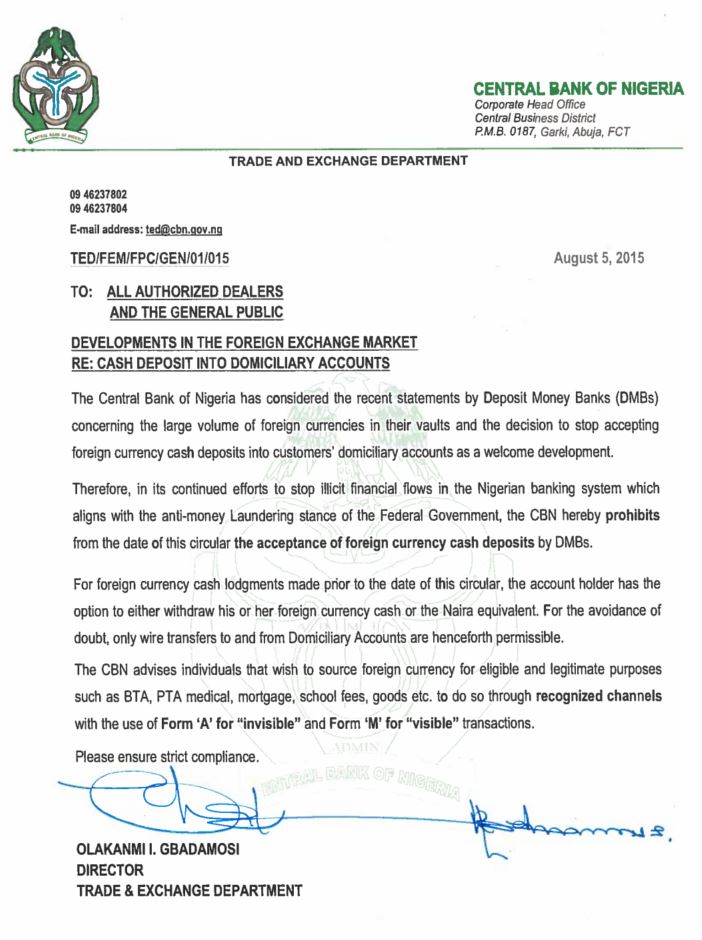

I woke up on August 1st of 2015 to receive a shocking mail from my bank that US dollar transactions couldn't be done over-the-counter in the bank forthwith, and would be limited to only transfers. I didn’t understand the mail and I quickly put a call through to my bank and the interpretation was shocking – the US dollar is no longer a legal tender in Nigeria except for travellers who are restricted to a minimal amount, which can be obtained either in the banks, and parallel market on presentation of travelling documents. As if that was not enough, I also received another abrupt revelation from my bank a few days after, that daily transactions on credit cards have been pegged to $300 and $1000 to individual and corporate card holders, which was corroborated by an official manifest from the Central Bank of Nigeria (CBN). Consequently, Forex brokers in Nigeria initially thought that the world had come to an end!

Nigeria is largely an import dependent country. For example, the country has grown in recent years to become a key producer of crude oil in the worldwide market, yet still imports gasoline. Over time, Nigeria’s foreign reserve gets depleted because its trade balance is always running a staunch deficit, thus the government is repeatedly forced to intervene in a bid to save the reserves as well as reduce the increasing spread between the parallel market quotes and the official rate. Consequently, forex traders have two effective means of funding their trading accounts with their brokers who are locally domiciled or offshore: i.e. either through a bank deposit/bank wire or credit card deposit. However, the launch of this new policy discourages deposits and bank wires are no longer possible because traders can no longer buy physical US dollars from the parallel market to be deposited in their trading account for wiring offshore. Moreover, card transactions have been pegged to $300 daily, which is very frustrating and domiciled brokerage firms find it difficult to wire money to their LPs or parent company as it is impossible to do such transactions. Already, low deposits in Nigeria have led to massive declines in volume. Offshore brokers were the biggest losers as clients were unable to maintain a fluid deposit stream as usual. In the midst of these challenges, brokers domiciled in Nigeria have struggled to find a legitimate solution to the fund wiring dilemma.