By Nick McDonald, founder and CEO of Trade With Precision.

Nick McDonald

The UK Financial Conduct Authority’s (FCA) proposals to curb the use of excessive Leverage by retail traders came as a shock to the market.

But the planned overhaul of the regulatory structure highlights an important point that is sometimes overlooked - education is important for retail clients, and should be encouraged. Many brokers do this already, others leave their clients to figure it out for themselves. The longer term impact of the proposed changes will be positive for the industry, even if there is pain in the short term.

The FCA’s consultation paper proposes leverage caps of 50:1 for all retail clients and 25:1 for clients with less than 12 months trading experience. It also says brokers should publicly disclose profit/loss accounts of all clients, and suspend all bonus practices. Companies have until March 2017 to submit their feedback.

It will be interesting to see how brokers respond. But it’s worth noting that, just because 200:1 leverage has been available, that doesn’t mean it needs to be used. Traders who have been well-schooled and learned their business are virtually never leveraged to the maximum extent.

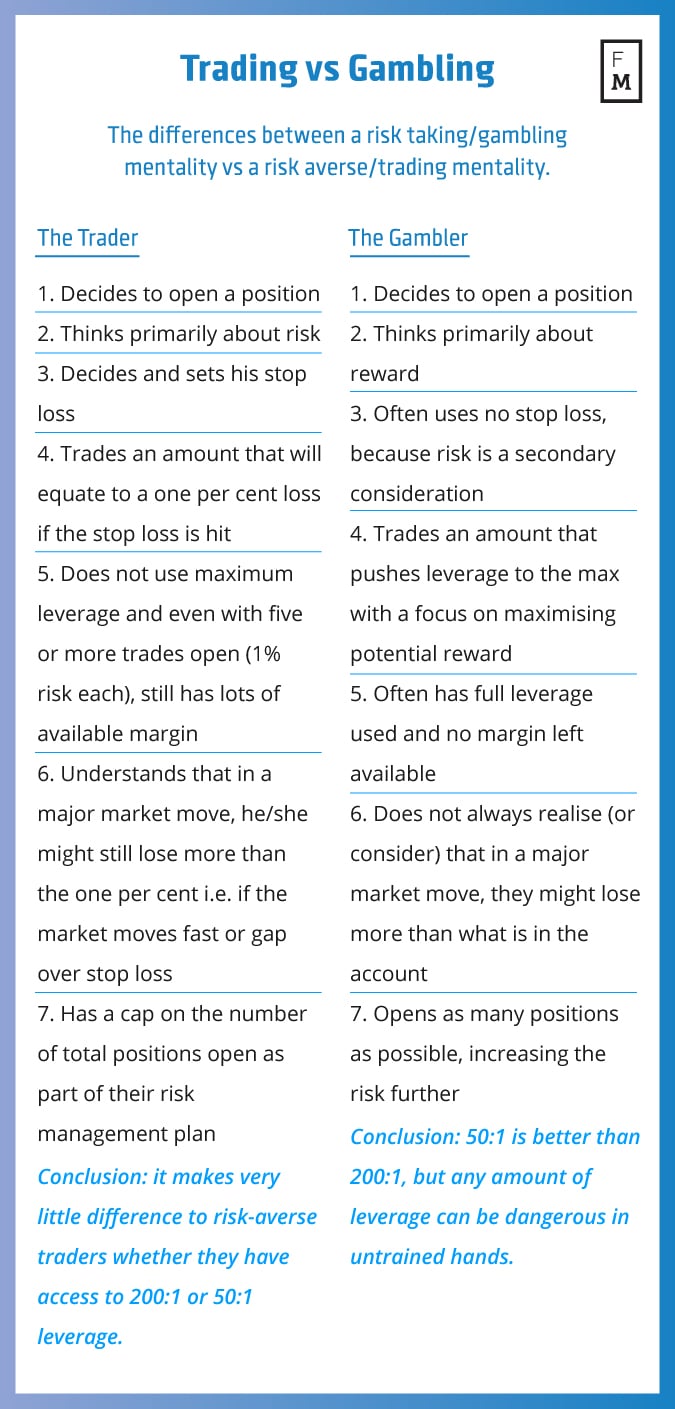

Those who do push out beyond sensible margins tend to have not been properly educated in market risk. Or they treat every trade as a gamble. And the reality is that even if the FCA lowers the cap to 50:1, there will still be those with a gambling mindset who will maximise their available margin. By contrast, traders who have been educated on the potential dangers of being over-leveraged, tend to manage their risk more responsibly.

We have been encouraged to see the number of brokers endorsing a more risk-averse approach in recent years. The gamblers need to be made aware that trading isn’t a game of high stakes poker in a Western saloon where a hidden derringer offers a get-out-of-danger option.

Successful traders realise that - like any other profession - trading requires training and a commitment to studying how markets work, and staying on top of best practices. The FCA proposals offer an opportunity for brokers to place more focus on educating their retail clients on Risk Management . In our experience, the best traders in the industry are more focused on risk than reward.