Vlad Gubernat

Vlad Gubernat is a full-time trader based in Romania who shares his thoughts on his blog, JLTrader.

The prevailing theory at the moment on financial websites and forums is that Greece (most probably) or another country from the PIIGS group (Portugal, Ireland, Italy, Greece, Spain) will soon leave the Eurozone. This is the third time since the financial crisis of 2008 that this will happen. The previous two instances were in early 2010 and in late spring/early summer 2012.

In my opinion, a Greek exit or Grexit is not as simple and profitable as some people make it out to be. Leaving aside the whole legal aspect of an eventual exit, which is very complex in its own right, I will concentrate on two aspects that are often treated very emotionally.

On one hand, returning to drachma and unlimited printing capabilities is just the illusion of an answer to the problem. Apparently you're getting back the powers surrendered to the big, bad, German run ECB. But try imagining a family which has debts left and right and has ran out of money: So they decide to start paying their bills and bank loans with monopoly money. Who will take them seriously? Who would want to provide goods and services to them?

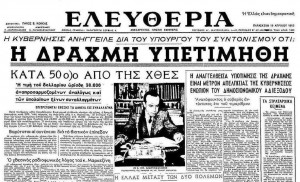

The sharp devaluation of the drachma by 50% against other currencies on April 9, 1953 was an event of enormous importance for the Greek economy, which was initiated and coordinated by the Ministers Papagos, Spyros Markezinis. The drachma was changed from 1:15,000 to 1:30,000 against the US dollar, which over time has worked well in monetary stability and improvement of the foreign trade sector. The government, though, was criticized heavily for having taken these drastic and manipulative measure for devaluation, resulting in some cases of people doubling their fortune overnight.

On the other hand, with all the dispute over German taxpayers' money being squandered away by bloated public spending of the PIIGS group, one would think that it's high time for the apparent charity work of the Germans to stop. The truth is much more complex though.

Germany has been gaining a lot from the euro project too. As a top exporter, it profited from selling goods that the PIIGS bought with money borrowed at low rates from German banks. And if the DEM (Deutsche Mark) was still in circulation, it would most probably act like another CHF, with its value going through the roof. That would put a serious damper on Germany's exports.

Critics say that currency unions have cracked before. But I don't think there's ever been one with the scale and interconnectedness of the euro area. That's why it's hard for me to believe that it's just a matter of time for a PIIGS country to leave the euro. It would be a lose-lose proposition.

This article is part of the Forex Magnates Community project. If you wish to become a guest contributor, please apply here: UGC Form and get in touch with our Community Manager and UGC Editor Leah Grantz leahg@financemagnates.com