ABOUT THE AUTHOR: John Putman II is a full-time trader and managing member at FX Analytics , a third-party research provider focused on exchange rate modeling, economic complexity, genetic programming and distributive computing.

The story this morning is of course the Swiss National Bank's (SNB) move driving the CHF's volatility overnight. With this being my first post for Forex Magnates and having this price action as a backdrop, I want to use the opportunity to talk just a little about risk.

I’ve been in the markets for a long time, fifteen years with forex, and the one thing I believe strongly is that we can never know what the markets are going to do, ever.

Our only true protection against that is to trade small. By small I mean with very little leverage. I know all the arguments about stops etc., but this is the kind of event I always come back to, the tail event, the Black Swan .

In those fifteen years I’ve seen this kind of thing at least five different times. Each one bad enough to ruin an account. There are traders out there this morning, professional and amateur alike, who are now staring at losses they will never recover from. Two days ago I was long both the CAD/CHF and the NZD/CHF, I was lucky enough to grind in half a percent combined trading 1:1 on each pair.

Many traders feel this is too low, that it doesn’t generate enough profit. But what is the downside? If I had been in those trades at 20:1 today, even 10:1, where would my account be? Gone. I feel terrible for anyone who got caught on the wrong side of this and hope those that survived take a moment to reflect on their money-management and exposure and see this for what it is. A reminder that we never know what is going to happen.

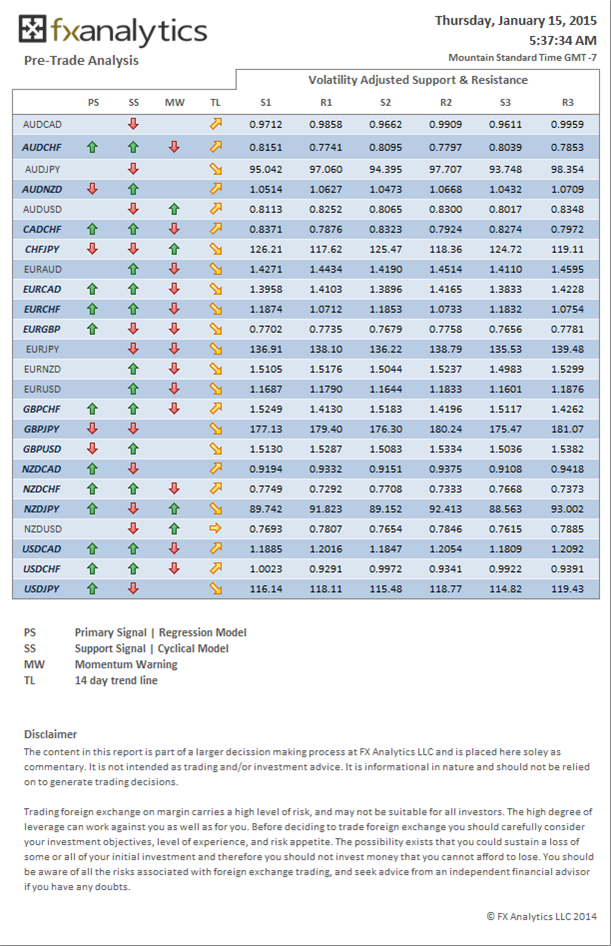

The matrix this morning has 16 primary signals, 10 of those also have secondary support, but only one – the GBP/JPY – isn’t experiencing counter momentum. This will keep me on the sidelines until tonight. Not to mention, I want this event with the CFH to play out and let the markets calm down. For me, patience and caution here are paramount. My primary goal is to survive and grind another day. - JP

This article is part of the Forex Magnates Community project. If you wish to become a Guest Contributor, please get in touch with our Community Manager and UGC Editor Leah Grantz