B2Broker, a technology and financial services supplier for the fintech industry, has added Match-Trader, the white-label trading platform developed by Match-Trade Technologies, to its offerings after purchasing the platform server license.

B2Broker Adds Match-Trader White Label

Along with Match-Trader, B2Broker offers white labels of other popular trading platforms, including cTrader, two MatchTrader platforms, and its two proprietary platforms, B2Trader for crypto exchanges and B2Margin for margin exchanges.

"I am pleased to say that the Match-Trader White Label solution is already fully integrated with B2BinPay and B2Core. Brokers that want to diversify their business and offer various platforms to their users may do so with B2Broker's White Label Offerings," said the CEO of B2Broker, Artur Azizov.

Check out the latest FMLS22 session on "Advances in Trading Technologies."

Rise of MetaTrader Alternatives

Earlier in November, Tools for Brokers, a competitor of B2Broker, added the white labels of Match-Trader to its offerings. Both these additions came when brokers were exploring MetaTrader alternatives following the ban of the MetaTrader 4 and MetaTrader 5 platforms on Apple's App Store.

MetaTrader platforms still dominate the trading space with around 83.8 percent of the total market share by the end of Q2 2022, according to Finance Magnates Intelligence. However, demand for its competitors' solutions has spiked following Apple's sudden move.

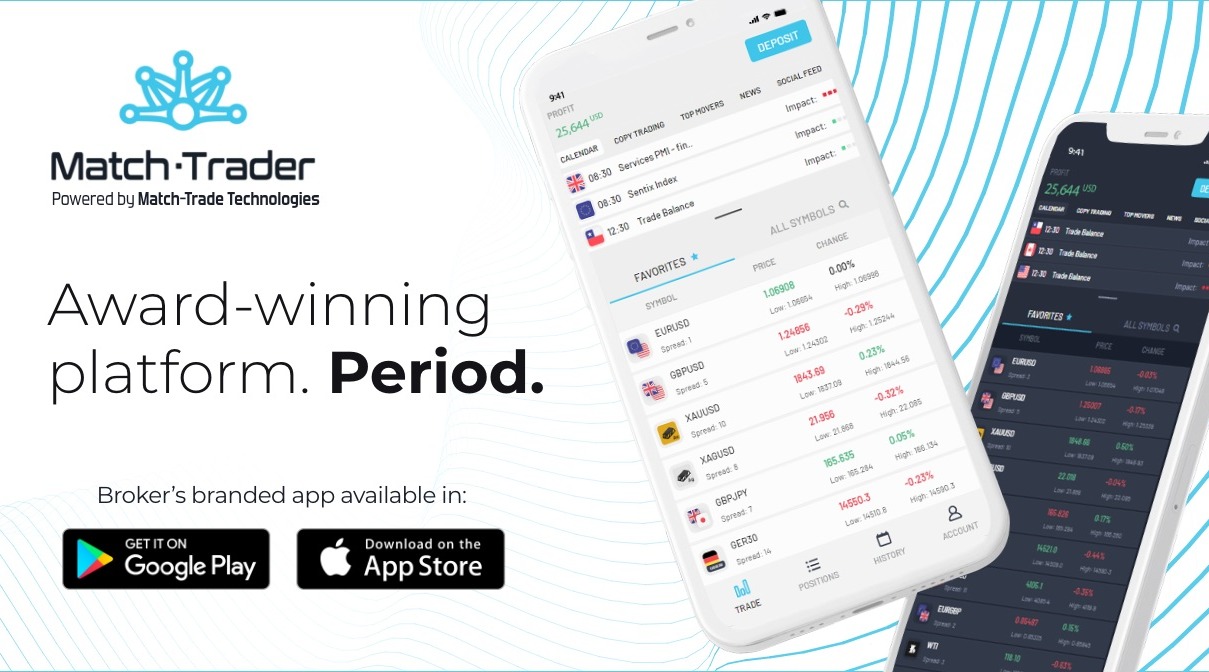

Match-Trade Technologies first launched Match-Trader as an institutional platform in 2015 and then added standalone White Label capabilities for retail brokers in 2020. Now, it is also selling server licenses.

Earlier, the company revealed that the sale of Match-Trader doubled compared to 2021. Further, the company acquired over 175 new clients, which is over 30 percent more onboarded clients than in the previous year, ending 2022 with a 103 percent growth in revenue.

Among MetaTrader alternatives, Match-Trader ranks second, only following cTrader. The market share of cTrader is 53 percent, excluding the two MetaTrader platforms, while Match-Trader holds 27 percent. Leverate and X Open Hub have 12 percent and 8 percent, respectively.

"I am extremely proud of our entire team seeing how the platform we have been developing over the years gains the interest of the largest players on the forex technology market," said Match-Trade Technologies' CEO, Michał Karczewski.

"Match-Trader is a universal platform; our wide range of APIs allows server owners to easily integrate it into their current setup to create a complete and unique trading ecosystem. B2Broker offers a wide range of tools for Brokers that will certainly enrich our platform and make the White Label solutions market even more competitive."