Clive Lambert MSTA MCSI is chief technical analyst at FuturesTechs, a UK-based independent technical analysis company covering Equities , bonds, commodities and Forex . FuturesTechs was established in 2000 and was awarded Independent Research House of the Year at the 2014 Technical Analyst Awards. He is a former LIFFE Floor broker and the author of “Candlestick Charts.” You can connect with him on LinkedIn or Twitter.

According to Citibank oil can fall as low as $20. In January, Goldman Sachs (who were once calling for $200 oil) downgraded their target from $75 to $40.

I am a trend-following technical analyst. Looking back at the analysis we send out to our clients each day I have discovered that I turned bearish of Brent Crude last July, when it was at $105, and there were only three days between then and the end of January when I wasn’t bearish. This is the glory of trend-following analysis, although I have to say it’s not as effective as this all the time!

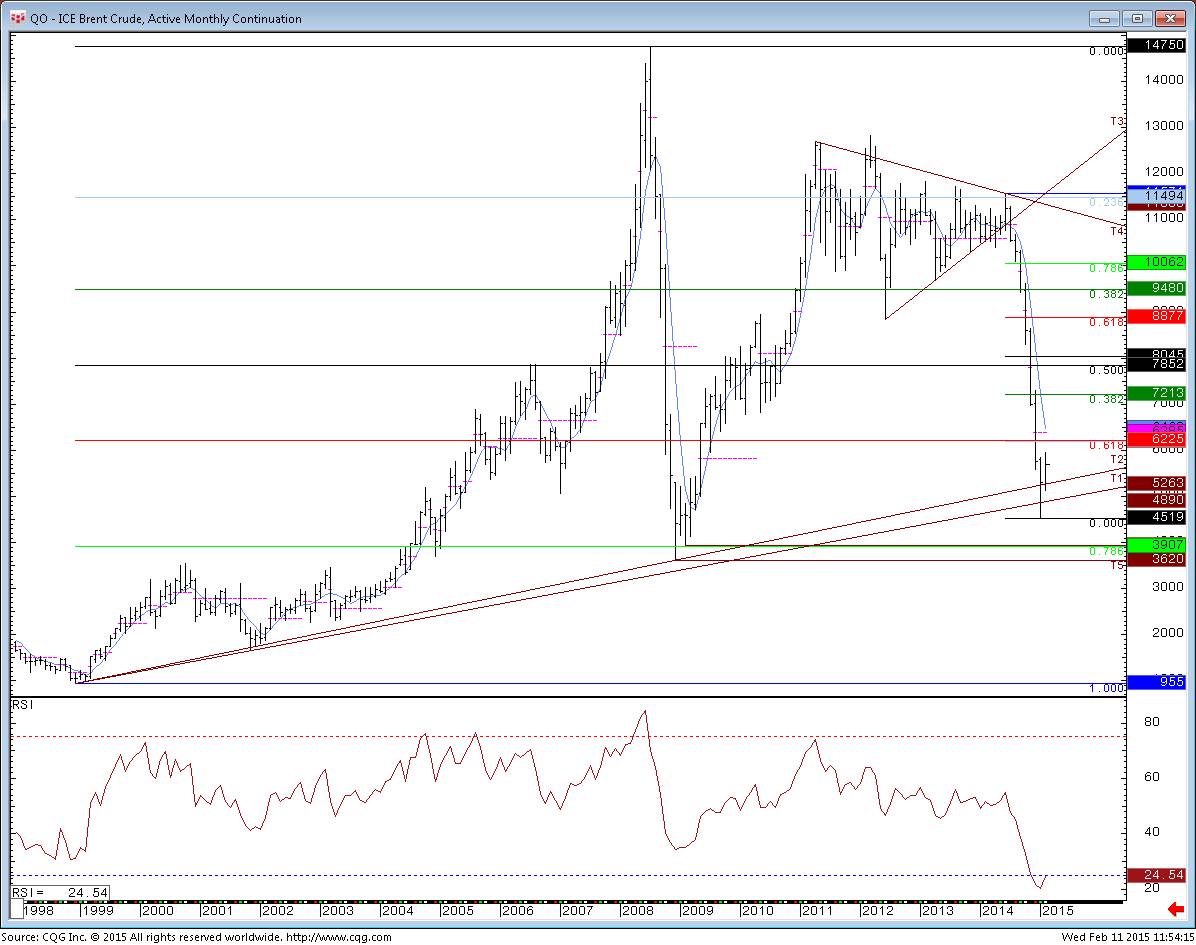

In January, just as the Goldmans of the world were downgrading their price targets I did start to turn less bearish. I’d had a target of $50 from mid-November and started to temper my bearishness when we reached this target. Another reason I thought we were near a bottom was the monthly chart below. As you can see we have hit a couple of gently sloping uptrend lines on this bigger picture timeframe. This says we have come back down to the long-term trend, and that we’re unlikely to head to $20. So far so good on this “call.” The recovery from the lows has not been without it’s pitfalls and it’s not going to be an easy ride for the bulls.

In Brent Crude I have a couple of important levels that I’d like to see holding to keep us on the bull tack in the short term. The first is 55.66 in (April ’15) Brent. If we didn’t hold here 53.65-54.06 is a key area and I would start to worry about my “bottom is in” call if we fell through here!

To the upside the recent high at 60.59 is the obvious first resistance. 61.83 and 62.54 are the next resistances of note, but if we can get through here I’d look for further gains to 67.50 then 72.00.

Incidentally the trendlines on our monthly chart are at 52.63 and 48.90 this month and protect the January low of 45.19.

The NYMEX WTI hasn’t recovered quite so much or quite so “cleanly” and could go back to 47.35-65 before buyers return. As with Brent there is an uptrend support line on the longer-term charts, at 46.51 in February, which sits in front of the recent low at 43.58.

So to sum up I think a bottom is IN, and there is scope for further recovery gains, although things are pretty volatile so you have to choose your moments to buy dips and try to join the recovery ride!

Finally I shall say this. I am a chartist, pure and simple. I don’t follow the fundamentals, and I’m sure there’s many “reasons” to expect $20 oil. There were probably many reasons to expect a retest of $150 when we were above $100. That’s why I don’t worry about the reasons! I much prefer to allow the charts to guide me!

This article is part of the Forex Magnates Community project. If you wish to become a guest contributor, please get in touch with our Community Manager and UGC Editor Leah Grantz leahg@forexmagnates.com and fill out this form.