This article is written by Stephen Simon

ABOUT THE AUTHOR: Stephen is the main content writer for anyoption. He specializes in new market research, Compliance and profitability reporting for Europe and South Pacific markets. When not following international economics, he enjoys sketching, analyzing German literature and teaching himself Danish, Dutch and Turkish.

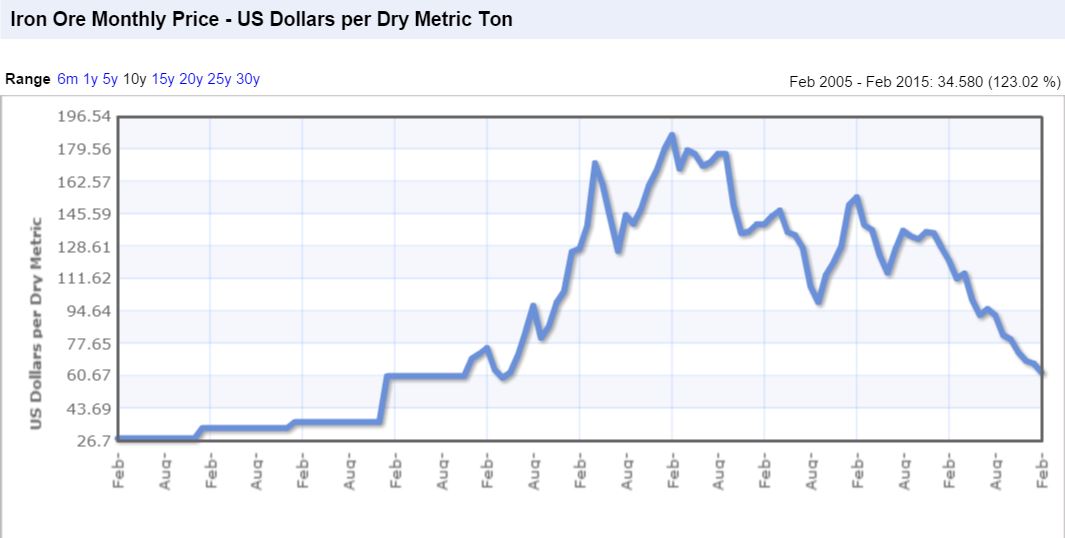

China’s long history of steadily increasing growth has finally tapered off. In recent statements, the Chinese government (and, in turn, Chinese industry) have reduced expectations for the scale of infrastructure developments and expansion. For global suppliers of raw materials, the drop in demand from China has come as a bit of a shock. China’s growth over the last 23 years has been a steady source of demand for global suppliers of raw materials, but the drop in demand has started to take it’s toll. The price of iron ore has dropped to nearly half of what it was this time last year as a result.

Bao Gang Steelworks, Baotou, Inner Mongolia, China (Photo: Bloomberg)

The most significant source of demand for iron ore in China over the past two decades has been housing. During that time, the Chinese government was concerned with providing sufficient housing for the country’s immense population, which led to unprecedented amounts of steel-frame structures being erected throughout the country. But those consumption trends are over.

The latest government plans look to decrease the amount of new land and real estate developments as China’s growth slows. This governmental shift in focus means that China is now on course to consume less iron than it has been for the past quarter century. With such a dramatic drop in consumption, it’s easy to ask yourself how producers of iron ore around the world are reacting.

Ignoring Demand

Economics 101 would teach students that a reduction in demand for a product naturally results in a corresponding reduction in supply. That is not the current reality of iron ore, however. Despite two consecutive quarters of reduced iron ore consumption in China, the top two iron ore producers in the world are not slowing down their mining operations.

In fact, they are increasing output significantly. The number 1 miner of iron ore, Brazil’s Vale SA, has recently announced record-high output numbers. Further increasing the amount of iron on the global market, the British-Australian mining giant, Rio Tinto, has also increased its iron ore production.

Although the top two producers in the industry appear to be able to handle the pressure of this commodity’s price dropping, competitors are having a rough time in this environment. Companies like China’s Fortescue and South Africa’s Kumba Iron are being forced to reduce dividend payouts due to the steadily falling price of their product.

Kumba has even released statements that they do not foresee a price rebound occurring for iron for a while, but that their mining operations have been and will continue to increase output nonetheless. It appears that, for now, the major miners of iron ore are going to continue to supply the world with plenty of cheap material, despite being heavily criticized for this decision.

Source: www.indexmundi.com

For investors, the commodities market may appear to be losing steam of late. Much like China, commodities have been trending downward. But commodities are not the same as a nation’s economy. In reality, the value of commodities will have its own ups and downs, similar to the stock market. And like stocks, it’s wise to buy commodities when they are down and sell them when they are up. Right now, iron ore is selling for prices we haven’t seen since 2009.

But in 2011, it was selling at almost three times that price. Hindsight is 20:20, but it’s still easy to see that buying into iron ore in 2009 and selling it in 2011 would have been a solid plan for high performance returns. Taking those figures into consideration, the current situation presents itself as another appropriate time to invest in iron ore with a long-term plan for a solid ROI. For those with the patience to hold onto iron ore until it comes back up in a few years, I advise you to invest in it now.

This article is part of the Forex Magnates Community project. If you wish to become a guest contributor, please apply here: UGC Form.