This article was written by Adam Perl from Techsors.

For those of you who have been in the financial industry for a while, you’ve probably witnessed a lot of changes. Some might call it evolution, while veterans, who were around during the good old days, call it market saturation.

For years we’ve been seeing different brokers popping up with the same business model. Technological providers provide the basic infrastructure and Risk Management , while the broker focuses on developing the front end of the business - marketing and sales.

Sounds simple, right?

We’ll, actually, it is far from it. The increase in competition has pushed marketing prices higher, while professional sales people in the industry have become a rare commodity, jumping from one company to another, due to an endless supply of companies offering lucrative salaries.

Furthermore, the financial markets are being scrutinised by regulators, making it on the one hand safer and more secure for the end user, but on the other hand, much harder for brokers who are required to comply with strict restrictions that impact conversions and enforce tough marketing guidelines that kill performance.

Did you know?

Back in 2009 CPC prices on keywords like these were priced at just under $1(!!!)

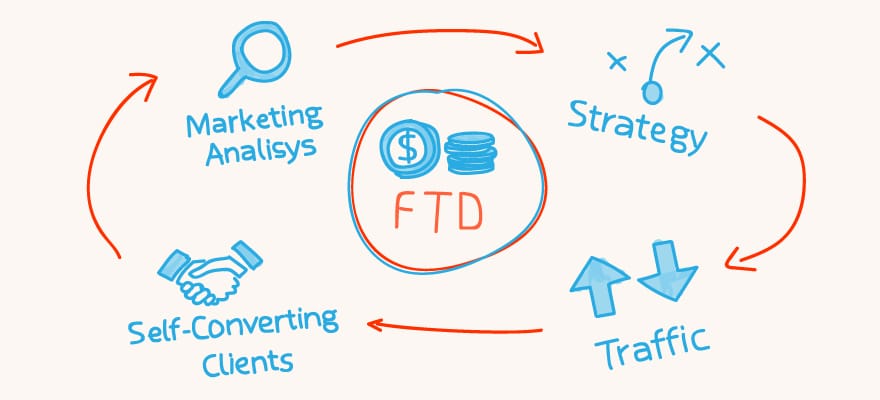

A couple of years ago a new player came onto the field, and since then has become a role model for most brokers.

Plus500 really changed the industry and in only of a couple of years reached numbers that most brokers could only dream of. Its model was a real eye opener.

Develop a self-activation process that would cut out the sales costs, allowing it to be more aggressive on the marketing side. This allowed it to compete on highly competitive keywords, ramp up prices and bid on virtually any term out there, irrespective of the keyword’s fair price. Well, why not? if it was saving on such a huge part of its expenses (sales), then why not invest a part of that money back into marketing?

Plus500 is a public company, so there isn’t really a need to go into its numbers, but when it released its first few statements, most competitors were surprised to see outstanding figures and conversion rates that were normally only achievable when using a sales team.

This immediately led different companies to implement a 'me too' strategy, trying to achieve the same results. While it might seem like a trivial task, it really isn’t.

Don’t think that by integrating an SMS verification process or enticing the client with free trading money is going to improve your company’s self-activation process. Implementing an effective self-activation process in any field, whether it's in eCommerce or in the financial industry, requires a lot of thinking, planning and most importantly, understanding your target audience.

In this article I am going to touch on a few different factors that can help you achieve a better self-activation process.

1. Know your target audience

You can have the best technology and well designed brand in the world, but if your target audience do not know what they are getting into, then your traffic probably won’t convert. If you are targeting newbies then think about this: most of your audience have probably never invested, let alone know what things like FX, spread, pips and all the other complicated jargon means.

Seriously, if you didn’t understand a thing about trading, would you get out your credit card and fund an account with a broker you’ve never heard of before? And for those of you who are offering a bonus during the marketing stage - do you think the majority of your prospects really care?

A 100% bonus on what?

if your target audience do not know what they are getting into, then your traffic probably won’t convert

If your potential client doesn’t have enough trust in your brand and doesn’t understand what he’s getting into, then that basically translates into a zero dollar bonus, as he won’t invest a dime. 100% on a zero probability of a deposit, equals a zero bonus - and that is how your prospects are thinking. In general, bonuses tend to be more effective once you have got the user hooked and not as the initial marketing pitch.

If you’re targeting traders, then its a different story. Make sure they enter a platform that caters to their needs, level of experience and understanding, especially if you want them to self-activate. Traders are people with experience and they tend to scrutinise the system much more, checking out the interface and what products you have to offer. In any case, for both types of clients you can use widgets or wizards to explain how easy things are.

Remember, trading is probably something new to most of your clients so develop a process that will increase their level of confidence in your product and your company, before you require them to take a big step and fund their trading account.

To achieve a successful self activation process first of all you need to understand that the process starts when you first engage with your users, through your marketing campaigns. Address your target audience in the right way and continue using the same tone and language throughout the whole process, a language that matches the user’s knowledge and understanding of the field. Unfortunately there is no 'one process fits all', especially if you are targeting different audiences from different regions of the world.

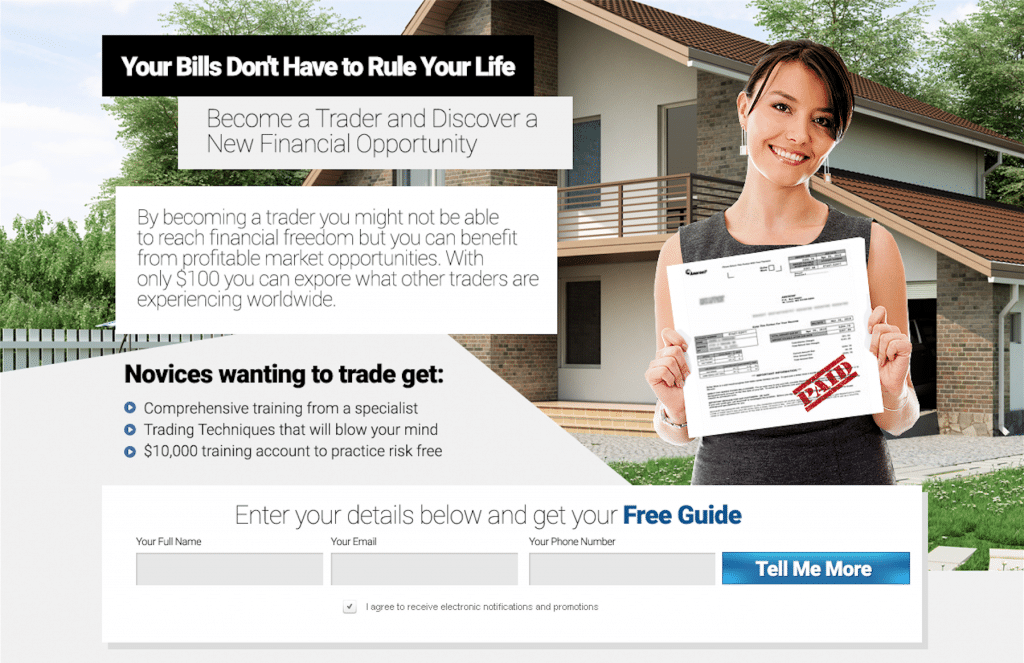

This will get you thinking - would a user know what to do if he landed on a sophisticated Trading Platform after coming from a landing page that looks like this? The answer is probably not.

2. Remove friction and irrelevant exit points

Sometimes I see conversion funnels that are so bad I am astonished that the company is even making money. Take a look at each stage of your funnel. Take a good look and think what elements you can remove.

Elements that give your users the possibility to take an action which is not the one you really want them to take. Remove any information that will allow the user to think about his next step or put the user in a situation where he/she has to make any unnecessary decisions.

Take a good look at each stage of your funnel and think what elements you can remove.

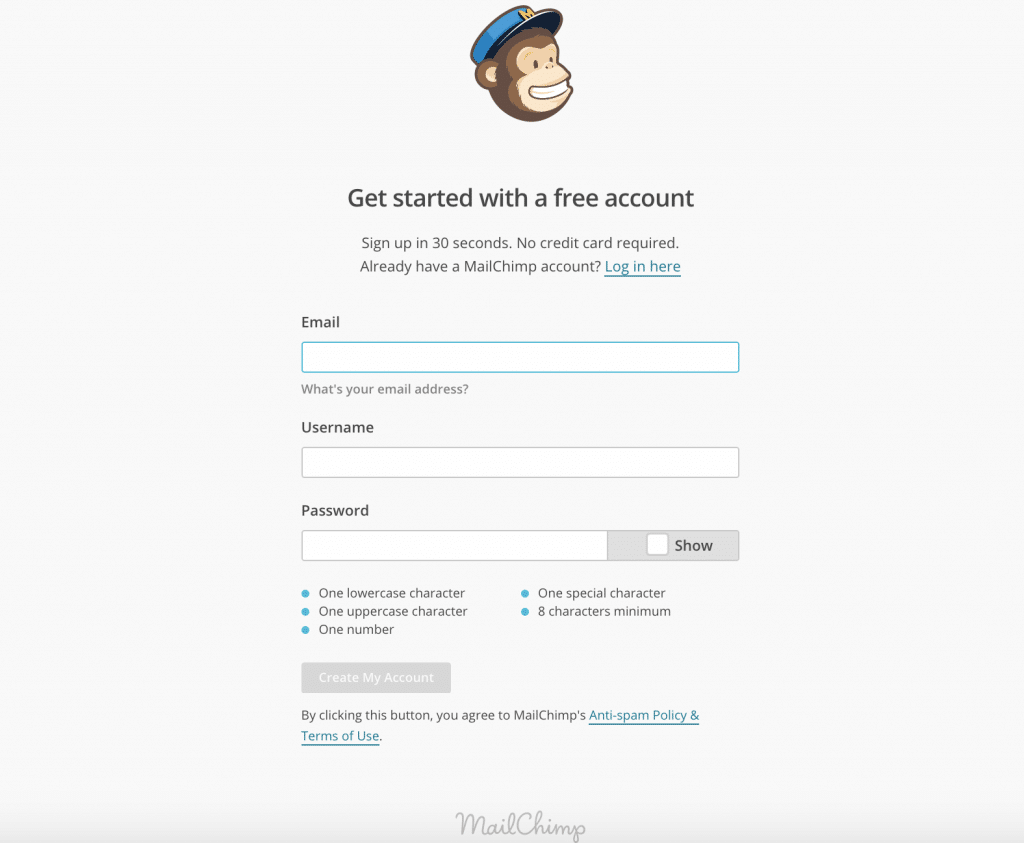

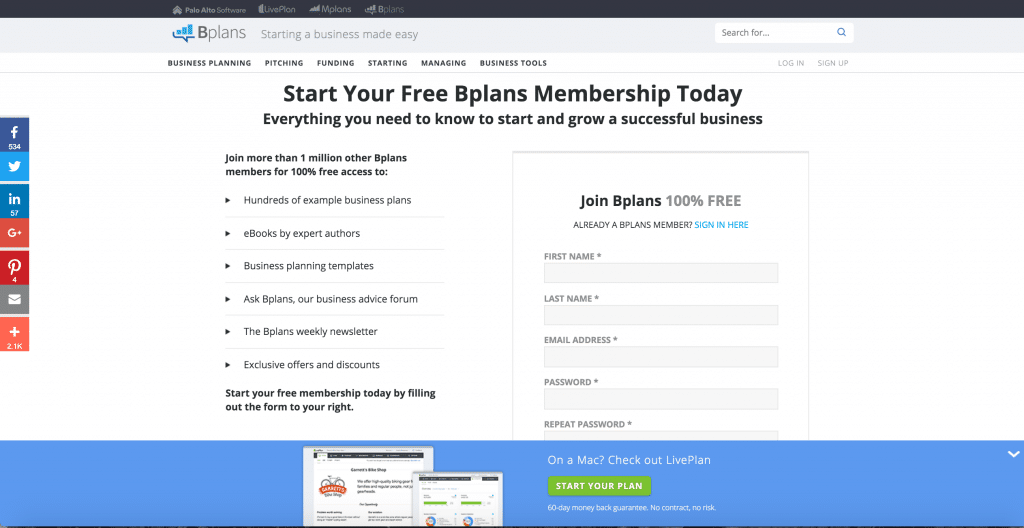

For example, take a look at the following two examples. In both cases once the user clicks on the “SignUp” he lands on a registration page. It is obvious that both companies want the user to continue registering, but both companies present it in a completely different way….

MailChimp has a clean page allowing the user to focus on one thing - signing up. They even removed the header of the website to prevent the user from going to other parts of the site or going back. Everything is structured in a vertical way, allowing the user to complete each field and move on to the next step without getting confused. The page even allows you to view your password by clicking the small toggle.

You’d be surprise to know that masked passwords are a real conversion killer, constantly causing people to question whether or not they entered their right password.

MailChimp

Bplans, on the other hand, also wants signups but it provides so many different exit points and clutter on the page that it is hard to focus on the main goal.

Bplans

3. Do your users understand your lingo?

Ok, I am pretty sure that most of the people that are going to be reading this article work in the financial industry or have some understanding of the financial markets. The problem is that most of you are probably targeting people who don’t!

Don’t assume that your users understand what you want from them. Use dumbed down terms and correct wording that directs your users to take action.

Don’t assume that your users understand what you want from them.

Think about your insurance statements for a sec, do you really understand them? Do any of us really understand them? I know when I get mine it seems like I’m getting an encrypted code that I have to decipher. Then their agents tend to call me trying to sell more insurance. Or maybe the same insurance wrapped in a different package. Why would I buy more insurance when i don’t really understand what I am reading or what I already have?

So the same goes here. Make the process easy to understand. If you’re asking for personal information then make sure you explain why you need it. Let your users know the process before they enter it and use easy to understand lingo. Make your users understand your product and bring them to a level of comprehension that will make it easier for them to deposit, trade or complete any other action that you want them to do.

4. Do you evoke enough trust throughout the process?

If your company has been around for long enough, you’ve probably got a reputation. This means that your users will have more confidence in your company and the chances of them turning into an active client is higher than if your company is brand new. That’s obvious, no? Problems occur when you haven’t got a reputation.

To overcome this barrier, new companies tend to implement only the standard solutions, adding a bunch of trust elements at the start of their funnel and then forget about the rest of the funnel. For example they might write in their “About Us” page that the company has been around for years or decades even, or add a badge or two on their homepage. Trust me, this is good, but not enough.

Internet users are a lot more sophisticated than they used to be and will doubt each step of the process. People want to know that the company they are going to invest with is reputable, established and gives them a trustworthy feeling throughout the whole conversion funnel.

There are many different ways you can evoke trust, and this needs to be done throughout each part of your self-activation process. Think about your funnel as a route your users have to take. During each step you are probably asking them to take an action or pass over different types of information. For them to do this, each step needs to make sense and your request for that information needs to be legitimate.

Internet users are a lot more sophisticated than they used to be and will doubt each step of the process.

Asking for a name or email address is an easy one. Most users will provide real details and won’t have a problem with it. It is less committing and less intrusive. But asking a user for his real telephone number starts to cross a border of trust. Trust that needs to be developed. Asking for a user to fund a trading account is even harder. Most of your users don’t really understand that it is not you that is conducting the payment clearing, but a third party PSP provider that is globally recognised and secure. Furthermore, they don’t understand that your company works with global established banks.

Think about it, if you are using a PSP’s API service, then your users will probably never know, as your brand will always be in the front. They came to your brand, entered your trading platform and understand that they are funding an account with you. If your brand doesn’t ooze trust, you could be working with the Federal Reserve - it simply won’t matter.

In a successful self-activation process trust is developed one step at a time, and those steps are normally baby steps. If you managed to market trust already from your campaigns and continued to develop trust throughout the whole of your conversion funnel, your users will reach their final destination and take action with ease. If not, they will start to ask a lot of questions, look around and probably leave.

Similar to everything in life, timing is everything. Know when to ask the right questions throughout the funnel, give your users a positive feeling and you will reach killer conversion rates.

Break up your self-activation process into steps. Throughout the upper funnel you can use badges, numbers, testimonials, social elements and endorsements. One example is 24Option and its collaboration with Boris Becker.

Throughout your lower funnel, you will need to market credibility and professionalism. Plus500 does this by offering an easy-to-use trading platform, showcasing a vast amount of tradable products, and always putting the popular ones that people are most familiar with in front.

If you have the technological capabilities then you can go one step further and personalise the whole experience. So for example, if a user from the UK lands on your homepage let him first see content that is relevant to him. He will probably want to trade the FTSE, so make sure that you’re marketing what he/she is familiar with and wants to see.

Once your users enter your platform, make the new environment seem user-friendly by walking him through the platform. Make the user feel like he is at home. Remember that your 1-on-1 training should be a process that leads your clients to take action. This can be achieved by implementing widgets, walkthroughs, tutorials etc…

5. Make sure you implement easy testing

Testing is a serious thing and one that must be taken into consideration, especially if you want to achieve results. Your conversion funnel should be pretty flexible and customisable. If you can refrain from hard coded texts that might need changing at a later stage, do it.

If you can use a CMS to control your funnel texts and design then it will save you a lot of time. Make sure you track all events within the conversion funnel for example; buttons, actions, paths and so on… You will need to know throughout your funnel if specific parts are scaring off potential clients and which parts are achieving their goals. Track everything! Loading times, exit rates, bounce rates and anything else that comes to mind.

Track everything!

Try to measure every part of the process to understand where you can improve. There are thousands of tools out there that can assist with the process, including Google Analytics, Kissmetrics, Visual Website Optimiser, etc…

Similar to other third party services, some of these tools you might not be able to use or implement due to security reasons, but the main thing is try to measure as much as you can and accumulate data. Conduct A/B tests or multi-variate tests on various things throughout the process and always make sure that sample size is significant enough to reach a decision.

Whether you decide to test call-to-actions, images or the layout of a specific section always make sure you give your tests enough time, whether you are aiming for leads, activations or ROI.

Final Thoughts

Developing a successful self-activation process in any field isn’t an easy task. It requires a lot of planning and testing. Define your goals and understand the audience you are targeting.

Don’t expect that one process will convert all the different type of audiences (traffic) you are targeting. Try to drill down and analyse each step of the process and most importantly, put yourself in your client’s shoes.