This article was written by Darya Kirilochkina, Communications Manager at EXANTE Ltd.

Be it a terminology issue, or should it be caused by any other reason, newcomers to the world of financial markets and trading are often confused by the differences between common and preferred stocks. These differences are crucial, however; even the basic manuscript, ‘Investments’ by William Sharpe, Gordon Alexander and Jeffrey Bailey, covers common stocks in a separate section, while the preferred ones are described in the ‘Fixed-Income Securities’ section, together with bonds.

preferred stocks require deep and detailed analysis, but you should definitely give them a try

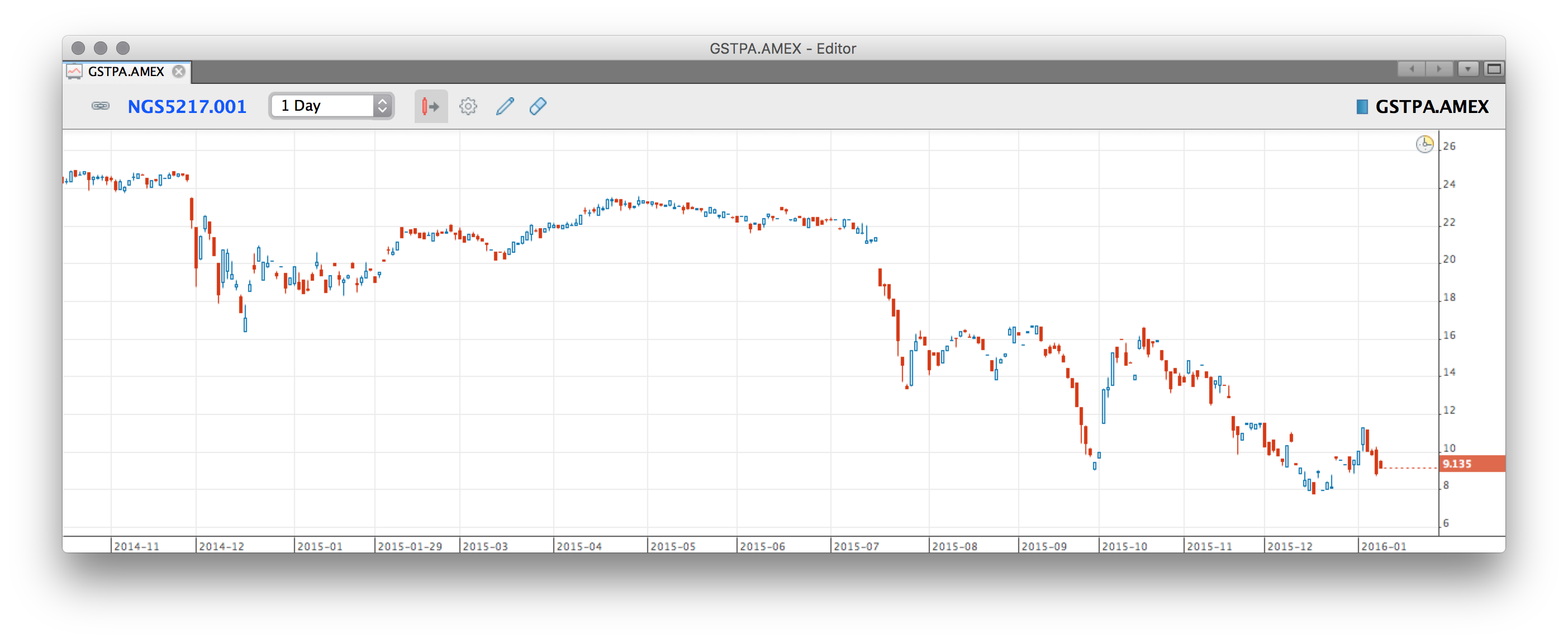

Preferred stocks are in fact something in between common stocks and bonds. On the one hand, they produce fixed income (though the way it is calculated may differ), just like bonds. On the other hand, they are still stocks, while they provide the owner with a share of the company, and they are definitely not a promissory note. As for the prices, preferred stocks usually behave like common stocks, not like bonds. There are, however, significant differences between common and preferred share quotes interpretation, and one of them can be illustrated by the following chart.

It shows the dynamics of Gasbar Exploration Inc. Series A cumulative preferred stocks. At first sight it may seem that the company’s state has been truly unstable lately: the steep downfall of the stocks would be a real matter of concern if we were talking about common stocks. However, these stocks are preferred, and everything turns upside down: the nosedive did not make them less attractive for investors, but it turned these stocks of Gasbar Exploration Inc. into one of the best fixed-income assets in the US. Its nominal yearly yield is defined at the level of 8.625%, but after the price fall it is estimated at the exciting level of 18.16%. The mechanism is rather simple: the price falls, but the company's Obligations remain the same, and it cannot do anything but pay the dividends — because in the case of preferred stocks it has to.

As to the differences between preferred stocks and bonds, one of the main factors is the Volatility of the price. In the case of bonds the prices are usually quite stable. It is

Darya Kirilochkina

usually stressed that stocks represent owning a company share, while owning bonds means the company owes you something. In practice, however, it only matters in case of the company’s bankruptcy. If you own bonds, you will be the first to receive the compensation. The owners of preferred stocks have the second priority, while the common stock holders will be the last in line.

Buying preferred stocks, an investor counts first of all on receiving fixed income, the dividends. The company’s responsibility to pay dividends on preferred stocks is declared in its policy and is unconditional, while the dividends on common stocks strongly depend on the company’s financial state, the market conditions — or even just on the management’s wish to pay or not to pay them. For example, Apple Inc. did not pay any dividends to its stakeholders for more than 10 years. The same is true for such giants as Yahoo and Netflix. On the other hand, some companies are stable in sharing the profits, like IBM: the computer giant has been reliably paying dividends since 1987.

Preferred stocks are in fact something in between common stocks and bonds

Preferred stocks are regularly evaluated by rating agencies, which makes it easier for investors to find the proper balance between risk and profitability. These evaluations are, however, rather low in comparison with the same companies’ bond — that’s obvious, because the stocks remain non-promissory. The low ratings are often ‘recompensed’ by even higher profitability; take New Source Energy Partners LP and its Series A cumulative preferred stocks that are bringing over 45% of annual profit now — the numbers are speaking for themselves.

Well, and this is not to mention the ‘classic’ stock feature adherent to preferred stocks — the price changes. Bonds holders are usually deprived of this income source, as bonds prices are rather stable — just due to their nature. If bond prices become volatile, it may mean dramatic changes of the issuer’s state.

For preferred stocks price changes are absolutely normal. They usually follow the quotes of the common stocks — a lot more smoothly, though.

All things considered, preferred stocks may become a real optimum for many investors who are seeking comparatively high income paired with rather low risks. The wide range of preferred stocks requires deep and detailed analysis as well, but you should definitely give them a try.