Yahoo Japan has just announced it is acquiring Japanese broker CyberAgent FX for $254 million. According to Yahoo Japan, the deal is aimed to strengthen their presence in the financial industry as well as supporting their “Yahoo Wallet” business. Yahoo Japan stated CyberAgent FX’s advanced smartphone Trading Platform and financial know how as reasons for being interested in the broker. Yahoo Japan sees synergies in the deal through CyberAgent FX increasing Yahoo’s mobile transaction business.

As opposed to previous M&A action in Japan which has included the larger brokers buying weaker players in the midst of a consolidating market, this deal adds a new player to the local market. Yahoo Japan is the largest internet portals in Japan with a strong presence in both the desktop and mobile. Also, unlike in the US, where Google has a commanding lead in search, Yahoo Japan has the leading portal in Japan for around 10 years. Yahoo Japan is 65% owned by Japanese Internet and Mobile powerhouse SoftBank, with Yahoo having a 35% stake in the business and is publically traded on the Tokyo Stock Exchange with a market cap around $20 billion. With SoftBank being a big driver of Yahoo Japan’s corporate actions along with the company citing mobile as a fundamental reason behind the deal, mobile based trading is expected to be aggressively promoted. Therefore, the acquisition is part of Yahoo Japan trying to incorporate more smartphone based transactions within a users day to day actions. As such, in addition to simply having a well backed new player in the Forex industry, the existing brokers will also be battling against Yahoo Japan’s emphasis on changing the landscape of trading from the desktop to the smartphone. While this has already been taking place at many brokers with innovation of trading platforms being a core business development policy in Japan, having Japan’s #1 portal involved will make things more interesting.

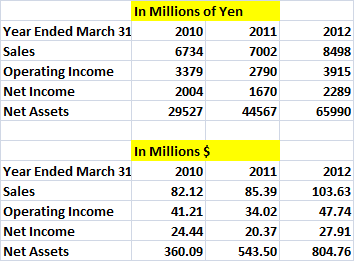

Yahoo Japan is also buying a well managed company as seen by financial data that was released by Yahoo Japan and CyberAgent. Despite the tighter margin environment for forex trading, CyberAgent has been able to continually grow its revenues and profits over the last three years. This was especially seen as 2012 as the broker achieved 37% net income growth on a 20% increase in sales.

CyberAgent FX 2010-2012 Figures