Retail Forex broker OANDA has conducted a survey among its clients looking into the most important factors that contribute to their success, finding that for the great majority risk awareness comes first.

Reading Charts and Knowing Your Macroeconomics

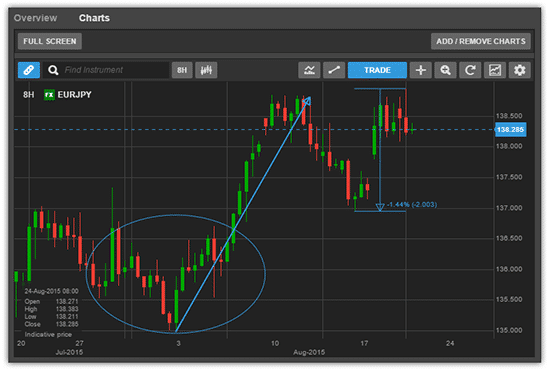

A total 81 percent of the traders surveyed by OANDA said that awareness of risk is a key prerequisite for successful trading. Second from the top on the list of necessary skills came the ability to read charts, with 56 percent of those surveyed noting it as very important. The top three was completed by knowledge of macroeconomics – this was selected by 50 percent of respondents as an important factor contributing to success.

OANDA then asked its traders about any advice they could give to those who are just venturing into the field of forex trade. Once again, risk, more precisely Risk Management , surfaced as the top pointer for obvious reasons, given the risky nature of retail forex trading. For true rookies, the advice is to use smaller trade sizes and stop loss options.

Making Plans and Sticking to Them

Risk management, respondents in the survey also shared, must be combined with discipline – the ability to develop plans and sticking to them – and awareness of how to use leverage without going overboard. Cash management was also among the priorities outlined by OANDA’s top traders.

“Success and risk management go hand in hand”

The Chief Marketing Officer of OANDA, Drew Izzo, commented: "The clients we surveyed are our top traders as measured by longevity of accounts and returns over that period. The results show that success and risk management go hand in hand. Global regulators and policy makers are looking to put risk management and discipline at the heart of the FX industry. Our best retail traders are already doing this."

Another conclusion from the survey is that as a trader gains experience, they start targeting higher returns. 38 percent of the broker’s top clients eye returns of 20 percent and above, and as many as 71 percent aim for 10 percent and more. Interestingly, the figures were not much different for the same traders when they were rookies: 31 percent targeted 20 percent and above in returns, and 62 percent eyed 10 percent and above.