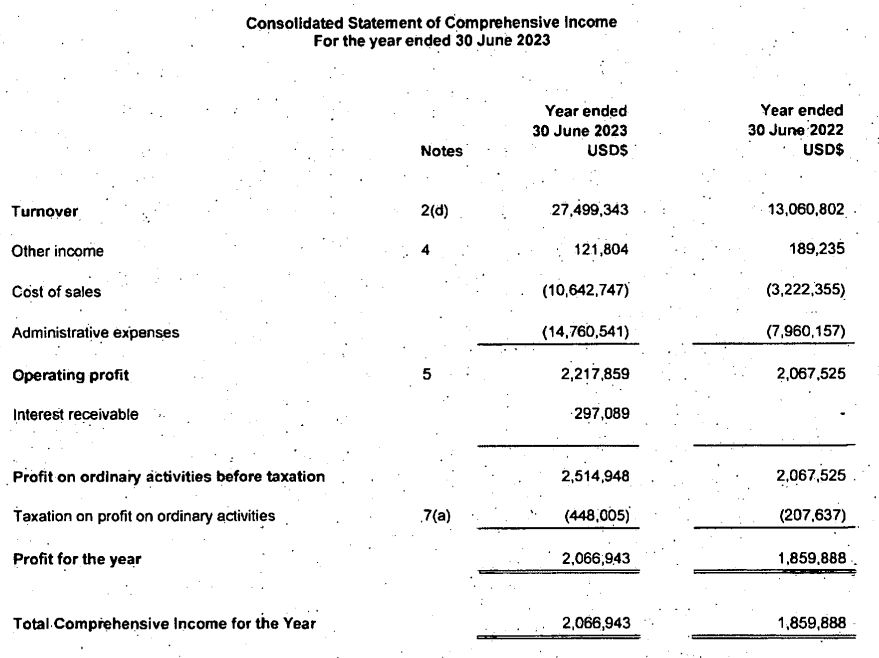

The UK-registered subsidiary of Axi, a forex and contracts for differences (CFDs) broker, closed the fiscal year ended on 30 June 2023 with an annual client revenue of $27.5 million, a jump of about 110 percent.

Axi’s UK Revenue Soars

The recent Companies House filing presents the business performance of Axi Financial Services (UK) Limited and its three subsidiaries, two of which are dormant. The UK unit is a subsidiary of Australia-based AxiCorp Financial Services (AFSPL).

The principal activity of the UK business of the brokerage “continues to be the provision of support and trading facilities in foreign exchange and CFDs to individuals and corporate customers, who are both clients” of the company and its Aussie parent. The UK company provides administration services to the Australian parent and other subsidiaries.

The average month-end client money balance on the UK unit and its subsidiaries jumped to $21.3 million by the end of the last fiscal year, compared to $10.2 million in the previous one. The highest month-end balance in the 12 months was $22.9 million.

“The key business risk relates to the continued support of AFSPL to provide the Group's revenue stream,” the Companies House filing added.

Another Profitable Year

Apart from the trading revenue, the UK business of Axi generated $121,804 as other income. Its sales cost and administrative costs went up significantly, echoing the revenue, resulting in an operating profit of $2.2 million, compared to over $2 million in the previous year.

The company further earned $297,089 from interests, taking the pre-tax profit to $2.5 million from $2.06 million in the previous year. After taxes, it netted $2.07 million as comprehensive income for the year, an increase of over 11 percent.

Meanwhile, Axi has expanded its business streams over the last few months. It jumped into the prop trading space by launching services with up to a 90 percent profit split. Interestingly, Axi offers prop trading with live accounts, unlike demo account prop trading, which is offered by most firms.