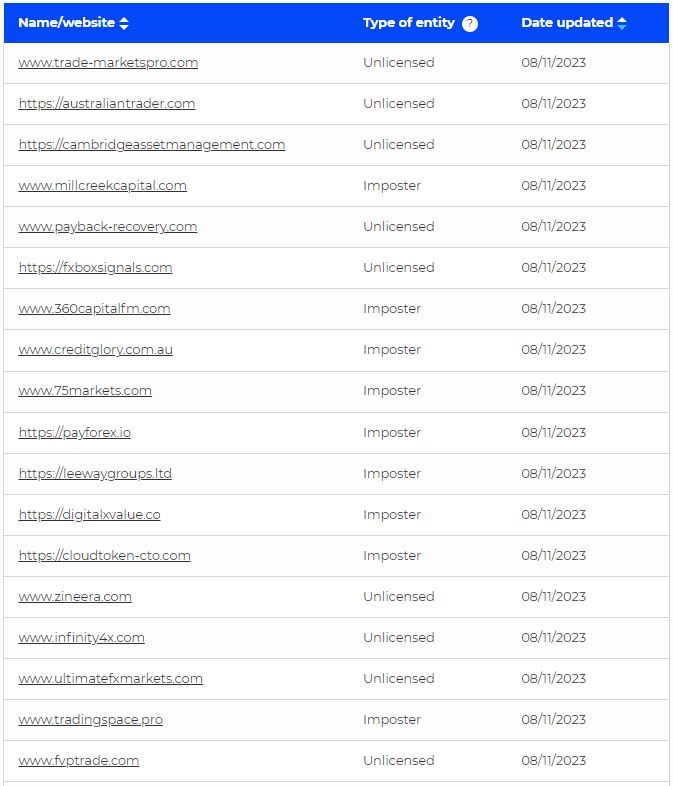

The Australian Securities & Investments Commission (ASIC) has doubled down on illegal financial services platforms and fraudsters by publishing its first ‘investor alert list’. Upon its release, the list identified 52 unlicensed entities and 25 websites impersonating legitimate entities.

ASIC’s ‘Investor Alert List’

“Unlicensed and imposter investment opportunities cause serious financial and non-financial harm, significantly eroding consumer trust and confidence,” said ASIC’s Deputy Chair, Sarah Court. “There are bad actors out there, and while we can’t avoid being targeted, having access to the right information can help consumers better protect themselves.”

The Australian regulator was already publishing a list named ‘Companies you should not deal with’, which only contained the names of unlicensed companies. The new ‘investor alert list’ categorizes the entities in two ways: unlicensed entities and imposter entities. It also added 1,256 unlicensed entities from the previous list, labeling them ‘unlicensed (legacy)’.

The concept of an investor alert list is not new. Several other regulators globally, including the United Kingdom, Cyprus, Italy, Spain, and Malaysia, are actively flagging suspicious financial services.

However, maintaining such a list is difficult as fraudsters and scammers regularly come up with new websites to target victims. ASIC also pointed out that its investor alert list is not exhaustive, highlighting that “there will be websites or entities that do not appear on this list that may be engaging in scam behavior of which ASIC is not aware.”

The Deputy Chair added: “ASIC is calling on industry and consumers to assist us in identifying suspicious investment websites by reporting them to Scamwatch to assist our investigations and actions.”

ASIC’s Action against Scams and Fraud

The Aussie watchdog created the investor alert list within a week of revealing its action against more than 2,500 investment scams and phishing websites. It has implemented a scam website takedown capability, with which it has already taken down 2,100 websites and has placed another 400 websites in the process of being taken down since July 2023.

These measures by ASIC to tackle investment frauds are being taken after Australians reported a record AU$3.1 billion loss to scams in 2022, out of which AU$1.5 billion was lost to investment scams, according to the official figures by the Australian Competition and Consumer Commission.