This article was written by Sarah Fenwick who is the founder of Jazz Arts & Communications, a boutique marketing communications and video production consultancy in Cyprus.

It often feels like there’s an actual war between politics and economics, a never-ending string of battles leaving behind the corpses of investments and well-laid plans.

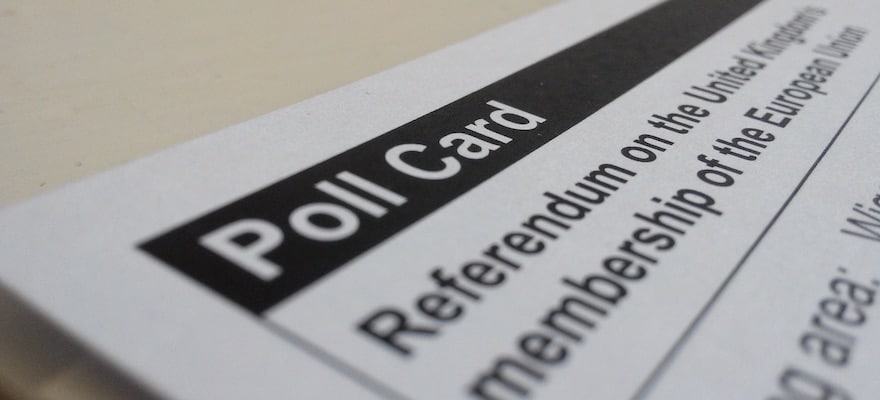

The most recent example of this mighty clash is obviously the Brexit vote in the UK. In a staggering turn of events, politics routed economics on June 23rd. God, they say, laughs at our plans, and life is what really happens while we design our elaborate strategies that go suddenly and dramatically down the tubes when massive Volatility sets in.

Case in hand; the GBP behaving like an emerging currency and losing 13 percent in just a few days.

The Leave campaigns didn’t even make any sense other than propagandistic. One of them claimed that the EU ‘takes’ 350 million GBP that would be better spent on a new hospital every week.

The implication here is that the helpless UK taxpayers are being beggared by European Union membership and don’t have any choice in the matter. Take control, sobbed one Leave campaign; you’re in a car that’s being driven by the EU and you don’t know where it’s going and can’t get out.

It was news to most people that the Eurocracy was suddenly so exciting that it had turned to crimes like carjacking. What’s next, one wonders, petty theft and burglary? Somehow, the vision of Jean-Claude Juncker dressed in a hoodie and stealing the silver was missed by the campaign designer. Surely they’re kicking themselves now for having lost this angle, it would have fitted right in.

Still, like the triumphant Brexiters said on June 24th, Bremain lost and they should get used to it. Funny that they say it like it’s a good thing, because some might say that a dramatically weaker currency, a looming recession, utter economic and legal uncertainty plus the bonus - a political power vacuum - were bad things.

All of Mark Carney’s efforts, that unelected governor of the Bank of England….wait a minute, it’s not just the Eurocrats that are unelected? Oh, and just another minute, 99 percent of any state are not actually directly elected positions? Out goes that Brexit argument, then. Back to the point, all of Mark Carney’s efforts to stabilise the GBP and insert some economic sense into the battlefield are so far failing to make any headway. The doves just can’t fight the vultures, it seems.

Carney has a huge challenge coming up on Thursday July 14th. Representing the economic side against the increasingly hysterical political rhetoric side is never easy at the best of times. Now the stakes are even higher than at any point in the UK’s modern economic history.

A protracted global slowdown and lingering contagion from the US subprime crisis, EU sovereign debt and financial crises are all dragging on the UK’s economy. Carney’s few weapons are an interest rate cut, and to max out the QE budget, currently at 375 billion GBP. Wait just another minute, how many hospitals could be built with that money, and it’s being ‘taken’ by Treasury bonds and whatnot? Another missed angle for the Leave campaigners to kick themselves for.

It’s clear that for the moment, rampant politics is winning this battle at the cost of the UK’s economy. What investors hope for is for some kind of balance and stability to re-emerge. Realistically, that would come under two scenarios; the first being that the next prime minister gallops off to Brussels with an Article 50 in his or her briefcase, calling a truce and peace negotiations. The second is that the legal challenges to the referendum will prevail and the whole idea of the UK exiting the EU will be consigned to history and the comedians on Saturday night TV.

Which one is likely to prevail? There’s too much uncertainty to tell.