This article was written by Dwayne Buzzell, a financial analyst with more than two years experience in Forex trading and private investing.

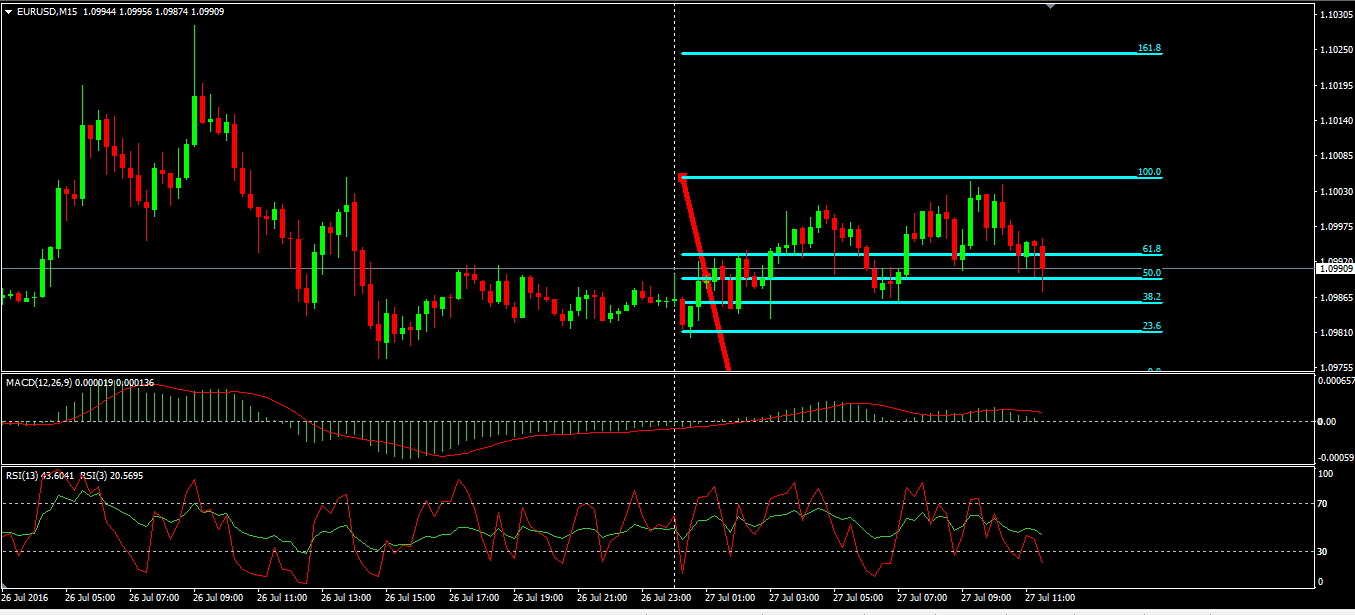

The currency pair EUR/USD has not moved much during Asian trading with a slight upward trend. The dollar has stabilized compared to most counter currencies before this week's meeting of the Federal Reserve. The two-day meeting will be finished tonight and it will show a new growth projection, there won’t be a press conference after it finishes.

After the decision is made, the Fed will only release a statement in which the decision will be explained. During the day, the eurozone will be publishing significant economic results, while in the afternoon, a report is going to be released on durable goods orders in the US.

The euro has strengthened against other major currencies, although the published data showed that German consumer climate fell in June, however less than expected. Forex pair EUR/USD rose to 1.0995. Official data showed that German GfK consumer climate fell in June to 10.0 points from 10.1 in the previous month, and was expected to fall to 9.9 points.

A separate report showed that German import price index increased in June by 0.5 percent after rising 0.9% in the previous month, a predicted growth of 0.6% against the pound, the yen and the Swiss franc. The euro has strengthened. EUR/GBP climbed to 0.8390, EUR/JPY rose to 115.98, and the EUR/CHF jumped to 1.0916.

Japanese Prime Minister Shinzo Abe said his government would put together a stimulus package of more than 265 billion dollars in order to stimulate the economy. The single currency rose against the Canadian and New Zealand dollar. EUR/CAD rose to 1.4493 and EUR/NZD rose to 1.5606. The Euro Index has increased by 0.23% to 88.20. It shows a key resistance at 1.10 in the picture.

The price has bounced from the 100 Fibonacci level. It was confirmed by the double peak at M15 charts. The price has broken the 61.8 Fibonacci level and continued a short-term declining trend. A double bottom shows at 38.2 Fibonacci level.

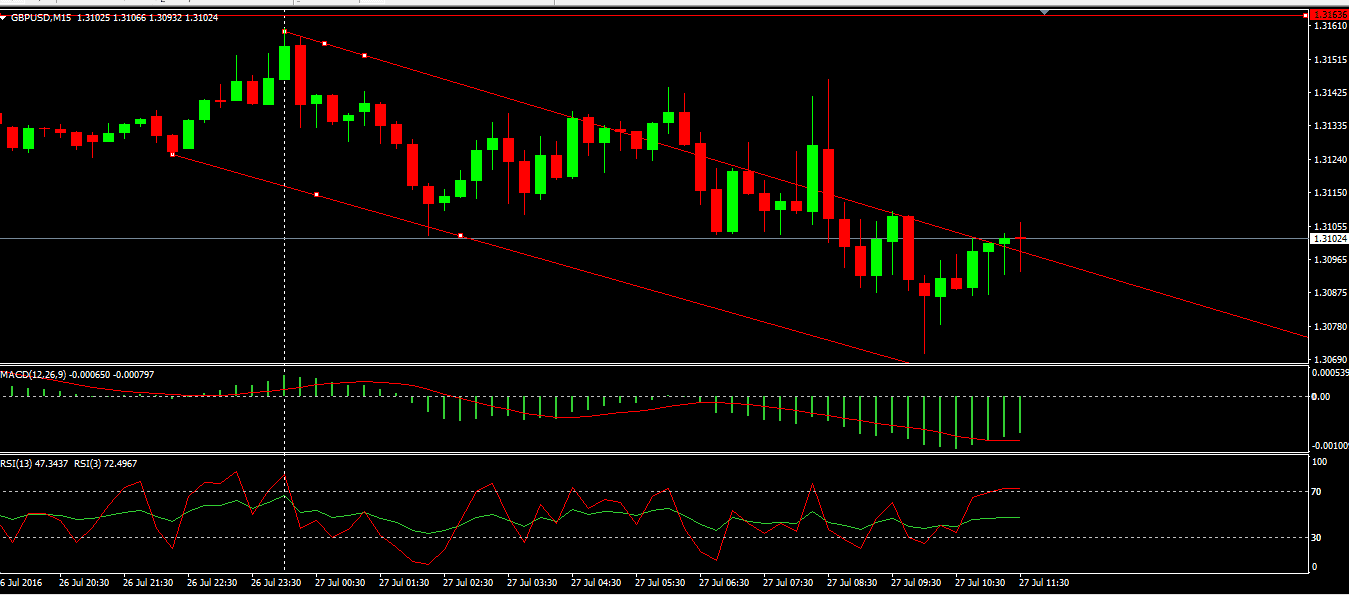

The British pound did not move much against the dollar during Asian trading, though increased oscillations occurred after it posted better than expected results of the GDP during the second quarter.

Compared to the previous quarter, it had a growth of 0.6%, which was better than the expected 0.4%. On an annual basis, GDP grew 2.2%. Preliminary data showed that the economy of Great Britain has increased during the second quarter by 0.6%, after rising 0.4% in the first quarter. Economists had expected growth of 0.4%.

The index of the service sector of Great Britain rose in June by 0.3 % after rising 0.5% in the previous month, which was in line with the forecasts of economists. A declining trend line can be seen in the image below. Double peak wasn't broken at the 1.31500 strong resistance area. The short position below shows the 1.31500 with targets at 1.30750 and 1.30 in extension.

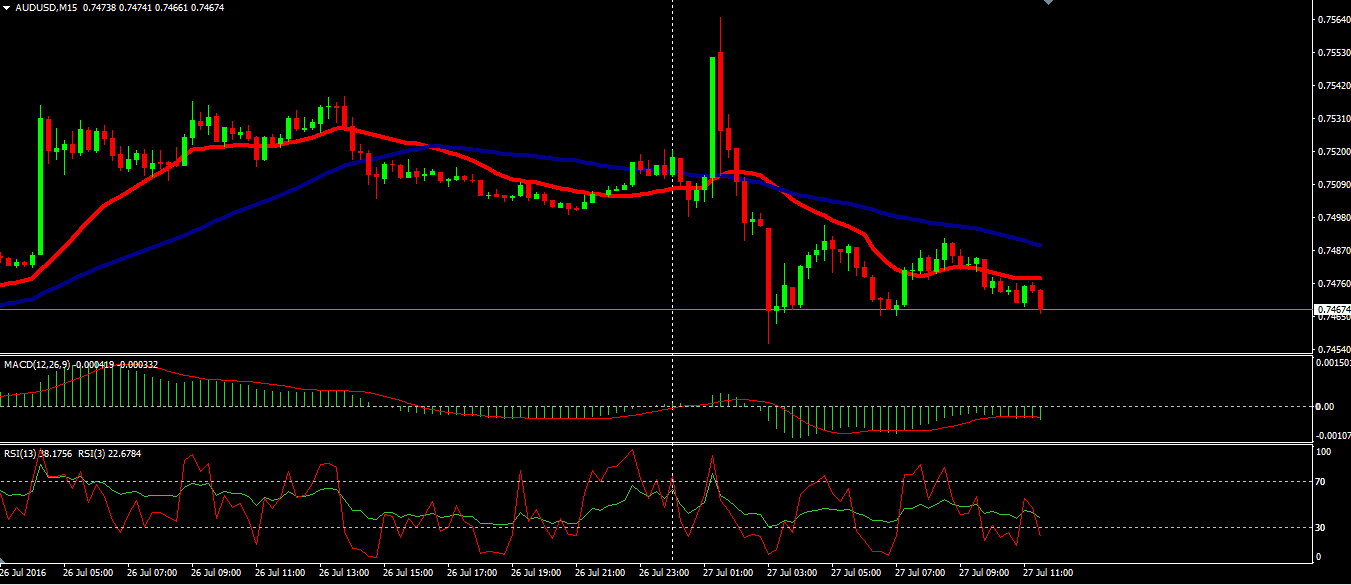

The Australian dollar fell against other major currencies after published data showed that consumer price inflation in Australia rose in the second quarter, in line with expectations. The pair AUD/USD is up at the moment of writing, recorded on the bottom 0.7456, and subsequently consolidated at 0.7484.

Official data showed that consumer price inflation in Australia rose in the second quarter to 0.4% percent from minus 0.2% in the previous quarter, which was in line with forecasts of economists. Australian core consumer prices rose in the second quarter to 0.5% from 0.2% in the previous quarter. Analysts had expected growth of 0.4%.

The Australian dollar fell against the yen. AUD/JPY dropped to 78.90. AUD/USD sharply dropped below the 0.6565 area. 20MA full red line crossing over 50MA full blue line was taken as a signal for short positions on AUD/USD below 0.75200 with targets on 0.74500 and 0.74. It can be seen the double bottom at 0.75400. It wasn't broken but it can be tested very soon. Technical indicators are bearish and call for a further decline in prices.

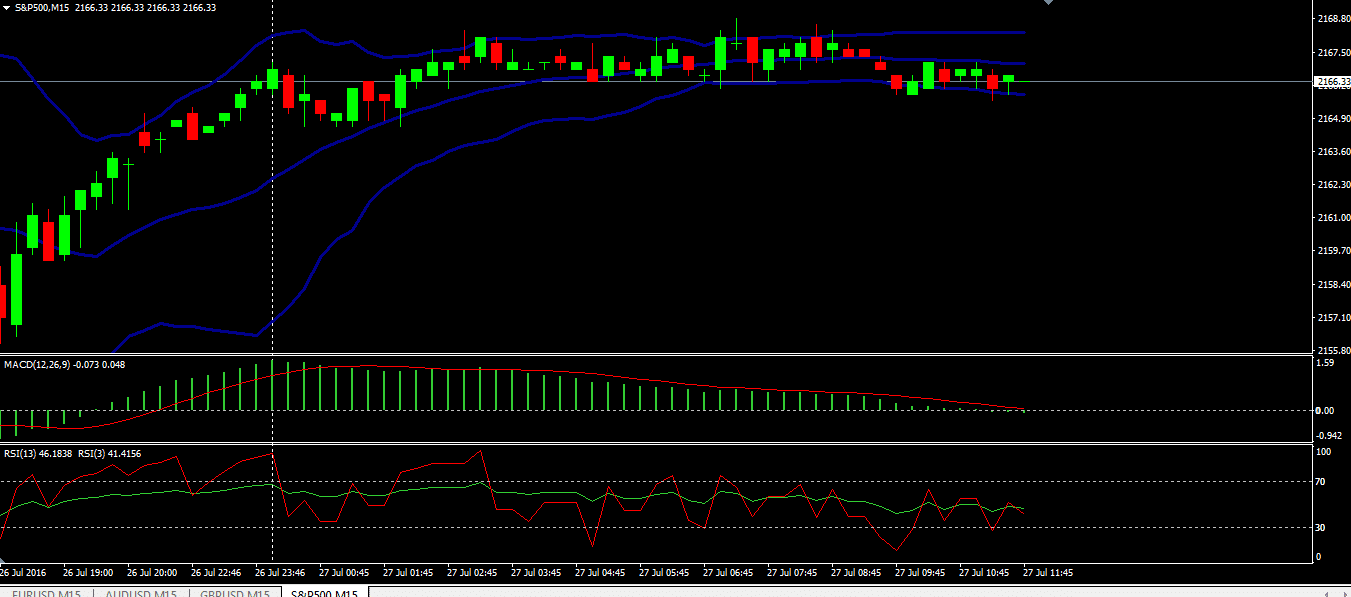

Prices of stocks on Wall Street were mixed as investors were cautious ahead of the outcome of the meeting of the Federal Reserve. Dow Jones fell by 0.10%, the S & P 500 climbed by 0.03%, while the NASDAQ was higher by 0.24%. Investors are wary of the two-day meeting of the Federal Reserve. Analysts do not expect the central bank to raise interest rates but they’re waiting for signals related to the possible tightening of monetary policy by the end of the year.

Asian stocks were mixed. The Japanese Nikkei 225 index rose 1.72%, the Hang Seng index in Hong Kong fell 0.28%, while Australia's S&P/ASX 200 was higher by 0.04%. Japanese Prime Minister Shinzo Abe said his government would put together a stimulus package of more than 265 billion dollars in order to stimulate the economy.

Investors are hoping for the new stimulus measures and for the Bank of Japan to print new money, increase Liquidity and credit, and thus encourage economic growth and inflation. The Bank of Japan will be soon announcing a decision on monetary policy. Analysts believe there is a little chance that it will increase the negative interest.

European stocks rose. Euro Stoxx 50 rose 0.72%, France's CAC 40 climbed 1.07%, and Germany’s DAX 30 was higher by 0.86%, while London's FTSE 100 rose 0.24%. Prices and US stocks closed mixed yesterday.

The industrial sector, the sector of basic materials, and oil and gas sector closed in decline yesterday, while on the other hand, shares of companies in the utility sector, the communications sector, and consumer goods increased.

During the Asian and early European trading, S&P 500 rose 0.21%. A long term rising trend line can be seen. The price has formed a strong support area at 2166. It is confirmed by lower Bollinger Bands.

It shows that it was taken as a signal for buying positions above 2166 with targets on 2170 and 2190 in extension. The price was trading in the range of 2163-2168. The price didn't break the strong first resistance level at 2170. It can be expected to rise in price very soon. Technical indicators are bullish and call for further advance. It can be broken with 2200 index points as a strong resistance level.