This guest article was written by Nikolai Kuznetsov from NikolaiKnows.com.

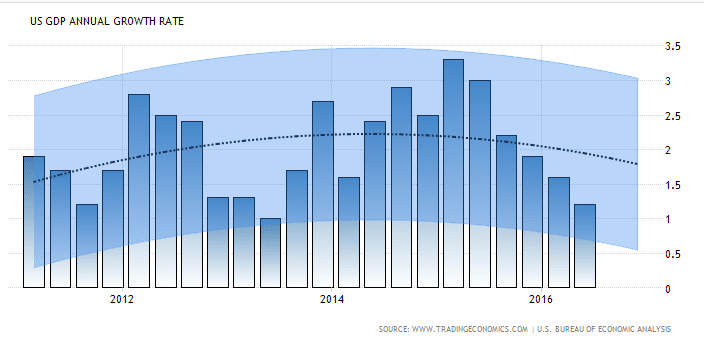

The chart below shows how GDP in the United States have been faring over the last decade. Just as a reminder, the GDP is considered the biggest measure of the growth and the output of the economy. It is the sum of consumer spending, government spending, national investment and net exports.

According to Trading Economics the US economy is shrinking. Even though the economy grew at a stellar rate at the beginning of 2015, there has been a consecutive five-quarter decline in the growth rate of the economy. That’s the first time this is happening since the first quarter of 2010 – about when the economy started recovering from the last financial crisis.

And even though the stock market suffered in the first quarter, times are currently rosy for stocks. In fact, the S&P 500 registered a new all-time high during April. The ironic part, however, is that positive vibes from the economy were the main factor that propelled the stocks. But as far as we know with the GDP indicator, the economy is not in a pretty situation. So the question now is why the stock market is faring well in recent times despite the lackluster economic growth. There is a two-word answer for that: crude oil. The crude oil market has had an influence on both the GDP and the stock market.

First, the GDP and the crude oil market. As stated earlier, one of the variables that goes into GDP calculation is business investments. That is, if business investment in a given time is strong, there’s a good chance that the GDP will fare well, as it’s one of the biggest inputs. However, some or all of the other variables have to be healthy to achieve growth.

On checking what these variables have looked like, one finds that consumer spending has been strong. And while governmental spending is down based on historical standards, it’s been pretty much on the rise over the last three years. And it currently lurks around pre-recession levels.

The two biggest culprits for the poor growth are the net export and investment variables. And the crash in the crude oil market has played a part in ensuring the two are down. As for the investment variable, since the oil business is capital intensive, the cut in investment by energy companies due to the oil market turmoil weighed heavily on investments.

In essence, the low GDP growth rate doesn’t exactly describe the growth rate of the US economy. This is embodied by strong consumer spending and job data. And this is a big reason why the stock market is on the rise despite the 'entire' economy showing signs of weakness.

From what we know already, as long as the oil market stays low, US GDP could still be low – except for a significant spike in other variables. In addition, as long as consumer spending and job data stay strong, the stock market is likely to keep on performing.