We saw the AUD take a bashing in yesterday’s Asian session on the back of soft capital expenditure figures from the private sector, with expenditure falling 2.2% in the last quarter and investment intentions for the year underwhelming with a 12.4% drop. Australia’s unemployment jumped to 12 year highs last month at 6.4 per cent and we know that governor of the RBA has warned they expect it to stay at these levels for quite some time. ANZ’s economists in a new report say that the downside risks to commodity prices in the medium term has induced more job losses in the mining sector , more than 40,000 last year and they believe there is a lot more to go.

The market is looking for the AUD to trade lower and according to the RBA continuing to repeat that the currency is overvalued, with the RBA Governor Glenn Stevens repeatedly stating that 75.00 is fair value, at the time of writing is 5 per cent away.

However, we take issue with this view and think that any sell off (if it occurs) is a golden opportunity to pick up some cheap AUD for what could be the lowest seen for years to come. If we look at the weekly AUD/USD chart we can see that the AUD decline from the 1.1080 is in a double zigzag corrective pattern. It has slightly overshot the initial target, the low of the previous wave 4, and we believe a rally should start, if it hasn’t done so already from nearby levels. As those of you who follow my articles know, I am a trader of price action and believe that all this bearish news has already been priced in.

AUD Weekly Source: Bloomberg Charts

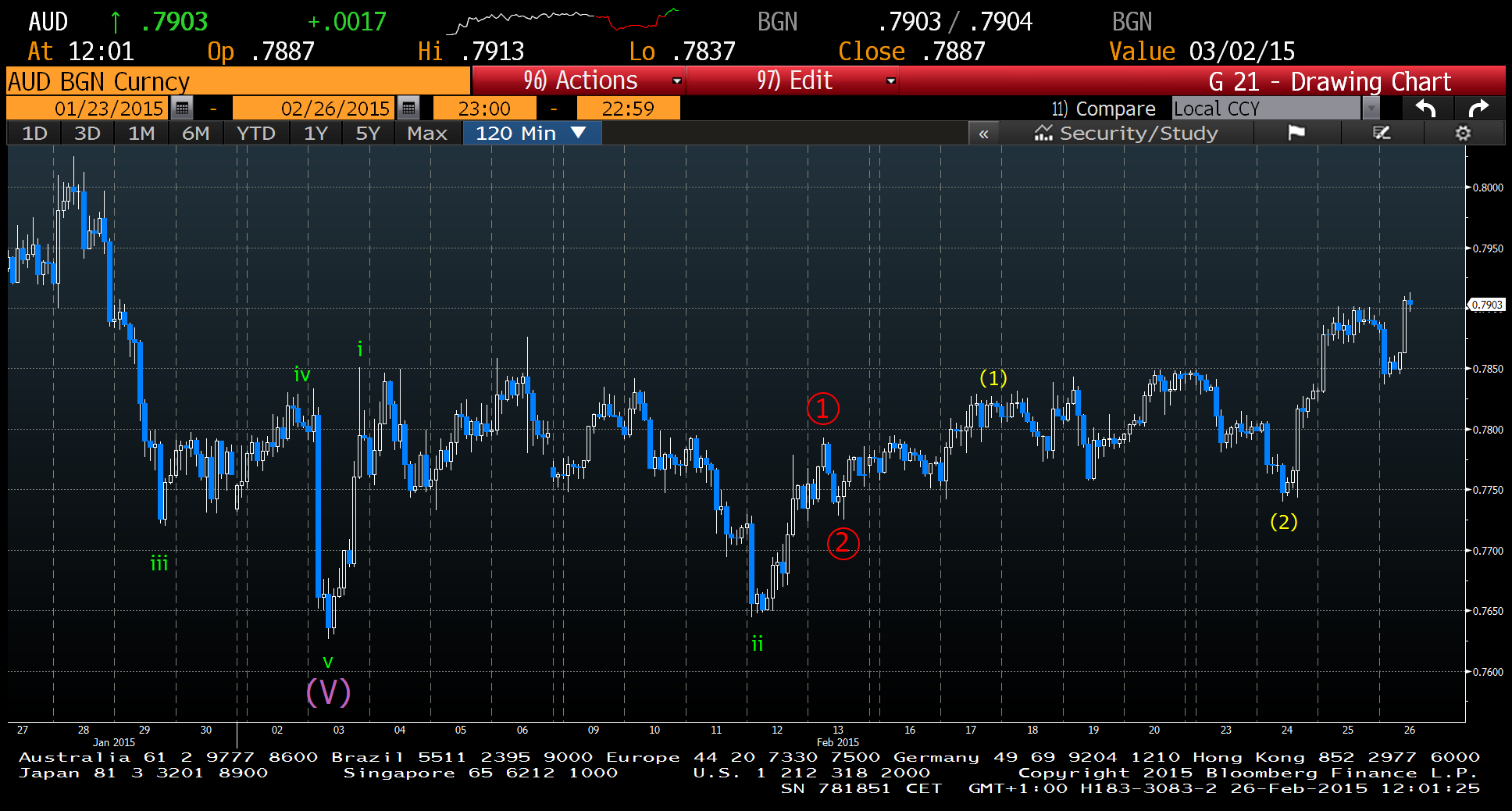

We can see in the short-term charts that the spike down following this data was soon reclaimed, giving us greater confidence in our long-term view. Even if we get a sell off next week following the rate cut, the question will soon be as to whether there is another and we believe the AUD will quickly reverse. But whatever happens, don’t be like an English cricketer and drop this opportunity!!

AUD 2 Hourly

Source: Bloomberg Charts

This article is part of the Forex Magnates Community project. If you wish to become a guest contributor, please apply here: UGC Form.