The euro has been strengthening steadily over the past week against most major currencies. Against the US dollar it has appreciated 3.4% to trade at 1.1213 highs and against the GB pound it has appreciated 3.2% to trade at 0.7169 highs. These are very large advances in a currency that has been in a bear trend since mid-2014 when it was trading above 1.3000 against the US dollar and above 0.8000 against the pound.

Tuesday evening saw Greece secure a deal for a third bailout, this had already been in the pipeline and is what has probably been fueling the euro’s rise. The euro however is still suffering from a long-term low interest rate scenario, compared to currencies like the USD and GBP which are both already in the process of gearing up the markets for an interest rate rise in the near future.

Some calls are for as early as September for the USD and by end of the year for the pound. Last Thursday’s Bank of England (BoE) meeting already saw one board member vote for a rise in interest rates. The board of the BoE consists of nine members who vote at each meeting on whether to raise, cut or leave the key interest rate unchanged.

Looking forward, the euro looks more likely to fall, returning to its down trend, after the Greek bailout euphoria is over, especially against GBP and USD.

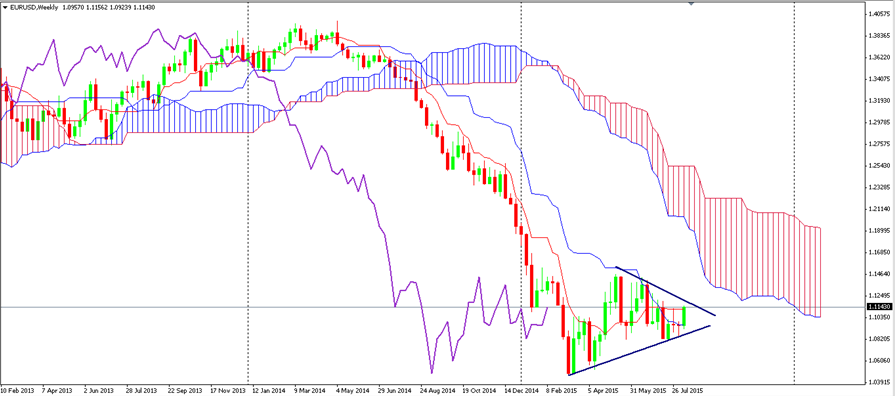

Looking at the Charts

The weekly chart for EUR/USD shows the formation of a triangular pattern, which is usually a continuation pattern, in this case signaling that price should continue further down once it breaks the bottom support line. Price is also fairly close to the bottom side of the Cloud where it would find further resistance if price were to break the triangle on the up side.

EUR/USD Option Trading Strategies

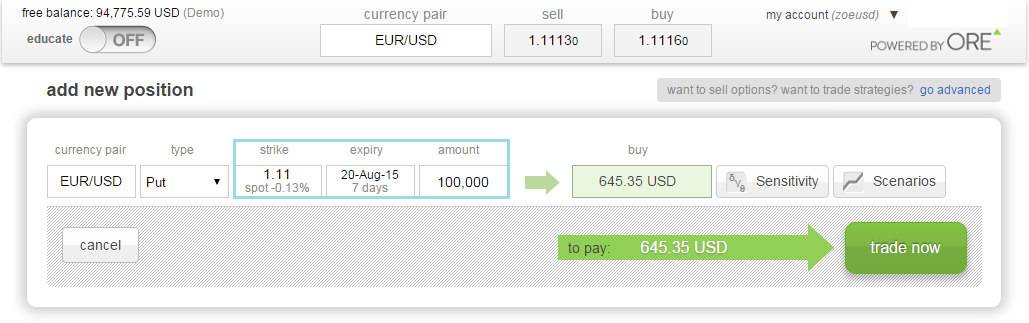

If you think retracement has reached its peak, and applying the old saying “buy on rumour, sell on fact,” then as the bailout has been announced and finalized, the next direction for this pair is back down, In order to take advantage of this market movement you may buy a Put option which gives you the right to sell EUR/USD at a predetermined rate within a set time.

The image below is a 1-week Put option trade example set-up on the ORE Web-Platform; the predetermined sell rate is 1.1100 and the contract size (amount) is for 100,000 EURs. It costs 645 USD premium to open this trade.

If the EUR/USD falls below 1.11 within the next week the option will payout, the profit will be at least 100% if the pair trades below 1.0971 and if it falls to Aug-5th lows, at 1.0850, profit will be at least 1855 USD. The total risk is 645 USD (open premium) and the trade will lose if the pair does not fall below 1.11 by the options expiry.

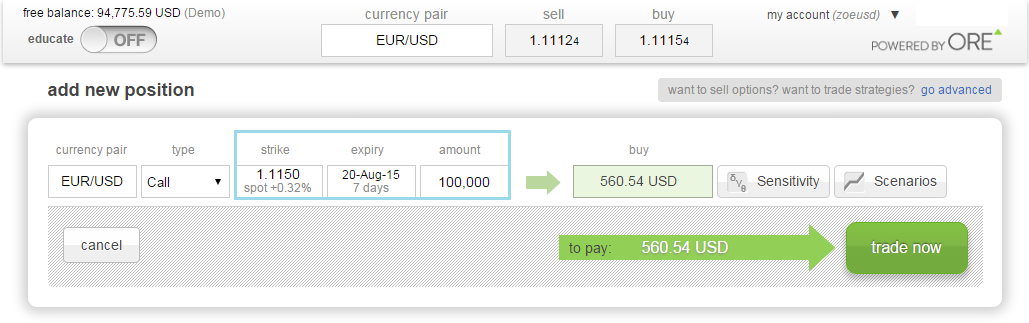

If you think the EUR/USD will continue its trend upward and continue its correction, then you may take advantage of this price movement through buying a Call option which gives you the right to buy EUR/USD at a predetermined rate within a set time.

The image below is a 1-week Call option trade example set-up; the predetermined buy rate is 1.1150 and the contract size (amount) is for 100,000 EURs. It costs 560 USD premium to open this trade.

If the EUR/USD rises above 1.1150 over the next week the option will payout, the profit will be at least 100% if the pair trades above 1.1262 and if it rises to June 7th highs, at 1.1435, profit will be at least 2,290 USD. The total risk is 560 USD (open premium) and the trade will lose if the pair does not rise above 1.1150 by the options expiry.