The European Central Bank (ECB) has just published the results of its year-long examination of the resilience of the 130 largest banks in the euro area. The results show that 40 banks had only capital ratios of 7% or below during the test, which is the absolute minimum allowed under the new international banking rules known as Basel III.

The comprehensive assessment, which consisted of an asset quality review and a forward-looking stress test of the banks, found a capital shortfall of almost €25 billion at 25 banks. The ECB revealed that 12 of the 25 banks have already covered their capital shortfall by increasing their capital by €15 billion in 2014. The rest of the banks have up to nine months to cover the capital shortfall.

“This unique and rigorous exercise is a major milestone in the preparation for the Single Supervisory Mechanism, which will become fully operational in November,” said Vítor Constâncio, Vice-President of the ECB. “This unprecedented in-depth review of the largest banks’ positions will boost public confidence in the banking sector. By identifying problems and risks, it will help repair balance sheets and make the banks more resilient and robust. This should facilitate more lending in Europe, which will help economic growth.”

The asset quality review showed that as of end-2013 the book values of banks’ assets needed to be adjusted by €48 billion. Furthermore, the bank's non-performing exposures (any Obligations that are 90 days overdue, impaired or in default) increased by €136 billion to a total of €879 billion. The assessment also showed that a severe financial crisis scenario (3 years recession) would deplete the banks’ loss-absorbing Tier 1 capital, the measure of a bank’s financial strength, by about €263 billion. This would result in the banks’ median ratio decreasing from 12.4% to 8.3%, a higher higher than in previous similar exercises.

“This exercise is an excellent start in the right direction. It required extraordinary efforts and substantial resources by all parties involved, including the euro area countries’ national authorities and the ECB. It bolstered transparency in the banking sector and exposed the areas in the banks and the system that need improvement,” said Danièle Nouy, Chair of the ECB Supervisory Board. “The comprehensive assessment allowed us to compare banks across borders and business models, and the findings will enable us to draw insights and conclusions for supervision going forward.”

Cyprus Banks in Focus

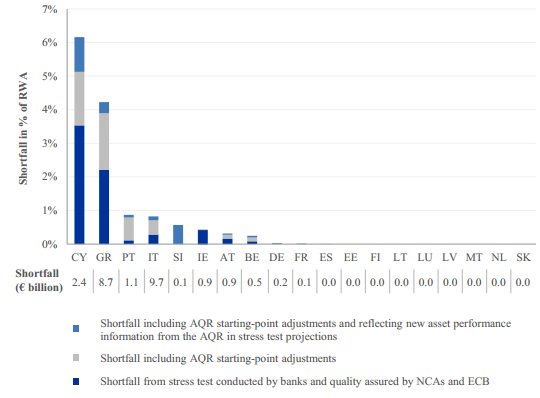

The ECB results show that the €24.6 billion capital shortfall is proportionally highest in Cyprus, Greece, Portugal and Italy. In fact, three banks from Cyprus were included in the above mentioned list of twenty five and had a total capital hole of €2.4 billion. This will no doubt strengthen the ECB's pressure on Cyprus for structural reforms and fiscal consolidation.

Still, only one out of the four Cypriot banks that were examined by the ECB failed the stress test. This comes as mixed news to the Forex industry for which the European island serves as an established hub for years. Bank of Cyprus Public Company Ltd, Co-operative Central Bank Ltd and Russian Commercial Bank Ltd (RCB) passed the test. The fourth, Hellenic Bank Public Company Ltd, failed it and its board is reportedly meeting to discuss an additional equity issue, according to reports from the local media.

Capital Shortfall by Country (CY=Cyprus,GR=Greece...)