Competing global derivatives trading solutions are at the forefront of efforts of a changing banking system to provide reliable access to global markets for clients. In its latest effort to optimize its offering, UBS Securities has announced an expansion of a long running partnership with one of the fast growing companies in the technology landscape when it comes to derivatives trading.

The Swedish company Orc, majority owned by the leading fund for private equity investments in the nordic region, Nordic Capital Fund, has announced that it will expand on its existing partnership with UBS Securities.

The technology firm will provide an extended version of its Electronic Execution system, facilitating Direct Market Access (DMA) to the Australian Stock Exchange (ASX) and the Chicago Mercantile Exchange (CME).

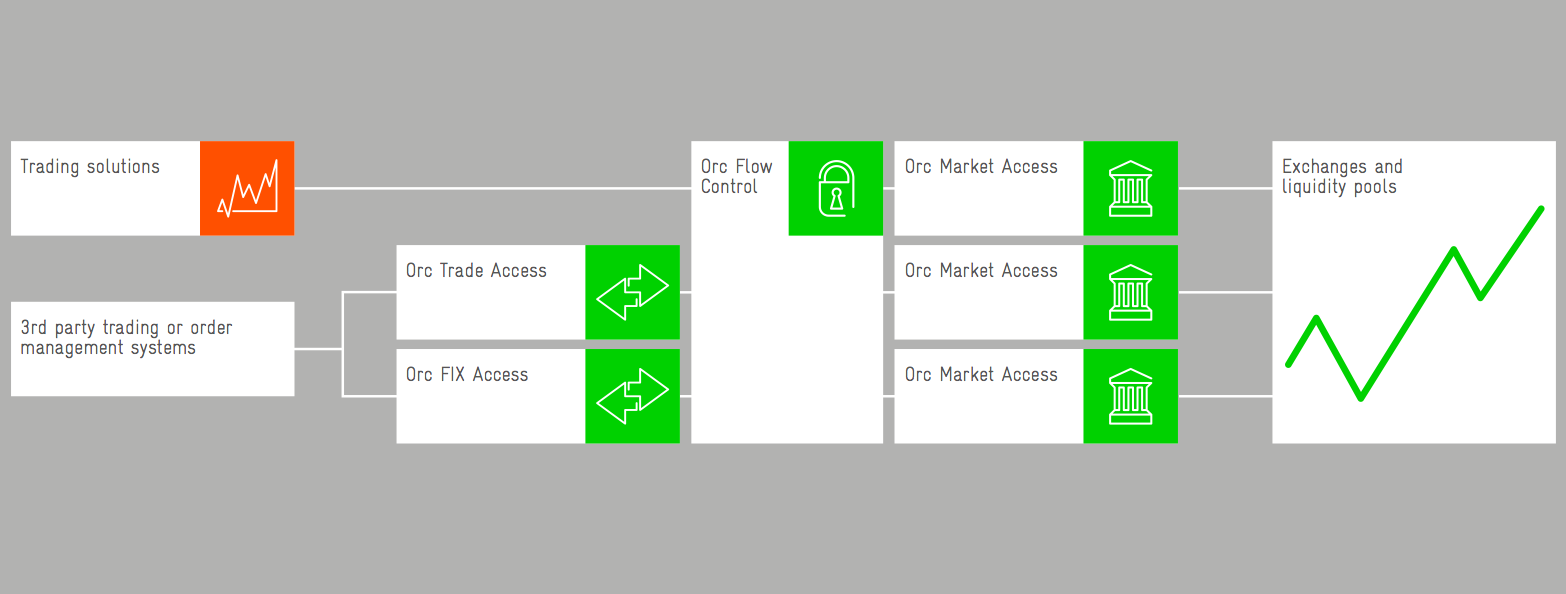

The extended functionality will integrate Orc’s low-latency market access and a new version of the integrated pre-trade Risk Management product, Orc Flow Control. The offering won't constrain end-clients to the use of any of Orc’s trading solutions, providing platform independence for clients of UBS Securities.

At the same time, UBS Securities will use the Orc Flow Control system to provide multi-market pre-trade risk controls in accordance with the appropriate regulatory frameworks. The brokers will be able to set up limits and monitor trading activity in real time for all participants across all markets from the solution.

Amongst the features that stand out are limits based on theoretical values, which can be very beneficial as firms can control their order flow based on various market scenarios.

A UBS representative shared in a company announcement that the bank has already added ASX, planning to include the CME at a later stage.