This article is written by Vladimir Bezruchenko

ABOUT THE AUTHOR: Vladimir Bezruchenkois an independent trader based in Kiev, Ukraine. He has been actively trading from home since 2013. He specializes in US natural gas futures (NYMEX Henry Hub) and high-yielding commodity currencies.

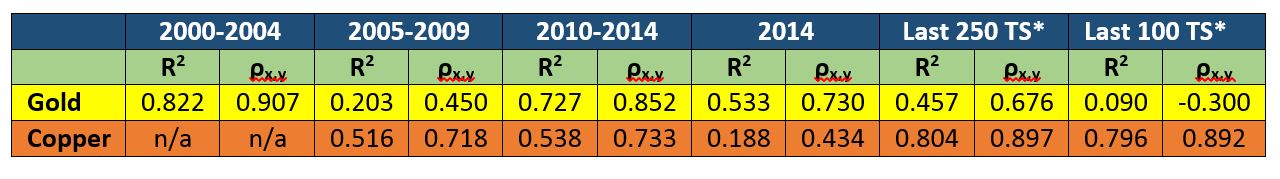

The Australian dollar (the Aussie) is a commodity currency. It has a strong correlation with both gold and copper. This correlation may help in identifying turnarounds in the Aussie that may not be anticipated via interest rates. But what commodity offers the best guidance? Historically, gold prices have been instrumental in Aussie price action, but the correlation has weakened over the past year, while connection with copper remained largely unchanged and even strengthened. In fact, the difference in dependences between Aussie-copper and Aussie-gold has been quite significant especially over the last 200 and 100 trading sessions (see the table below).

Coefficient of Determination (R2) and Correlation (ρx,y) Indicators Between AUD/USD Exchange Rate and Gold and Between AUDUSD and Copper.

Source: Thomson Reuters, Personal Calculations

R2 – coefficient of determination

ρx,y – correlation

* - trading sessions

It appears that copper has become a more influential commodity, at least temporarily.

Copper

After touching a 5-year low on January 29, copper prices have been on an upward trajectory since. Strong Chinese data showing that the country's banks extended 1.02 trillion yuan ($162.87 billion) of new loans in February and bullish storage expectations are contributing to the metal’s modest recovery.

Reuters quoted Macquarie's analyst Vivienne Lloyd saying that there was doubt as to whether a copper surplus would emerge given the reduction from miners and price-related cutbacks and closures last year. Equally, GFMS, a respected economic consultancy in metals, expects copper prices to rise to $6,500 per tonne by the end of the year and to average $6,000 per tonne in 2015 (at the time of writing copper was trading at around $5,850 per tonne).

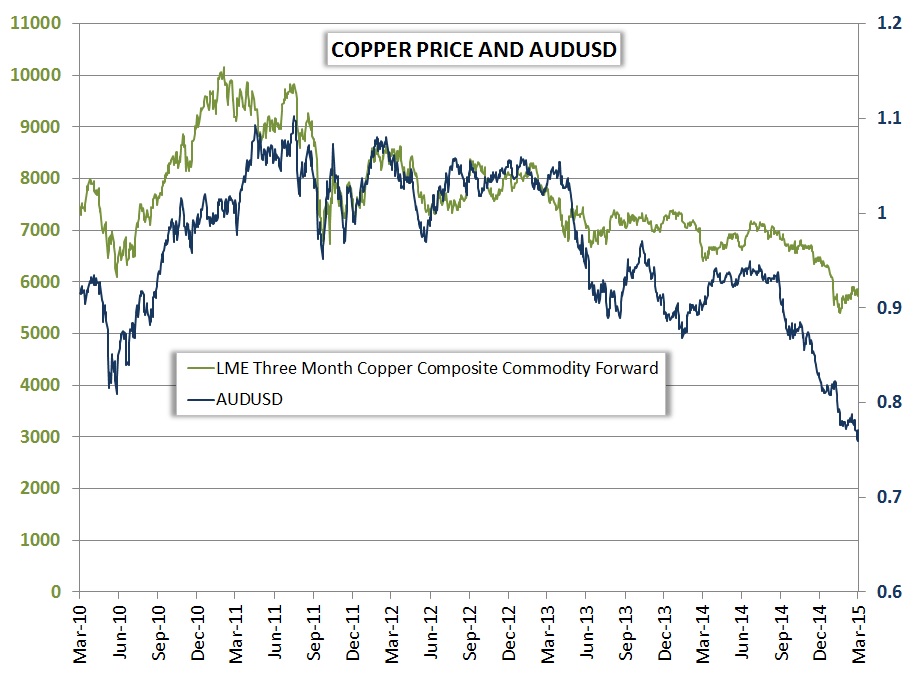

Source: Thomson Reuters

Bets that China will experience a seasonally strong second quarter and bullish supply fundamentals should support copper prices in future. In turn, strong copper prices should no doubt support the Aussie. Even by looking at the chart above, one notices that the decline in currency has been overdone and clearly exceeded the decline in copper.

CFTC COT Report

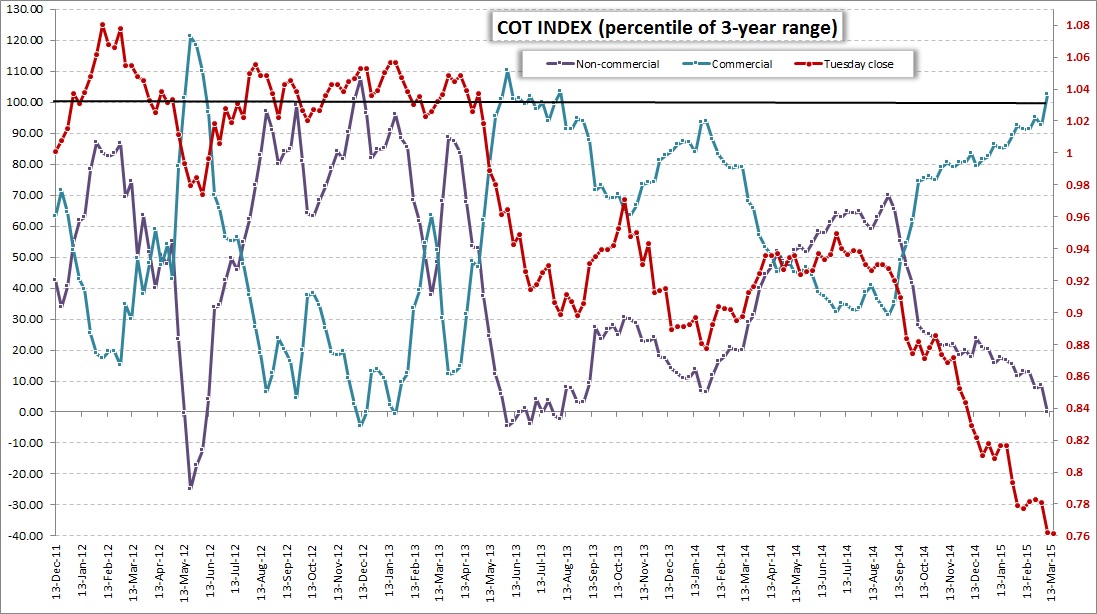

Another good reason to consider going long AUD/USD is a very stretched positioning as per the latest CFTC Commitment of Traders Report (COT). Indeed, both commercial and non-commercial traders’ positions have breached their 3-year range on percentile basis (see graph below). The probability of a reversal is very likely at this point and I would highly recommend at least exiting short positions and start looking at technicals with a view to get long. If you are a long-term, conservative/position trader, you can already start accumulating AUD/USD longs as the pair stabilizes near its 5-year low.

Source: US Commodity Futures Trading Commission

This article is part of the Forex Magnates Community project. If you wish to become a guest contributor, please apply here: UGC Form.