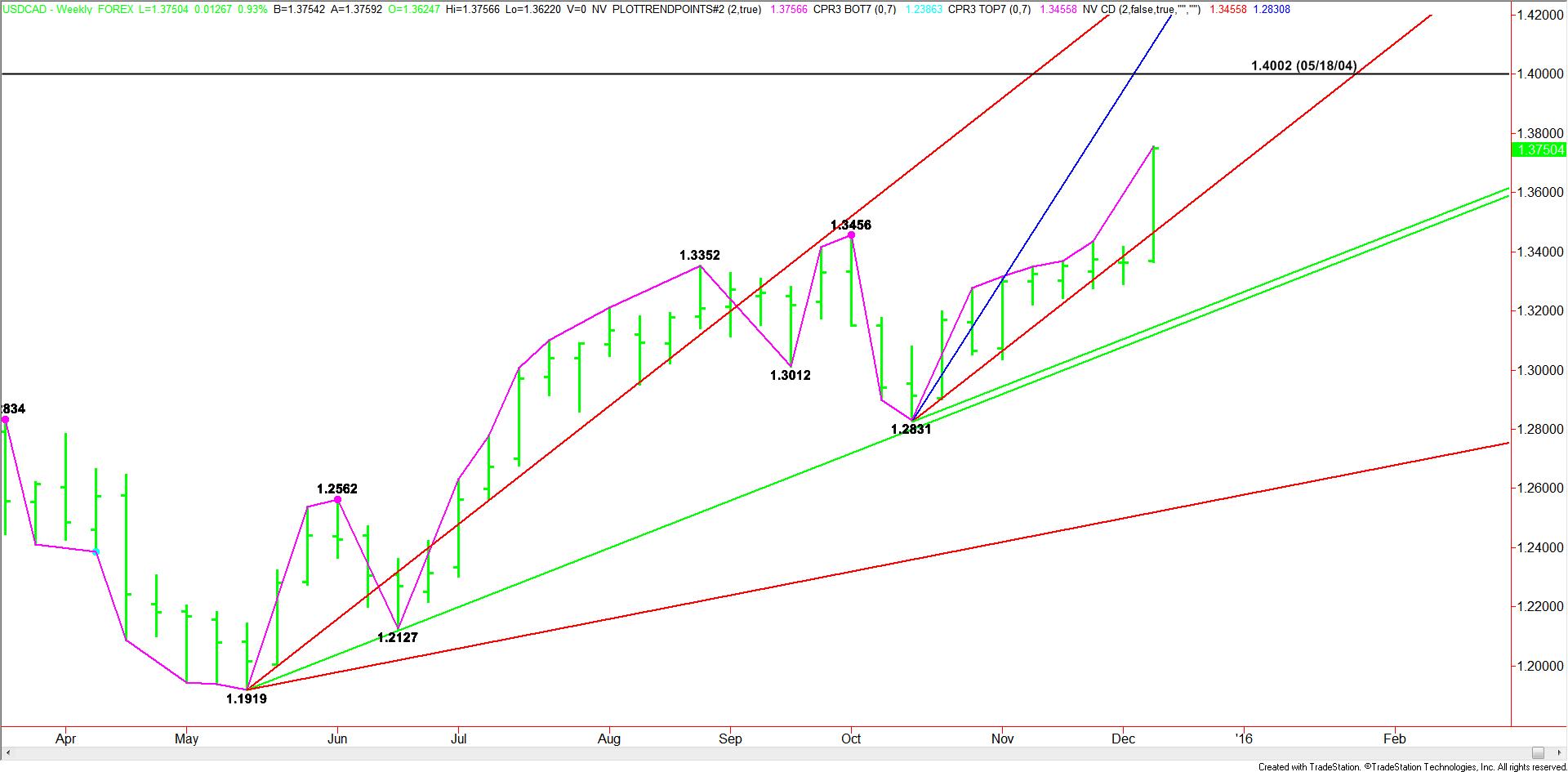

If crude oil futures continue to break into their 2008-2009 bottoms then look for another price surge by the USD/CAD. The best upside target is the May 18, 2004 top at 1.4002.

We should be looking at another volatile week, not only because of the sell-off in the crude oil market, but because of the Fed interest rate decision on December 16.

This week is also the eighth week up from the 1.2831 bottom created the week-ending October 16. This puts the USD/CAD in the window of time for a potentially bearish closing price reversal top. This could lead to the start of a short-term correction.

Watch the price action and order flow early in the week at 1.3757. A sustained move over this price coupled with a sell-off in crude oil will likely mean the rally will continue into 1.4002. This is a pure momentum move that will need the help of rising volume and falling crude oil prices.

If buyers fail to show up after taking out 1.3757, or if crude oil begins to mount a short-covering rally then the USD/CAD will begin to sell-off on profit-taking.

An interest rate hike by the Fed on December 16 should also be bullish for the U.S. dollar and bearish for the Canadian dollar. However, keep in mind that this has been expected for some time so it may already be priced into the market. The USD/CAD may rally on the initial reaction to the news, but it may also give long-traders an excuse to book profits. The Forex pair may actually be set-up for a “buy the rumor, sell the fact” scenario.

In summary, the USD/CAD trend is up on the weekly chart, the fundamentals are bullish and momentum is pointing up so we want to continue to play the upside until we hit our 1.4002 objective. However, we are going to have to have support from falling crude oil prices to sustain the move. Continue to trade the long side as long as crude oil prices continue to fall. Watch for a two-sided trade if crude oil reaches a low and starts to rally.