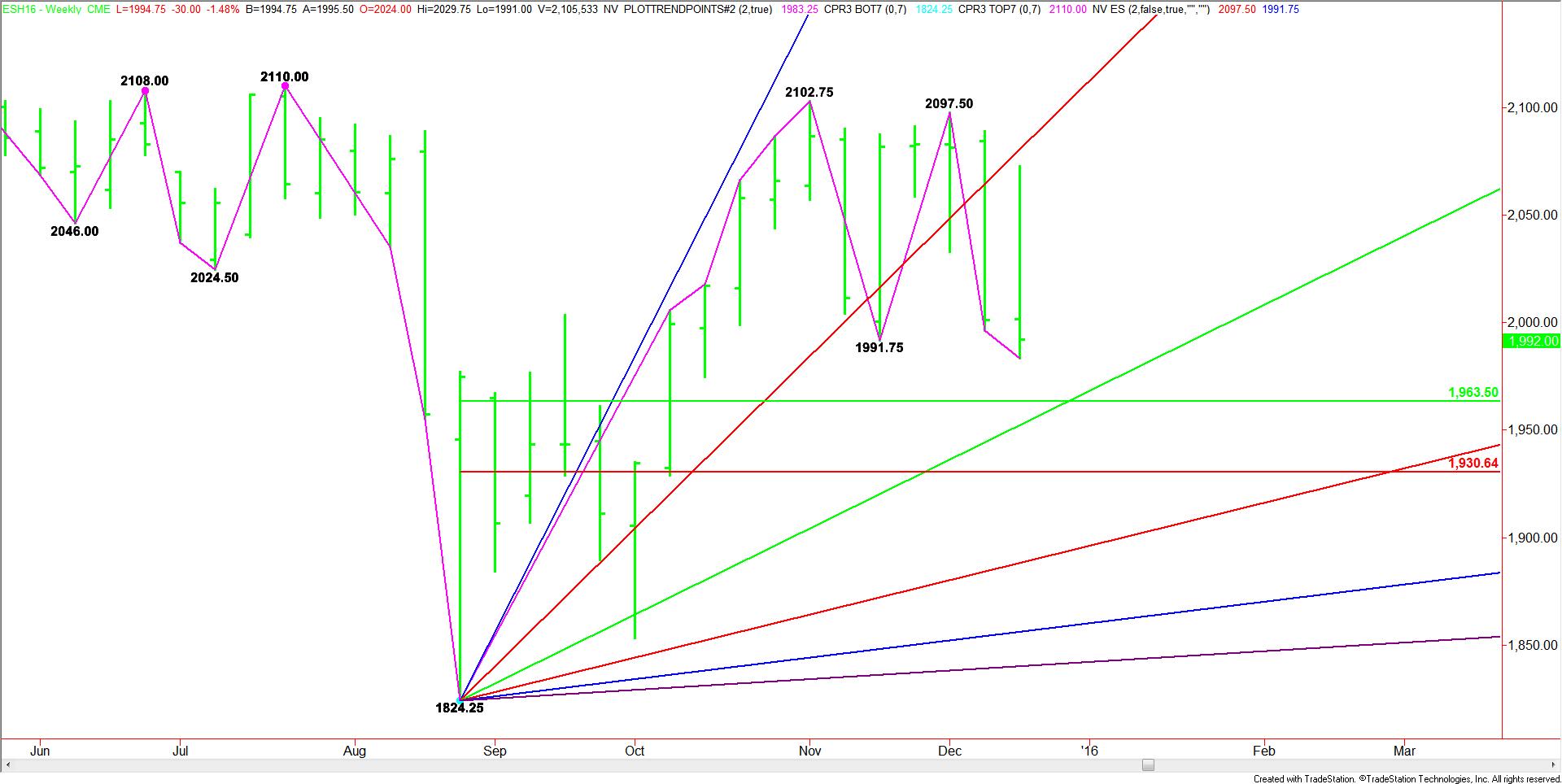

March E-mini S&P 500 Index futures faced selling pressure last week with prices dropping to their lowest levels since the week-ending October 16. The main trend also turned down according to the weekly chart when the index took out the swing bottom at 1991.75.

The main range is 1824.25 to 2102.75. Its retracement zone at 1963.50 to 1930.50 is the primary downside target along with an uptrending angle at 1960.25, which passes through the zone.

Last week, the major stock indices fell as risk sentiment soured in the days following the Federal Open Market Committee’s monetary policy announcement, where Janet Yellen and her partners raised the central bank’s benchmark interest rate for the first time since 2006.

Play it safe

Looking ahead this week, investors will get the opportunity to react to the latest third-quarter GDP figures and the November Durable Goods report. However, because this is a holiday-shortened week, we are looking for a limited reaction to these reports unless they deviate substantially from expectations.

We’re going to play it safe this week and pass on trading momentum since volume and Volatility are expected to be below average. We’ll be looking for a technical bounce inside a value area instead.

If the downside momentum continues this week because of Friday’s heavy selling pressure then we expect the weakness to continue into at least the 50% level at 1963.50 or the uptrending angle at 1960.25.

A test of the 1963.50 to 1960.25 is likely to attract buyers who are either looking to take profits, or to take an aggressive counter-trend long position. If we don’t get the technical bounce inside this zone that we are looking for then the break is likely to continue into the Fibonacci level at 1930.50. This would indicate that the stock market is weaker than we thought.

Let the market come to you

Overall, we are looking for a quiet, consolidative trade as Liquidity is likely to thin out as we head into Thursday’s shortened trading session and Friday’s Christmas holiday.

Based on the expected trading conditions, let the market come to you. The best entry area this week for a long position in the March E-mini S&P 500 index is 1963.50 to 1960.25. We’re not looking for a major bottom, only a technical bounce, following a test of this area.