This article was written by Aayush Jindal, currency analyst at Titan FX.

The euro this week declined to a new monthly low of $1.0950 versus the US dollar, and during the recent downside, the EUR/USD pair broke many important supports. Let’s try to analyze whether a recovery in the shared currency is possible or not.

ECB Rate Decision and Draghi’s Nothing Lasts Forever Comment

Today, there was an important release in the euro area, as the ECB interest rate decision was announced by the European Central Bank. The market was not looking for any change in the interest rates, and the result was the same.

The ECB kept the main refinancing rate unchanged at 0.0%, but the market was waiting for ECB President Mario Draghi's comments on the ongoing events. Here are the key takeaways from his speech:

- Committed to very substantial monetary accommodation.

- Extraordinary policy support won't exist forever.

- No signs of convincing upward trend in core inflation, but inflation to pick up in the next months.

The main takeaway was his comment that 'nothing lasts forever'. This caught the market's attention, and pushed the euro higher versus the US dollar. There was a spike in the EUR/USD pair towards 1.1040, but the recovery did not last long.

Reason? It’s mainly because the recent downside break in the euro was crucial, and even positive comments from Draghi may not help the common currency in a recovery.

EUR/USD Bearish Sentiment and Trouble for Euro Bulls

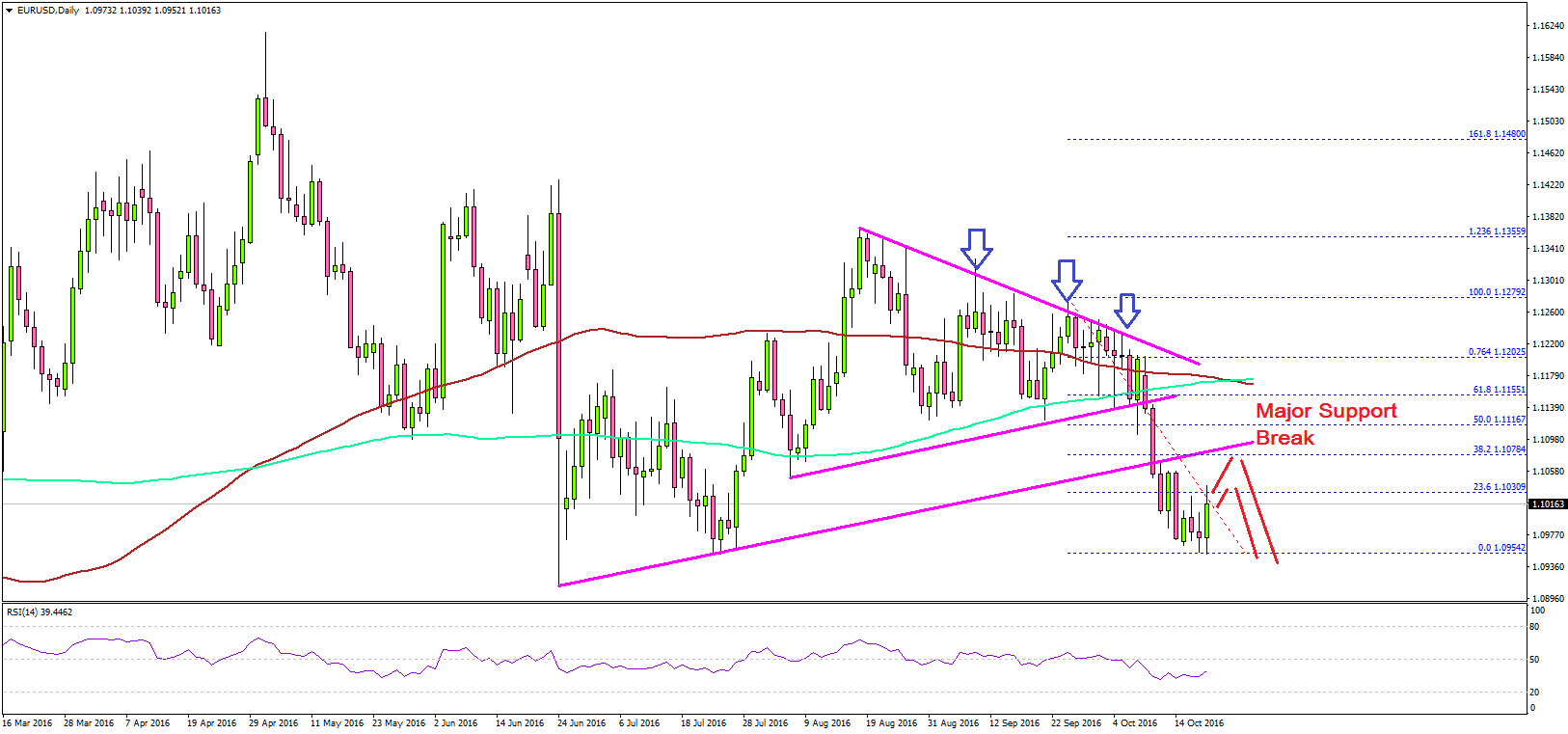

Let's have a look at the daily EUR/USD chart. There are a few important points to note, which suggests that the pair is now below a major support area.

First, the recent downside move was initiated once the pair broke a monster contracting triangle pattern on the daily chart. Second, the pair moved below a bullish trend line, connecting lows. Third, there was a close below the 100-day simple moving average. And, the last was a break below the all-important 1.10 support area.

The pair is currently finding bids near July’s low of 1.0950. So there is a chance of a minor upside move, which is currently underway. However, the pair may soon find sellers near the 23.6% Fibonacci retracement level of the last decline from the 1.1280 high to 1.0950 low at 1.1030-40.

If there are further gains at all, then the broken bullish trend line along with the 38.2% Fibonacci retracement level of the last decline from the 1.1280 high to 1.0950 low may act as a resistance at 1.1080.

Overall, any recovery from the current levels may find offers on the upside, and there are high chances of EUR/USD continuing its decline in the near term.