The foreign currency to watch this week is the Australian dollar. Following a prolonged move up on the weekly chart, driven by a recovery in commodities and a weaker U.S. dollar, the AUD/USD may have finally reached a top.

Despite the nearly three month rally, the Reserve Bank of Australia had been fairly quiet about the price rise from .6826 to .7722 and its potential impact on the Australian economy. However, Monday’s flat retail sales report may have been the tipping point that convinces the RBA that the time is right to cut interest rates.

I’m going out on a limb because shortly before the April 5 Reserve Bank meeting, traders are only giving a cut in the current 2 percent official cash rate a 7 percent chance.

Although the majority of traders believe the RBA will keep rates on hold, some feel that Governor Glenn Stevens is feeling pressure to pull the trigger as the Aussie nears the key .8000 level. His main concern is that the Aussie’s strength could smother the current economic recovery in Australia.

Even if the RBA leaves its benchmark interest rate unchanged, it is likely to try to talk the currency lower with a change in the language of its monetary policy statement. Given the neutral tone in its March statement, Tuesday’s statement may contain language that suggests the RBA would like to see a lower Australian dollar in order to help the ongoing rebalancing of the economy.

If the RBA passes on a rate cut and leaves the language in its monetary policy statement unchanged, then this will send a message to traders that the central bank is not too concerned about the relatively high price of the currency. In this case, it will be saying that it understands the currency is going up because of the weaker dollar and higher commodity prices, but over time, the currency will level off when the U.S. Federal Reserve begins to raise interest rates on a consistent basis.

Going into the April 5 RBA meeting, the consensus is predicting an unchanged cash rate decision, but investors should prepare for a surprise. The odds are extremely low for a rate cut, but a change in the language of the monetary statement itself could be enough to drive the Aussie lower from its current lofty levels.

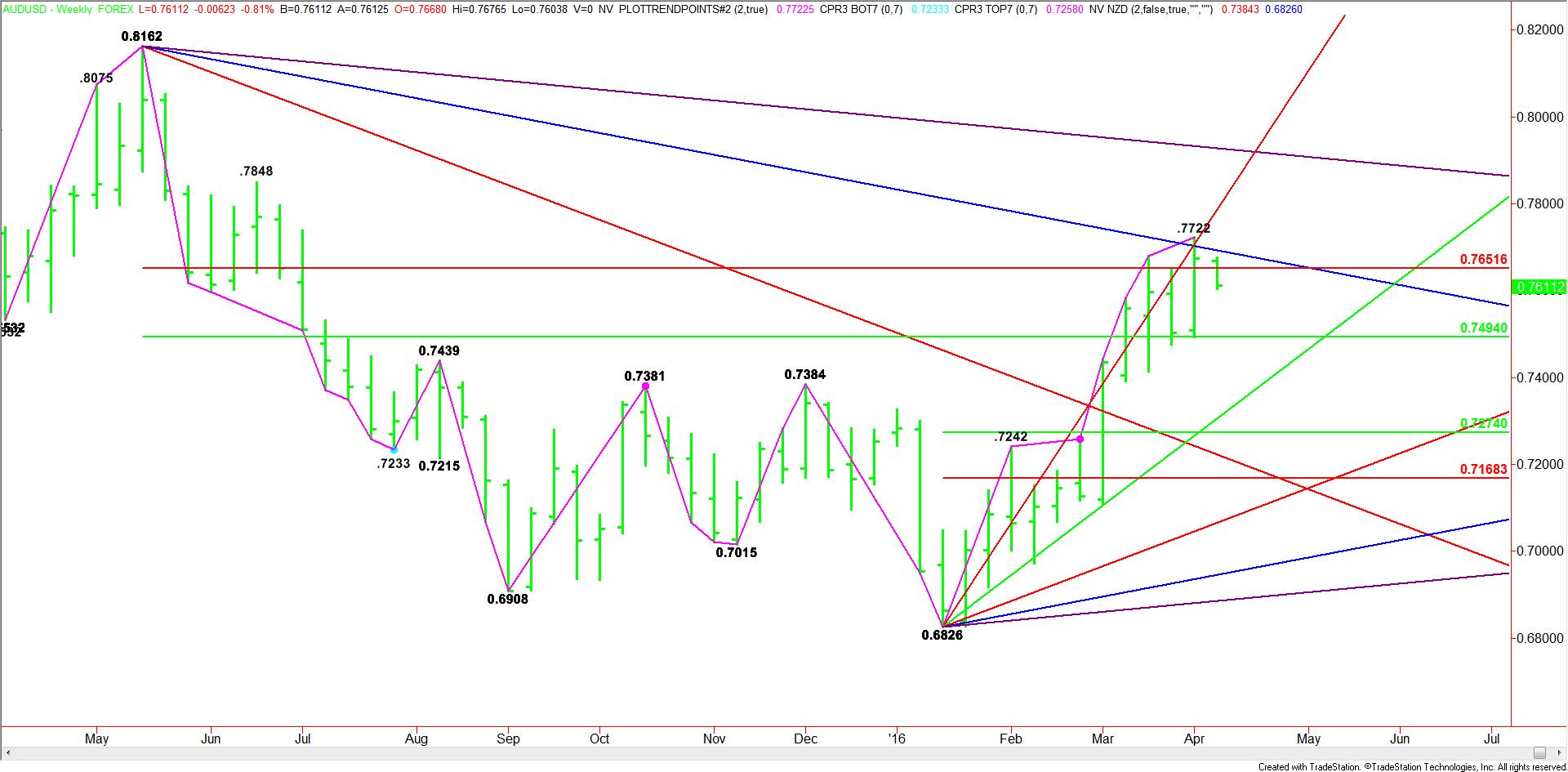

Technically, the main trend is up according to the weekly swing chart. However, the AUD/USD has run into a cluster of resistance levels that could trigger a profit-taking break after a prolonged rally in terms of price and time.

The main range is .8162 to .6826. Its retracement zone is .7494 to .7652. This zone is essentially acting like resistance. Currently, the market is trading inside this range. Trader reaction to this zone will likely determine the longer-term direction of the market.

Last week, the AUD/USD reached a high at .7722. This week, resistance is a major long-term downtrending angle at .7692. A sustained move under these levels will signal the presence of sellers. Taking out the Fibonacci level at .7652 could trigger the start of an acceleration to the downside with the first major target a major 50% level at .7494.

The 50% level at .7494 is also a trigger point for a steep break with the next major target zone coming in at .7274 to .7168.

If buyers can overcome the downtrending angle at .7692 and last week’s high at .7722 then look for a resumption of the uptrend with .7786 the next major target.

Crossing to the bullish side of the angle at .7786 this week will put the AUD/USD in an extremely bullish position.

In conclusion, the AUD/USD has reached a key retracement zone. Trader reaction to this zone will dictate the longer-term direction of the Forex pair. If the RBA is dovish in its monetary policy statement then look for the Aussie to break lower from this zone. If the RBA is neutral to hawkish then look for a resumption of the rally.

Trader reaction to .6952 will likely determine the direction of the market over the near-term. Look for a bullish tone to develop on a sustained move over .6952 and a bearish tone on a sustained move under .6952.