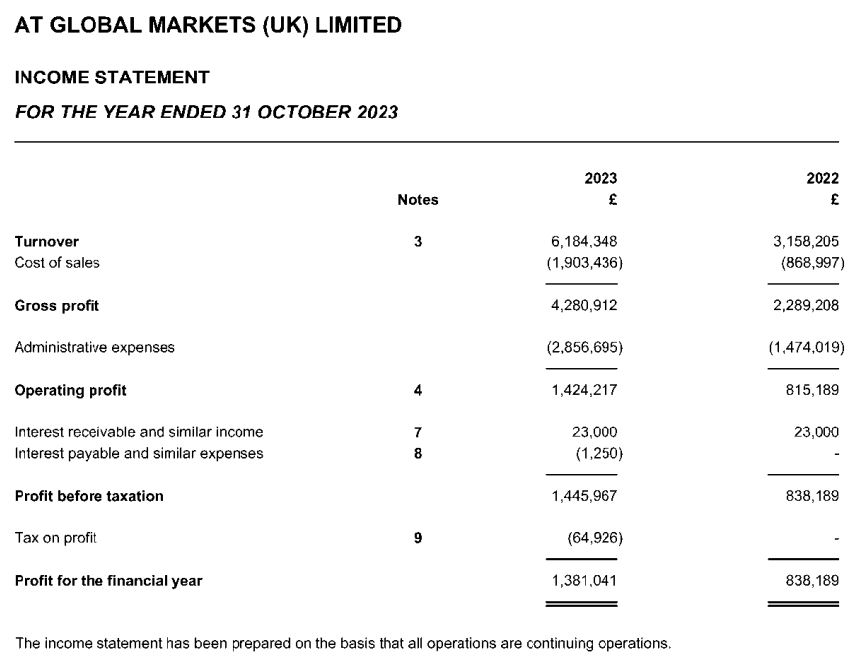

AT Global Markets (UK) Limited, which operates the ATFX Connect brand, has closed the year 2023 with an annual turnover of more than £6.18 million, an increase of 95.8 per cent from the previous year’s £3.16 million. Profits also echoed this growth, as the net income came in at £1.38 million, a jump of 64.8 per cent from £838,189 in 2022.

A Solid Year for ATFX Connect

According to the company's latest Companies House filing, its sales and administrative costs also increased with the rise in revenue. The sales cost for the year 2023 came in at £1.9 million, higher by 119.2 per cent year-over-year, while the administrative cost also jumped to £2.86 million from the previous year’s £1.47 million, an increase of 94.5 per cent.

After the direct costs, the UK-based company generated an operating profit of over £1.4 million. Considering the receivable and payable interests, the company's pre-tax profits came in at £1.45 million, which is higher by 72.4 per cent from the figures of the previous year.

Strengthening the Brand Globally

ATFX is a recognisable brand in forex and CFDs trading. Under the Financial Conduct Authority (FCA) licence, the UK entity operates the ATFX Connect brand, which offers services only to institutions and high-net-worth clients. The ATFX Connect brand does not offer services to retail clients.

“The primary focus of the business is on the foreign exchange markets. The firm also offers contracts based on precious metals, oils, individual stocks, and stock indices,” the filing noted.

“The firm will continue to market itself directly to EEA and other international territories, where permitted. The key targets will be the existing high-net-worth clients, fund managers, brokers, and banks who are looking to diversify their portfolios and are comfortable with the risk profile and volatility that investing and trading in derivatives can offer.”

Apart from the UK subsidiary, the group also operates with licences in Cyprus, Mauritius, and the United Arab Emirates. It also entered Australia last year by acquiring Rakuten Australia's CFD business.

Meanwhile, the group is also strengthening its presence in the industry by hiring prominent veterans, including Drew Niv and John Bogue.