The US Election is finally here, despite months of back and forth vitriol, rhetoric, speculation, and developments. By the market opening tomorrow (pending some unexpected ‘suspense’), financial markets will know who the next president of the United States will be, alleviating a groundswell of risk averse pressure in recent weeks.

Don't miss your last chance to sign up for the FM London Summit. Register here!

Earlier this week, financial markets already showed signs of pricing in a Hillary Clinton victory – this was of course boosted by revelations over the weekend from FBI Director James Comey, following his decision to assert that the FBI investigation into a new batch of Mrs. Clinton’s emails was all smoke and no fire.

However, many market participants still freshly recall the Brexit referendum back in June, which by and large portended a win for the ‘stay’ vote – Britons and investors worldwide woke to the opposite, convulsing markets in one of the most hectic trading days of the calendar year.

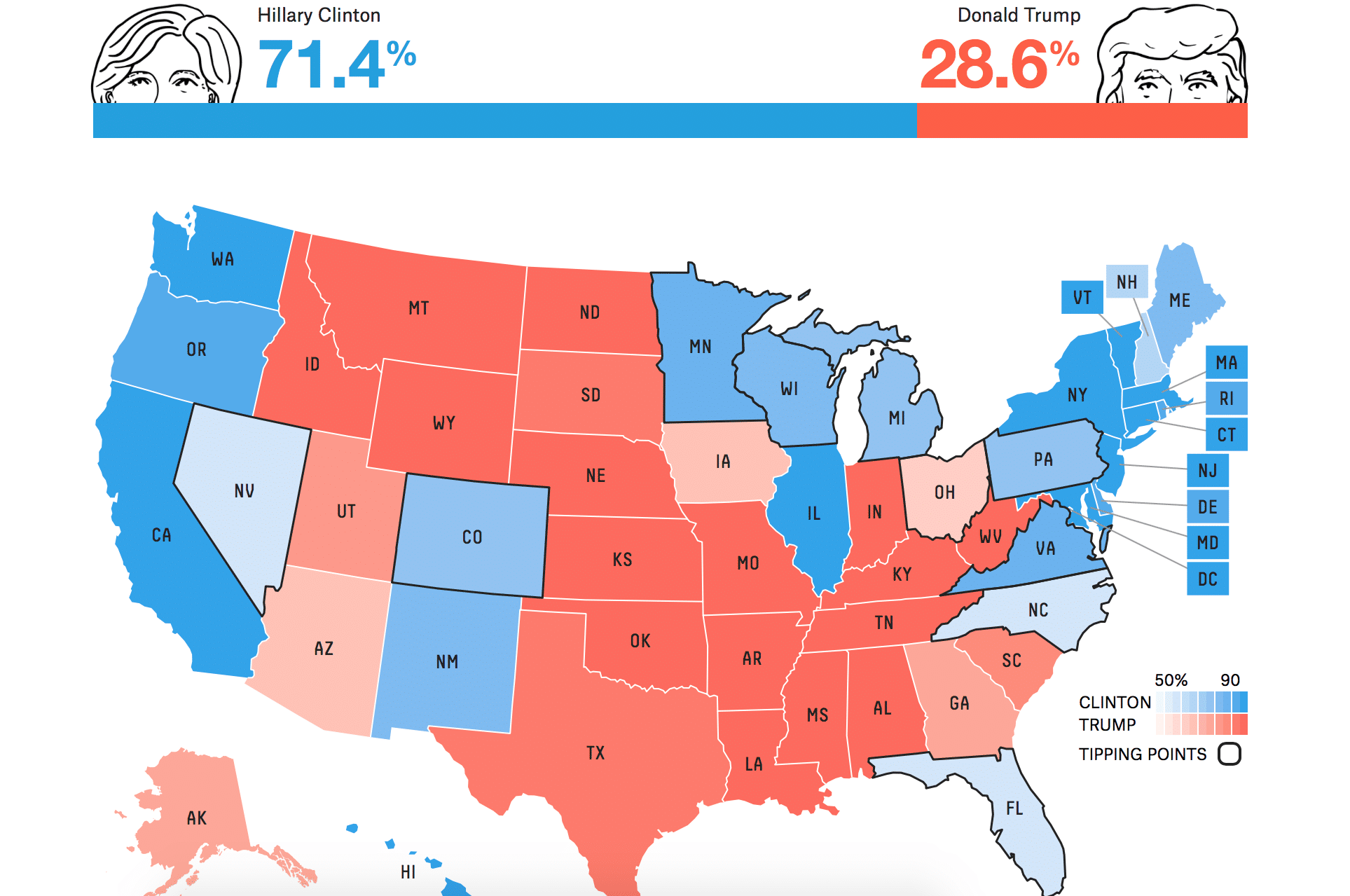

Source: Fivethirtyeight

Is Your Money Safe?

Ahead of the official count tonight, many brokers and venues have implemented margin changes to select instruments. A victory for Mr. Trump is clearly not priced into the market presently, with pollsters largely expecting a win for Mrs. Clinton. The biggest sign of this was reinforced by yesterday’s surge in US equities, which jumped over 2% during US trading Monday.

Historically speaking, a Clinton win does not necessarily indicate a bounce, with the largest post-election loss in market capitalization in US history coming on the heels of President Obama’s 2008 electoral victory. Moreover, the recent jump in US markets looks to have priced in a Clinton win, though a small boost could be expected, likely paving the way for a Federal Reserve rate hike by years end.

Alternatively, a Trump win is at a minimum likely to erase this week’s stock gains. With the recent breaching of support by the S&P below 2100, an unexpected Trump win would likely see a continuation of a downward trend below this figure, en route to a recent low of 2085 and beyond – while estimates are all over the place, a potential floor could be the June low during Brexit of 2000 for the index.

Moving to commodities, a Clinton win could potentially move the needle, with gold and silver each poised to drop. The simplest scenario is a Trump win, which would cause a jump in each precious metal as risk aversion would immediately build. Less clear is what would happen in the event of a Clinton win, as gold and silver have already given up the $1300 handle. A Trump win would also sink industrial metals, which bears notice.

Finally, in the foreign Exchange (FX) space, the US Dollar’s immediate fortunes are very much tied to the electoral result tonight. A Trump win would cause the EURUSD to recoil, resulting in a staunch climb above its recent highs. Investors would flock to safe haven currencies such as the JPY, causing a plunge in the USDJPY. Conversely, a Clinton win is likely to see a fall in the EURUSD and a general uptick in risk appetite.

What About a Tie?

A final potential outlier scenario is the event of a tie in the electoral map: 269-269. While unlikely, this result is hardly impossible, and given the polarity of US politics could be the most unwelcome scenario for markets, namely as it could drag out into a lengthy affair, leaving many investors searching for clarity at a time when there is none. As an aside, the US Supreme Court is presently staffed by eight justices, meaning a repeat of the 2000 campaign is unlikely to occur.