General consensus is for the SNB to leave rates on hold as it awaits to assess the impact on the Swiss economy from its shock dropping of the EUR/CHF base at 1.2000 and the negative interest rates taken in January. The risk does remain that SNB cuts rates further into negative territory in the future, with the SNB President Thomas Jordan telling Swiss radio that the franc was “clearly overvalued” and there was room for an even lower rate.

Worries of lower rates in the future have seen a flight to cash and with the cancellation of a vote at the National Council today, they are now expected to debate on the SNB action in January to remove the peg in EUR/CHF and to go to negative rates. This does highlight the independence of the SNB, but they appear to be struggling to stop fresh strengthening in the currency.

Markets have been awash with talk that 1.0500-1.1000 is the implied target range in EUR/CHF, but heavy selling in the EUR/USD has added pressure which could again be exasperated later following the FOMC. If the franc does come under substantial appreciation in the future it will raise the risk of lower rates in an upcoming meeting, but right now we do not think current levels will force it to act.

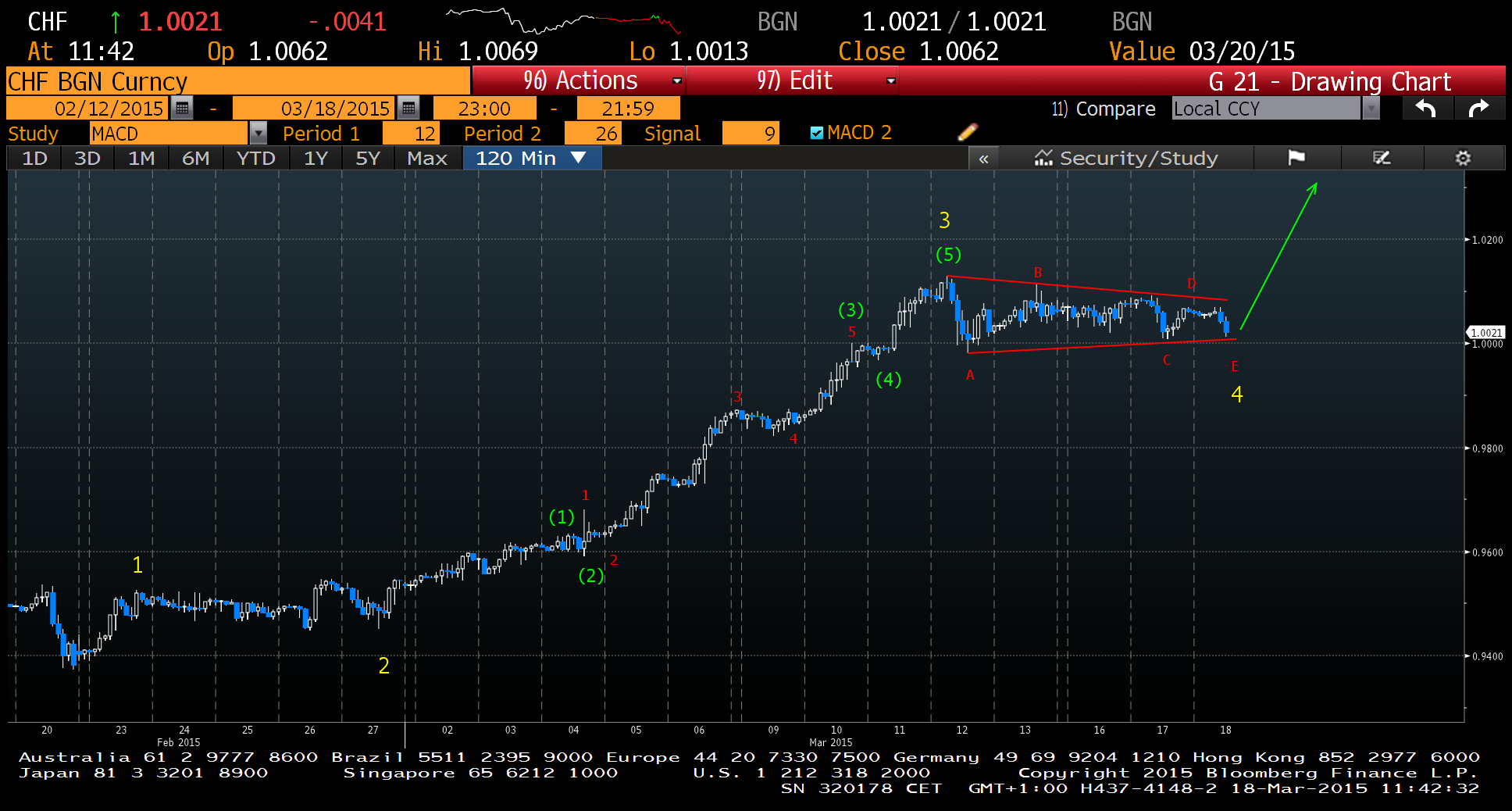

Surprisingly, the USD/CHF is actually trading higher than at the start of the year, as the expected divergence in interest rates between the FED and the SNB keeps the dollar bullish. With this expected to increase, how much is already priced in? Looking at the chart this wave 4 triangle is almost complete and this next leg higher in the dollar could prove to be its last. It is important to keep an eye on other related pairs with the potential thrust from similar triangles in the USD index and the EUR/USD warning that the dollar might be late in its advance and any turn lower will see the USD/CHF follow.

Source: Bloomberg Charts

This article is part of the Forex Magnates Community project. If you wish to become a guest contributor, please apply here.