The past week has seen crude oil slump even further with price action now below its previous low of $39.55, which was touched upon briefly on August 14 two weeks ago. The fundamentals for this commodity are still putting a lot of pressure on price. Fears of a slowdown in the global economy is the main factor, led by the US as the Federal Reserve starts increasing interest rates which could cause an economic slowdown and followed by China, which recently depreciated its currency over concerns of economic growth.

Supply does not seem to be diminishing with Iranian oil on its way to enter the market soon, adding further downward pressure. Last week’s data released by the EIA (Energy Information Agency) for crude oils stocks was expected at -1 million barrels but was actually released at +2.62 million. A large increase in supply over expected numbers, which has inevitably pushed price lower quickly.

This Wednesday’s figure is expected at -1.8 million, any number that is higher could give more momentum to the downside, a number released as expected will probably leave the current trend intact. United States Durable Goods Orders will also be released on Wednesday but at 12.30pm, this being an indicator of economic activity. It is also expected to be a negative number at -0.45% compared to last month’s number at +3.4%.

Consumer confidence will be released tomorrow at 2pm and is expected to be higher than the previous number of 90.9 at 92.5; this is an indicator of general consumer sentiment and a gauge for retail economic activity. It would take higher than expected numbers for the economic data and a very low EIA data to give crude oil some upward price momentum.

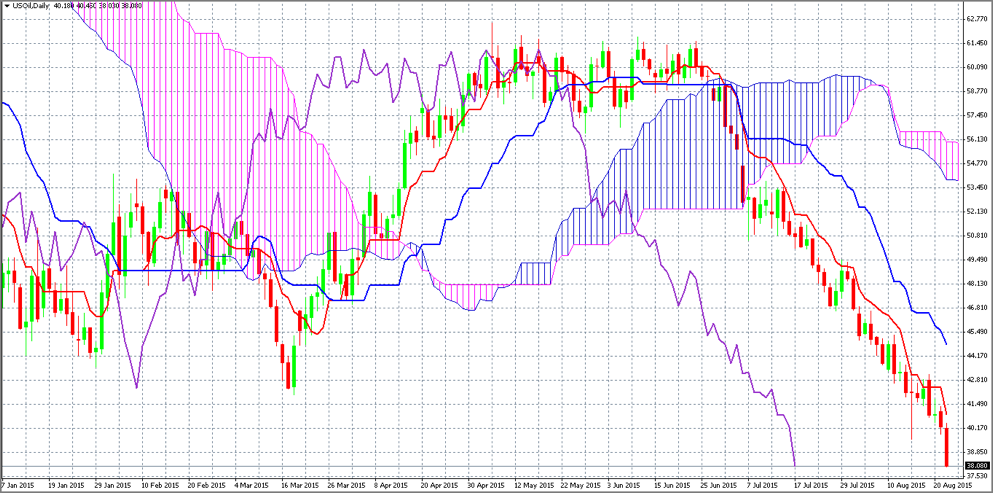

Technicals

From the day chart we can see how there is a clear bear trend in act, however price action is beginning to move extremely far away from the bottom side of the Ichimoku Cloud (Red vertical lined area) by approximately 26%, this indicates extreme oversold levels which could lead to a correction and a brief increase in price as the markets consolidate. A close above the Fast line (Red line) could be an early indicator of that reversal, resistance is at $40.785.

Crude Oil Chart, Source: Reuters

Taking Advantage of the Market with Options

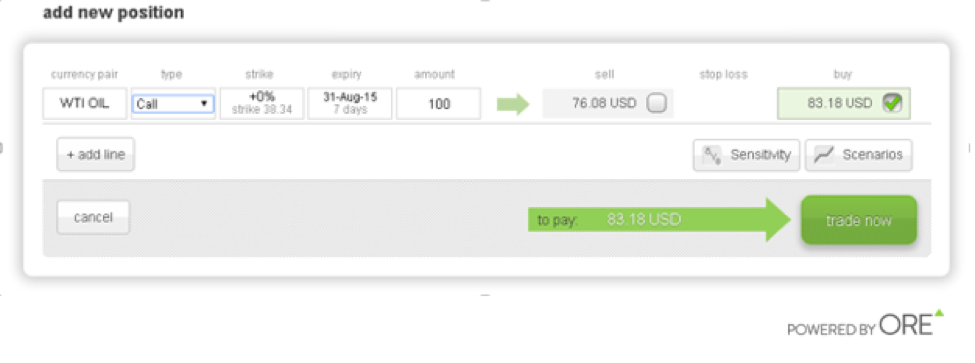

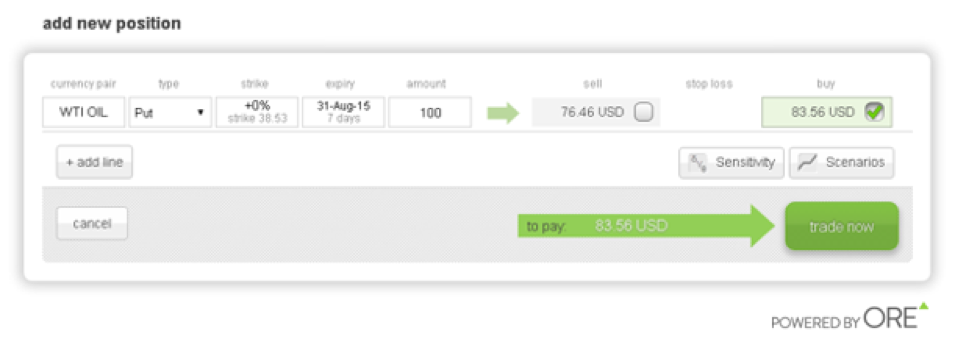

If you think price will continue to fall due to the overall economic situation and more negative data in the coming week, you may buy a Put option, giving you the right to sell crude oil at a fixed rate (strike) within a predetermined date (expiry) for a specific amount. In the below option example traded via an online platform, you can see that a Put option on crude oil with strike $38.53, expiry 7 days, for 100 barrels will cost $83.56, which is also your maximum risk

If on the other hand you feel that the price of oil may have reached a bottom or that data over the coming week will be positive for crude oil price, then you may buy a Call option, giving you the right to buy crude oil at a specific strike, expiry and amount. From the screenshot you can see that a Call option on crude oil, strike $38.34, expiry 7 days, for 100 barrels costs $83.18, which is also your maximum risk.