Although options are complex financial instruments, traders who are new to options can use them for very simple, yet effective strategies: sell options to initiate limit and stop orders.

In using short options as limit orders, the sale of a naked put is used as a vehicle to get long spot at a predetermined price while earning time-decay. The first thing you must have is a platform that trades both spot and options in the same account.

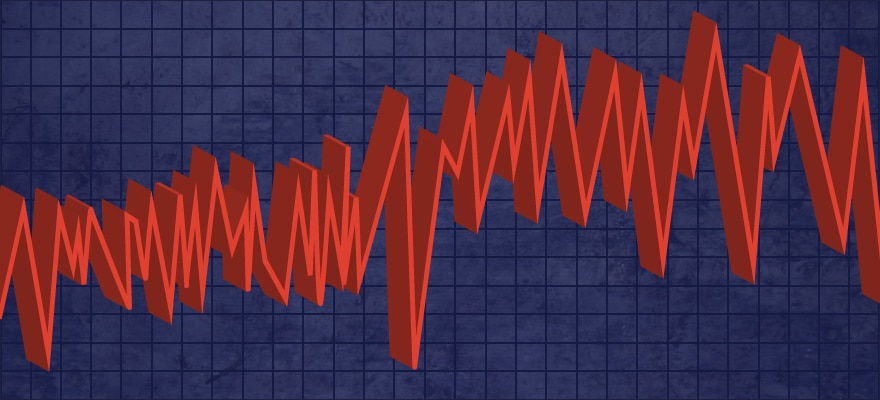

Consider the following six-month (180-day) spot price chart for the cross rate XYZ/USD:

Source: FX Bridge Technologies

We can see that the spot price fell to around 0.99 about 160 days ago, rallied to slightly more than 1.08 at 120 days, and then retreated to the same 0.99 level about 50 days ago. Since then we have seen another rally to about 1.05 and then another reversal lower.

A reasonable trade here might be to respect the 0.99 level as support and buy the spot if the price again falls all the way to that level. This can easily be done with a GTC (good ‘til cancelled') limit order to buy spot at 0.99.

Alternatively, you can sell a put option with a strike price of 0.99. This will obligate you to purchase spot at 0.99 if the spot price is at or below 0.99 on the expiration date of the option. The following table lists the value of 0.99 put options for various expirations (based on 10% Volatility and a current spot price of 1.01):

| Days | 180 | 150 | 120 | 90 | 60 | 30 | 0 |

| .99 put | 0.0190 | 0.0167 | 0.0142 | 0.0114 | 0.0081 | 0.0041 | 0.0000 |

For example, if you sold a 2-month (60-day) 0.99 put option on 100,000 units of XYZ, you would collect 0.0081 * 100,000 = $810. That $810 is yours to keep. If the spot price is at 0.99 or below on the expiration date of the option (60 days from now), you will be obligated to buy 100,000 units of XYZ at $0.99. If, on the other hand, the spot price rallies or fails to fall to 0.99, you will have earned $810 and will not have a spot position.

Let’s look at three possible market scenarios and see how the short put trade compares to the limit order trade over the next 60 days:

Spot price rallies

We are looking for the spot price to fall in order to give us an opportunity to buy XYZ/USD, so this is the least likely scenario (in our opinion). If, however, the spot price rallies and we have on a limit order to buy at 0.99, we will have no position and will not have participated in the market move. If we choose to sell a put, at least we have collected the $810.

Spot price falls, but stays above 0.99

The payoff is the same as for the scenario above, but the daily margin and account value will be different. This is because the short option will retain its value and perhaps even increase in value over its 60-day life. At expiration, however, the trade will result in a credit of $810 and no spot position.

Spot price falls below 0.99

As noted above, if the spot price is below the option’s strike price of 0.99 on its expiration day, then it will be exercised into a long spot position. It is important to note that the purchase price for that spot position will be 0.99 no matter how far the spot price falls.

For example, if the spot price is 0.98 on the option’s expiration day, your account will show a long spot position from 0.99, resulting in a 0.01 loss ($1000). Remember, however, that this trade also resulted in a cash credit of $810 so the overall loss at a spot price of 0.98 would only be $1000 - 810 = $190. Since the option was sold at a price of 0.0081, the breakeven spot price for this trade is 0.99 - 0.0081 = .9819.

Selling a put option to initiate a long spot position (or selling a call to initiate a short spot position) also results in a margin on your trading account. This margin can vary based on market conditions, but usually is about the same amount as a spot position margin.

This trade will result in a cash credit for the sale of the option and a long position if the spot price falls to or below the strike price of the short option. For this reason, using short options to initiate spot positions is sometimes referred to as 'getting paid to have a limit order'.