The Amsterdam-based commission-free trading platform, BUX, has gained significant popularity among retail investors in recent years by offering trades in stocks, ETFs, and cryptocurrencies. One downside to this success is the increasing number of companies and individuals impersonating the platform. This week, the UK's Financial Conduct Authority (FCA) issued a warning about one such clone.

FCA Warns against BUX Clone

The Financial Conduct Authority (FCA) announced yesterday (Monday) that a fraudulent company, Trader BUX Markets, is attempting to impersonate the officially registered UK-based BUX Financial Services Limited, a subsidiary of the European fintech firm.

The FCA cautions that clone firms often mimic authorized companies' details to deceive people into thinking they're legitimate. It urges people to avoid any dealings with these clones as they could result in financial loss.

"This firm is not authorized by us but has been contacting people pretending to be an authorized firm. This is what we call a clone firm," the FCA warned in its latest statement.

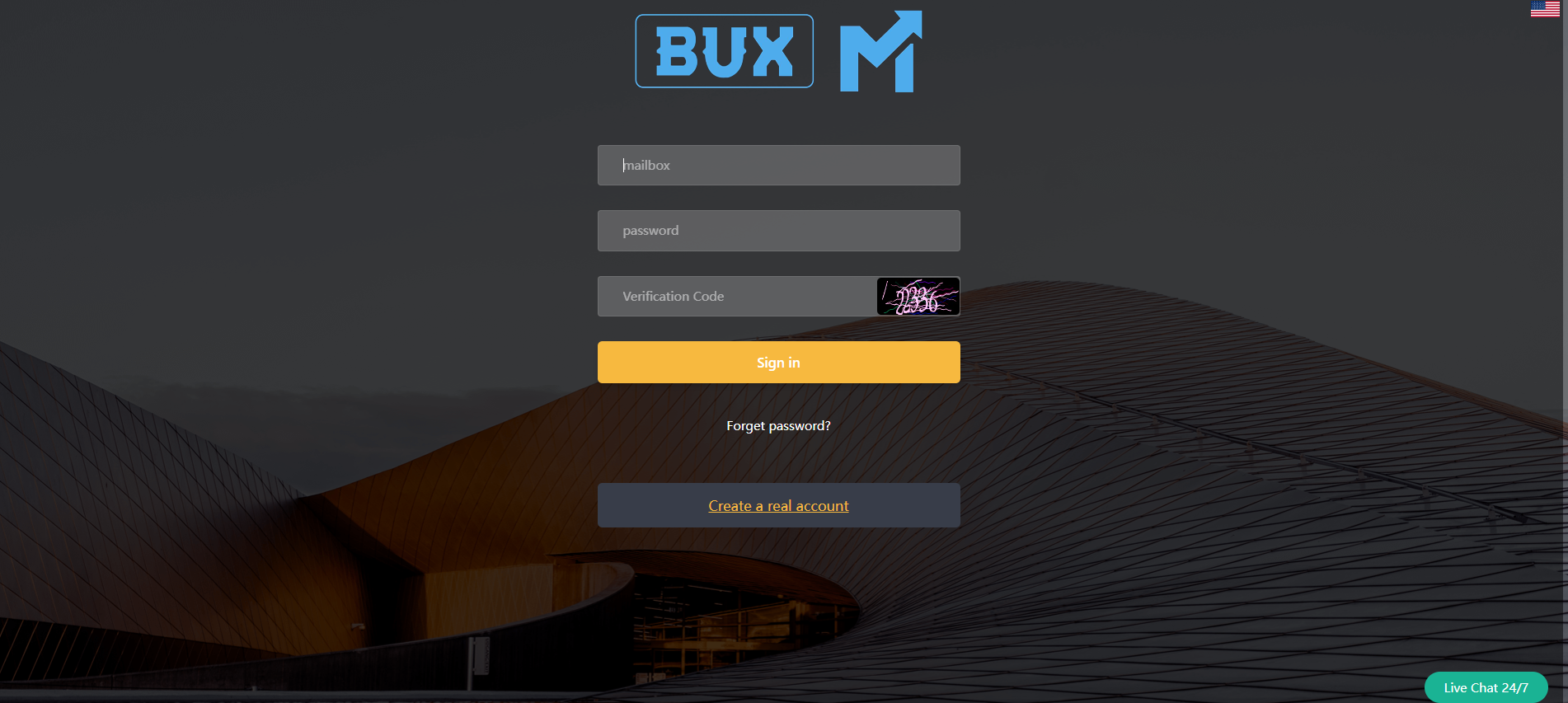

The clone operates under the website trader.bux-markets.com, contacting potential clients via the email address service@bux-markets.com. The official BUX site is buxmarkets.com, and the email address for official communication in the UK is compliance-lon@getbux.com.

Although the clone company's website significantly differs from the original platform, the logo is identical.

It turns out that this is not the first time someone has tried to impersonate BUX. The FCA issued a warning in November 2022 about another company named BUX Forex.

The FCA reminds people to only deal with financial firms authorized by them, as this offers greater protection if things go wrong. They also encourage verifying any firm's credentials in the Financial Services Register (FSR) to ensure they have the appropriate licenses for providing investment services.

Finance Magnates has repeatedly reported on clones of popular brands in the retail trading market. In August, Germany's BaFin exposed a clone of broker Fortex, while in June, Italy's Consob warned against companies impersonating E*TRADE and ActivTrades. Meanwhile, CySEC warned about a clone of OANDA TMS, a Polish brokerage acquired by OANDA in 2021.

What's Happening at BUX?

After almost two years as the Managing Director at the European financial technology firm BUX, Jean-Raphael Nahas has revealed his move to the retail trading broker Zara FX, taking up the Group Chief Operating Officer position. This personnel shift follows closely on the heels of Zara FX's recent appointment of a new Chief Financial Officer.

Simultaneously, BUX has responded to market demand by extending its offerings to include financial instruments usually exclusive to institutional investors. In collaboration with investment behemoth BlackRock, the company has introduced iBonds ETFs to its product lineup. These ETFs merge the features of traditional bonds and ETFs, offering European retail investors an economical pathway to the corporate bond market.

Additionally, BUX has rebranded its zero-commission trading platform , BUX Zero, to align it with its core brand. This rebranding effort is a continuation of last year's rebranding of its CFD platform to Stryk, formerly BUX X, to better differentiate between its multiple trading brands.